U.S. Highlights

- The Federal Reserve delivered a modest 25-basis point hike this week amid banking stress, lifting the policy rate to a range of 4.75-5.00% – a level that’s just a hair below its previous peak back in 2007.

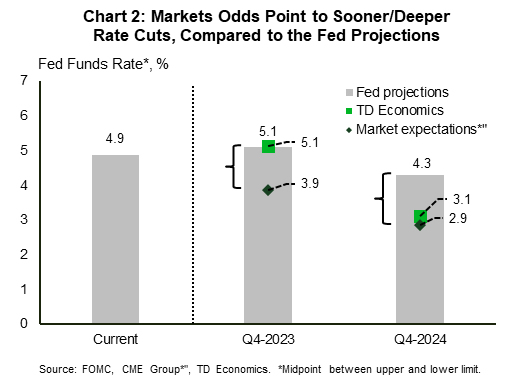

- Fed projections show the policy rate peaking at 5.1% in 2023, implying one more hike for the year, while next year a series of cuts are forecast to bring the rate down to 4.3%. Market expectations, however, are titled toward a lower rate environment in both years.

- Existing home sales rose 14.5% in February, recording the first increase after twelve consecutive months of declines.

Canadian Highlights

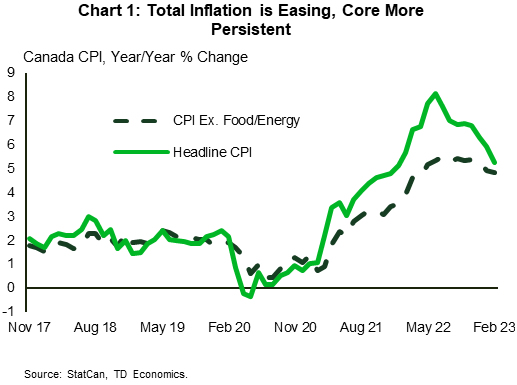

- Canadian Consumer Price Inflation was the main event this week. It showed a steady deceleration in price pressures, with total inflation falling to 5.2% year-on-year (y/y), from 5.9% y/y in January.

- The driver of easing inflation has been the steady decline in the price of goods, with gasoline prices leading the way, down 4.7% y/y .

- The services side of the economy has not budged. It is still hovering around its 30-year high, at 5.3% y/y. This kept Core CPI excluding food and energy steady at 4.9% y/y.

U.S. – Fed Delivers Small Hike Amid Banking Stress

Stuck between a rock and a hard place, the Fed appears to have taken a middle-of-the-road approach in setting monetary policy this week. Inflation, which remains well above target and has shown moderate signs of acceleration recently coupled with strong job growth, meant that the Fed could have opted for a more hawkish stance at Wednesday’s FOMC meeting. Fed Chair Powell nodded to this possibility in his testimony to Congress two weeks ago. However, the ongoing banking turmoil has upended this narrative. Instead of leaving the rate unchanged, – an option that was closely considered – Fed officials ultimately went with a 25-basis point hike, lifting the policy rate to 4.75-to-5.00%.

In taking this decision, the Fed acknowledged the risks from the banking turmoil, including the potential negative impact on the real economy from tighter credit conditions for households and businesses. Tighter credit conditions could do some of the Fed’s work for it in reducing inflationary pressures, substituting for further hikes. However, as Chair Powell noted in the press conference, it’s not clear how significant and how sustained the credit tightening will be. The Fed is keeping the door open to some further monetary tightening for now, but changes in the language of the FOMC statement suggest that it is very close to wrapping up its hiking cycle.

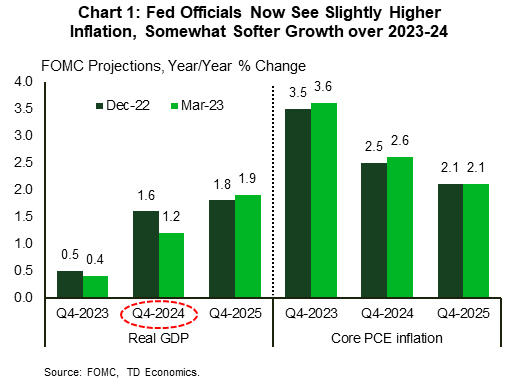

Along with the policy decision, the Fed also issued an update to its quarterly economic projections. Fed officials now expect inflation to remain slightly higher by the end of 2023 and 2024 compared to their view in December. Meanwhile, economic growth is expected to come in a bit softer over this same period, with a downgrade to the 2024 growth profile the most noticeable difference (Chart 1).

Policy rate expectations remained unchanged for 2023, with most Fed officials expecting the rate to peak to 5.1%, which implies one more hike this year. Market expectations, however, are not in tune with this view. The current pricing suggests that the Fed is done hiking rates, and that rate “cuts” will follow suit shortly this summer. Moving on to next year, while Fed officials have penciled in a series of rates cuts that will bring the policy rate down to 4.3%, market expectations remain more dovish, with the gap between the two forecasts widening (Chart 2). Our projection is aligned more closely with the Fed this year, but as growth slows into next year, we anticipate that in 2024 the Fed will loosen monetary policy more than it projects to steady the economic ship.

Reiterating Chair Powell’s view, the degree of credit tightening from the recent banking turmoil remains a major source of uncertainty for the outlook. On this front, it appears that authorities will need to stay alert in putting out more fires. Across the Atlantic, after finding a solution to the Credit Suisse troubles, the attention has now turned to another Global Systemically Important Bank (G-SIB), Deutsche Bank, after a surge this week in the cost of insuring the lender’s debt against default. With banking developments front and center, economic data played second fiddle, but a strong housing report did bring some cheer.

Canada – Inflation Moving in the Right Direction

The release of Canadian Consumer Price Inflation (CPI) was Canada’s economic headliner this week. With total CPI decelerating to 5.2% year-on-year (y/y) in February (from 5.9% y/y in January), markets continued to price greater odds that the Bank of Canada will start to cut rates as early as July. This pushed government of Canada bond yields even lower – the Canada 2-year yield was down another 20 basis points (bps) this week, after falling 80 bps over the prior two weeks. Although this has been a significant move, the U.S. 2-year has fallen by even more (-135 bps), causing Canada/U.S. yield differentials to narrow. This has put a floor under the Canadian dollar at 72.5 U.S. cents, even as commodity prices have been falling.

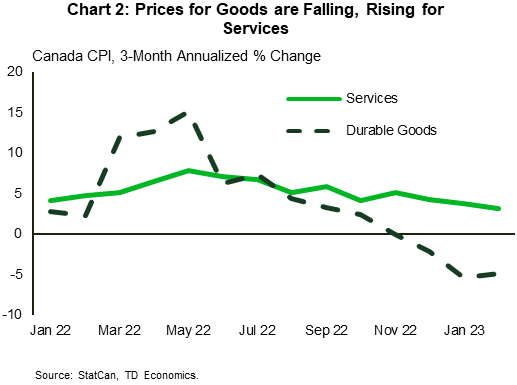

The easing in headline CPI was driven once again by a fall in energy prices (Chart 1 ). Total energy inflation has dropped in six of the last eight months, unwinding all the energy inflation witnessed after Russia invaded Ukraine. The drop in gasoline prices was the driver here, with prices at the pump down 4.7% compared to last year and down 27.9% since last spring. This has caused total goods inflation to go from its peak of 11.2% y/y in June 2022, to 5.27% y/y in February. Even more impressive is that on a three-month annualized basis, goods prices are in deflation at -0.9%, led by durable goods prices, which are falling by -4.8% (Chart 2).

While the easing in goods inflation will act as a tailwind for the BoC in its efforts to bring price growth to the upper edge of its target band of 1% to 3% by the middle of 2023, core inflation metrics have been less agreeable. CPI excluding food and energy was unchanged in February at 4.9% y/y. This is due to the consistent pressure coming from the service side of the economy. Even though goods inflation is moving lower on falling commodity prices and the unwind of supply chain issues, services inflation is still hovering around 30-year highs, at 5.3% y/y. With wages as the main driver of services inflation, the recent upturn in average hourly earnings to 5.4% y/y in February (from 4.5% y/y in January) is a concern.

The increase in wages mirrors the recent revival in economic momentum. With the labour market averaging 67 thousand jobs gained per month since October (nearly 5x the trend rate of job growth), and the government supplementing peoples’ incomes through a host of support programs, Canadians have seen incomes rise. Naturally, this has caused people to resume spending at a rapid clip. Retail sales released this morning confirmed this trend, rising 1.4% month-on-month in January. As we outlined in our recent paper on cyclical inflation in Canada (supercore), the current surge in spending risks pushing inflation higher over the coming months. For the BoC, which voiced its concern that “inflation could get stuck materially above the 2% target” in its policy meeting deliberations this week, the cyclical strength in recent data will further complicate matters.