Summary

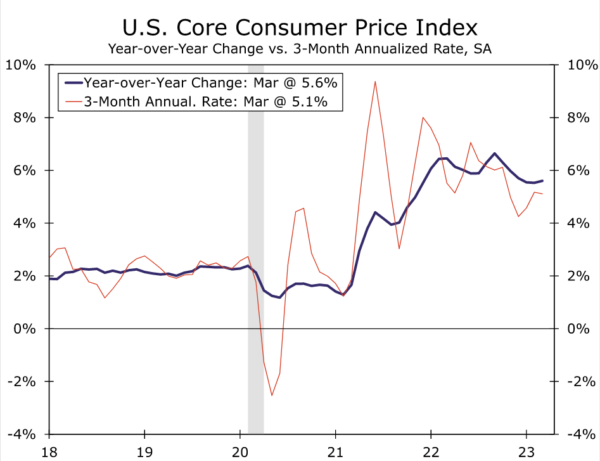

For the inflation optimists out there, the March CPI report delivered good news with total prices rising by the smallest amount in nine months and hints that core services inflation is starting to moderate. However, for the inflation pessimists, the latest CPI report shows the recent underlying trend in price growth remains far too high, with the core CPI increasing at more than a 5% annualized pace the past three months.

Consumer prices increased just 0.1% in March. Falling prices for energy and flat prices for food helped restrain the increase in the headline index. Excluding food and energy, core consumer prices rose 0.4% in March and 5.6% over the past year.

Core consumer prices continue to grow much faster than the Federal Reserve’s target, but we believe slower inflation is coming in the months ahead as the economy cools and finds better balance in a post-pandemic world. We do not think today’s report materially changes the outlook for U.S. monetary policy. We still expect a 25 bps rate hike from the FOMC at the conclusion of its next meeting on May 3. Past May, the outlook is increasingly uncertain, but we think the most likely outcome is for the FOMC to keep the federal funds rate steady for an extended period of time.

CPI Posts a Modest Increase in March

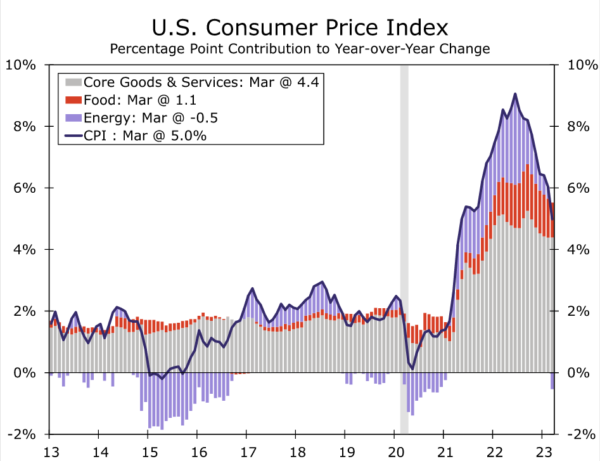

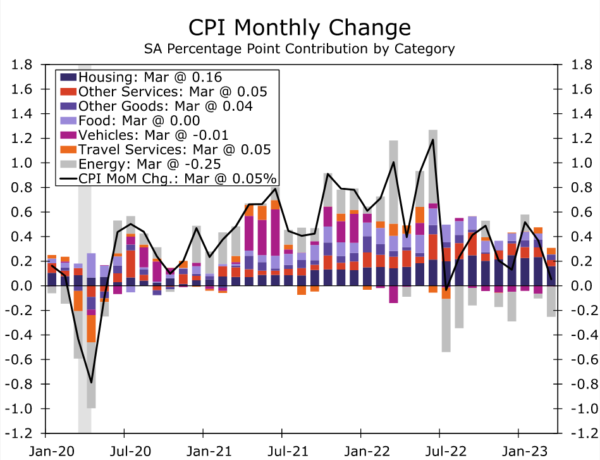

The consumer price index increased just 0.1% (0.05% before rounding) in March, the smallest increase since last July. A reprieve in price growth for frequently purchased necessities—energy and food—held the headline CPI to a more palatable gain and provided consumers a little more wiggle-room in their March budgets. Prices for gasoline declined 4.6% while energy services fell 2.3% last month. With the initial surge in oil prices related to Russia’s invasion of Ukraine a full year behind us, energy prices have turned to a drag on the year-over-year rate of inflation (chart). Food inflation also continued to moderate, with a flat reading in March pushing the year-ago rate down to a still burdensome 8.5%. Yet, while there is likely some further scope for energy services and food inflation to ease on a monthly basis in the near-term, the benefit to real incomes from lower gasoline prices is unlikely to carry over to April, as prices at the pump have rebounded in recent weeks. Declining inflation for food and energy have helped push the year-over-year rate of CPI inflation down to 5.0%, the lowest reading since May 2021.

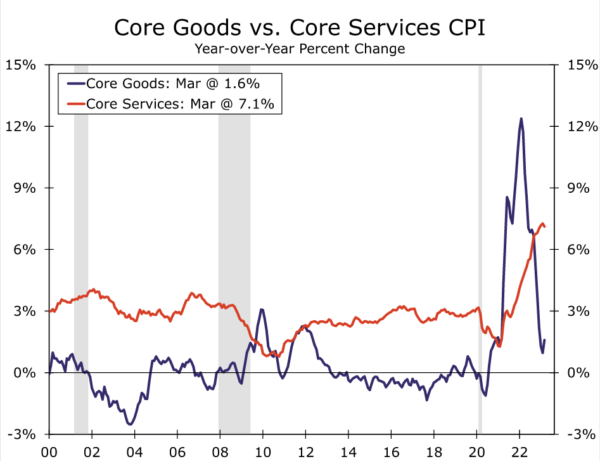

Excluding food and energy, however, inflation remains stubbornly high. Core CPI rose 0.4% in March and ticked up to 5.6% on a year-over-year basis (chart). In a sign that the path to quelling inflation will have some bumps along the way, goods prices, which have been leading the charge on core CPI disinflation, rebounded to 0.2% in March—its largest monthly gain since August. The pop was traced to somewhat firmer vehicle pricing; new vehicles rose by the most in three months, while the 0.9% drop in used vehicle prices was the smallest decline in seven months. Prices for core goods excluding vehicles continued its recent string of strong 0.5% monthly increases.

Yet there is a whiff of relief coming on the services side of inflation. Core services prices advanced 0.4% in March, the smallest increase since last July. The much-awaited downward trend in shelter inflation has finally seemed to arrive. Both owners’ equivalent rent (OER) and primary rent, which together account for 41% of the core, rose 0.5% after bouncing between monthly gains of 0.6%-0.8% for nearly a year. But softer services prices extended beyond shelter. The CPI equivalent of the Fed’s now closely watched “super core”, which we define as core services less OER and primary rent, rose 0.3% after 0.5% gains in January and February. Driving the softer print was another decline in medical services along with flat prices for recreational services. In contrast, prices for travel related services climbed 2.5% for a second straight month, fueled by strength in hotel prices (+2.7%) and airfares (+4.0%) in a sign that consumers are still willing to shell out for select discretionary purchases.

One More Rate Hike Coming

The bottom line is that inflation still remains too hot for the Fed’s liking. The core CPI has been above 5% on a year-over-year basis for 16 consecutive months, and over the first three months of 2023, core consumer prices have risen at an equally hot 5.1% annualized rate. This is not to say there has been no progress towards taming inflation. Energy prices have outright fallen over the past year, food inflation is slowing and prices for certain goods that surged during the pandemic, such as used vehicles, have declined. But, directional progress should not be confused with mission accomplished. As a result, we expect another 25 bps rate hike from the FOMC at the conclusion of its next meeting on May 3.

That said, there are forward-looking signs that suggest inflation will slow further in the coming months. Inventories of goods continue to normalize, and the ongoing contraction in the manufacturing sector suggests further softening in goods inflation could be in the offing. Shelter inflation as measured by the CPI has now started to rollover following the sharp deceleration in home prices and rents over the past year. Consequently, shelter’s contribution to CPI inflation should retreat as the year progresses. More generally, aggregate demand growth appears to be weakening, and wage growth has moved in a similar direction. Altogether, we think the May 3 rate hike will be the last of the tightening cycle. Our view is that the FOMC will hold the target range for the federal funds rate at 5.00%-5.25% for the foreseeable future in order to assess the effectiveness of their accumulated policy tightening.