With the banking turmoil receding, market participants will turn their attention back to economic releases. The spotlight will fall on the US employment report, where another strong reading could temper speculation that the Fed will start cutting rates soon, helping the wounded dollar to recover. Meanwhile in Australia and New Zealand, central banks are expected to take different paths.

Fed on collision course

It’s been a wild month for global markets, marked by bank failures and financial instability. The main casualty of all this turbulence has been the US dollar, as investors ramped up bets that the Fed will be forced to slash interest rates by the fall to prevent any damage to the real economy.

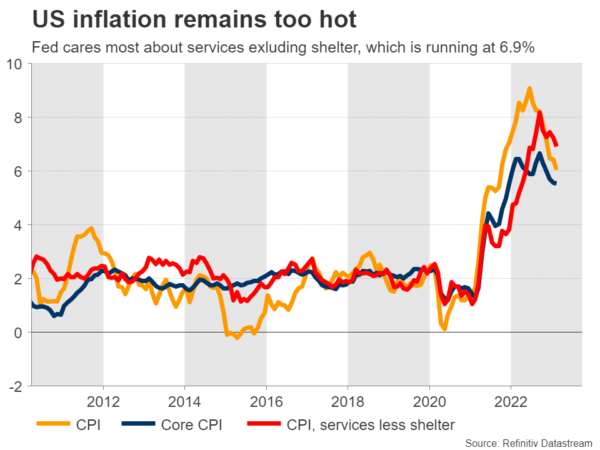

And yet, the economic data pulse tells a different story. Economic growth in the first quarter is estimated to exceed 3% according to the Fed’s GDPNow model, the labor market is exceptionally strong, and the ‘super core’ inflation measure the Fed focuses on is running at 6.9%.

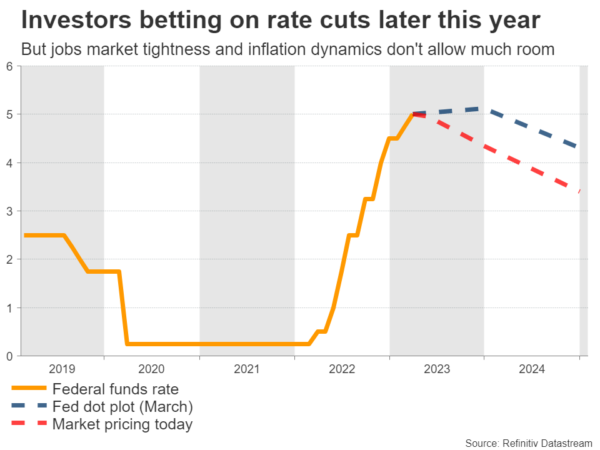

In fact, the latest business surveys point to a resurgence in US economic momentum, with demand recovering and inflationary forces regaining power. None of this is consistent with an economy that requires rate cuts soon, yet traders expect rates to close the year at 4.3%, well below the Fed’s projections for rates at 5% by year-end.

One of those bets will be wrong, which puts investors on a collision course with the Fed. The final say will inevitably come down to incoming data, starting with next week’s employment report on Friday.

Nonfarm payrolls are seen at 240k in March, while the unemployment rate is expected unchanged near 3.6%, remaining near multi-decade lows. These rosy forecasts are supported by early indicators such as the S&P Global business surveys, which signaled the fastest pace of job growth in six months. Similarly, applications for unemployment benefits remained historically low.

Wage growth might be an element that surprises investors. Forecasts point to slower earnings growth in yearly terms, but business surveys highlighted upward pressure on wages. A surprisingly strong print could resurrect inflation concerns, and push back against rate-cut speculation, helping the bruised dollar to recover.

Note that US markets will be closed for the Good Friday holiday, but the employment report will be released normally. This means that liquidity will be thin and the FX market will be the only game in town, which can amplify the reaction in the dollar.

Other releases during the week include the ISM surveys, with the manufacturing print out on Monday ahead of the non-manufacturing index on Wednesday. Both are considered leading economic indicators, so they will be closely watched.

RBA and RBNZ meetings

Over in Australia, the Reserve Bank is expected to hit the ‘stop’ button in its tightening cycle when it meets on Tuesday. Traders are assigning only a 15% probability for a rate increase, with the other 85% pointing to no action.

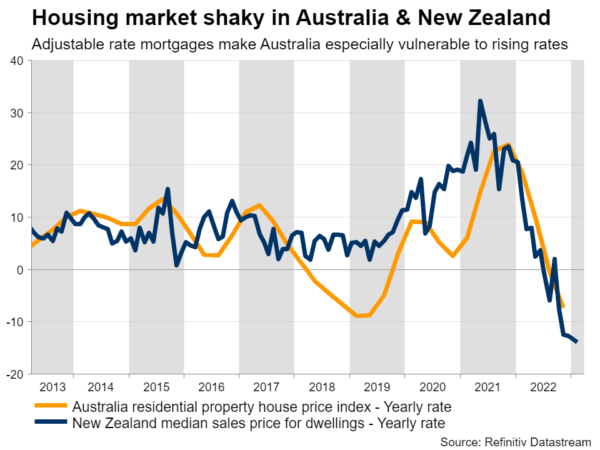

This follows a streak of disappointing data, from softer retail sales to cooling inflation, which have convinced investors the RBA will take the sidelines. There’s also concern about the housing market, as Australia has a high portion of adjustable rate mortgages that will reset at higher interest rates, directly impacting homeowners.

Hence, the focus of this meeting will be on whether policymakers keep the door open for any further action in the future. Of course, the bigger variable for the Australian dollar will be the fate of the global economy, and whether recession concerns come to fruition.

Crossing into New Zealand, a rate increase of 25 bps has been fully priced in when the central bank meets on Wednesday. In fact, traders are betting that if this doesn’t happen, the alternative will be a 50bps move, rather than a pause.

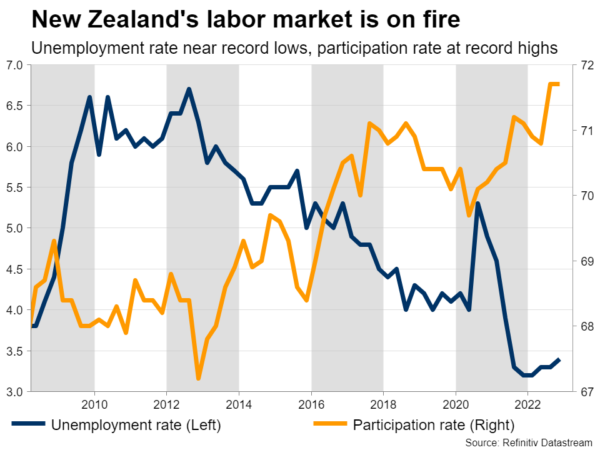

It’s difficult to draw any real conclusions from the economic data. Arguing for a cautious approach is the unexpected contraction in GDP last quarter, the steep decline in house prices, and the turmoil in global banking. However, the jobs market is on fire and ‘soft’ indicators are improving, with business surveys and electronic card spending firing up.

Hence, it’s a mixed picture, which supports a 25bps rate increase as a ‘middle of the road’ solution. The real question is whether the RBNZ will signal this might be the end of the tightening cycle, which seems unlikely judging from the strength of domestic data.

A generally hawkish message could help the kiwi dollar regain some poise, although it’s difficult to be optimistic in the bigger picture. The New Zealand and Australian dollars ultimately trade like proxies for global growth risks, leaving them vulnerable to sudden turns in the market mood as investors grapple with an unstable macro environment.

Staying in the commodity-currency complex, Canadian employment data will be released on Thursday, one day ahead of the US jobs numbers.

Finally, the Bank of Japan’s Tankan survey for Q1 will hit the markets early on Monday, providing clues about the economic outlook and helping investors decide whether the central bank will tighten policy in April when the new governor takes over.