Retail sales and inflation to make or break USD

The US dollar is higher against the NZD, AUD, GBP and JPY but finds itself lower against the CAD, EUR and CHF. The currency did not build a lot of momentum after the release of the Federal Open Market Committee (FOMC) minutes released Wednesday. The US central bank remains committed to higher rates, but there is a growing concern about consistent low inflation.

The US Bureau of Labor Statistics will release the consumer price index (CPI) on Friday, October 13 at 8:30 am EDT. Core CPI is expected to have gained 0.2 percent, the same as last month for the change in inflation excluding food and energy. The more volatile CPI reading is forecasted at 0.6 percent. US retail sales data will also be released at the same time with core sales anticipated to have gained 0.9 percent. The headline figure adding back auto is expected to have jumped 1.7 percent. The rebound in both is expected to be directly linked to the negative impact hurricanes Harvey and Irma had on purchasing decisions.

The rise of US producer prices (PPI) on Thursday by 0.4 percent doubled the forecast and another inflationary data gain on Friday could put the FOMC minutes in a new light. If inflation is indeed rising faster than expected it could move the emphasis on the doves and put the hawks back in the drivers seat ahead of the December Fed meeting.

The EUR/USD gained 0.20 percent since the Asian open on Thursday. The single currency is trading at 1.18364 on the back of strong eurozone data. Industrial production was 3.8 percent in August and beat expectations of a 2.6 percent rise. The improvement of economic indicators has been steady and could provide further evidence of recovery ahead of the European Central Bank (ECB) meeting. The central bank is anticipated to start tapering its QE program this year, which is boosting the EUR.

While the Fed tried to communicate to the market that tapering did not mean tightening it seems ECB President Mario Draghi wants to be more clear on the subject by saying earlier today that current rates will remain well past the end of the bond buying program. The market is not buying it, as it happened with the Fed and the EUR is rising. German policy makers will not be happy with those words as they have pushed for and end to all stimulus

US data also posted strong gains. US producer prices rose by the most in six months. The PPI was up 0.40 percent in September and comes at a time when the market is giving more weight to inflation data. The data is particularly strong considering the weather played a huge factor during that period.

The release of the consumer price index on Friday will be a decisive indicator to close out the week of the US dollar. The minutes from the September Federal Open Market Committee (FOMC) meeting showed a growing concern that the factors keeping inflation low could be more longer term than originally thought. Many FOMC members still see another rate hike as appropriate despite those concerns leaving the decision on the table for December but the outlook for 2018 is for less tightening actions from the U.S. Federal Reserve.

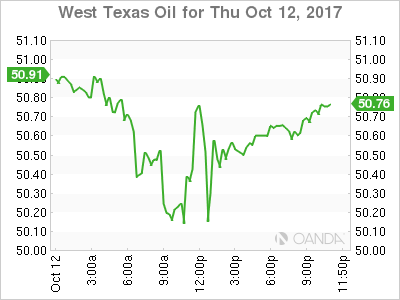

Oil gave back some of the gains of the week despite optimism from producers about higher energy demand forecasts and the release of the US weekly crude inventories showing a 2.7 million barrel drawdown on Thursday. The main factor for the decline in prices was a report by the International Energy Agency that forecasted lower demand for Organization of the Petroleum Exporting Countries (OPEC) crude. Current production is more that the appetite which means that oil prices can only recover if OPEC and other major producers not only extend the duration of the cut agreement, but limit their production even further.

US supply is not bound by this agreement and continues to ramp up higher making the OPEC cuts less effective. The US has turned from a net importer of oil to an exporter and with global demand for energy products stable the downward pressure on prices will continue until something changes.

Market events to watch this week:

Friday, October 13

8:30am USD CPI m/m

8:30am USD Core CPI m/m

8:30am USD Core Retail Sales m/m

8:30am USD Retail Sales m/m