The Federal Reserve’s March interest rate decision comes amid significant market turmoil that has raised the prospect of a pause on its tightening cycle. On one hand, there are good arguments for the Fed opting to take a wait-and-see approach amid (by some measures) the worst bond market volatility since the global financial crisis. Recent developments should tighten lending standards and dent confident, doing some of the Fed’s “tightening” work for it. On the other hand, the Fed clearly think it has more work to do when it comes to inflation — just last week (before financial stability concerns intensified) Chair Powell opened the door to a 50 bp hike. Recent data has been firm, on balance, with payrolls surprising to the upside yet again in February and underlying inflation remaining too strong for the Fed’s liking. As of this morning, the market is leaning toward a 25 bp hike. Validating that could be seen as a vote of confidence in the banking sector, and an indication that actions taken over the past week free up monetary policy to continue to address inflation. Assuming fresh financials stability concerns don’t emerge early next week, we think the Fed will go ahead with a 25 bp increase.

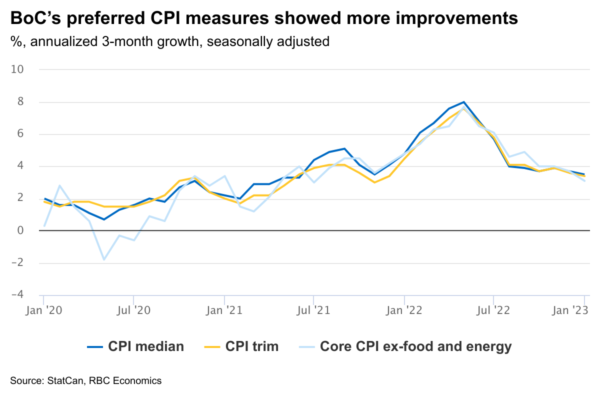

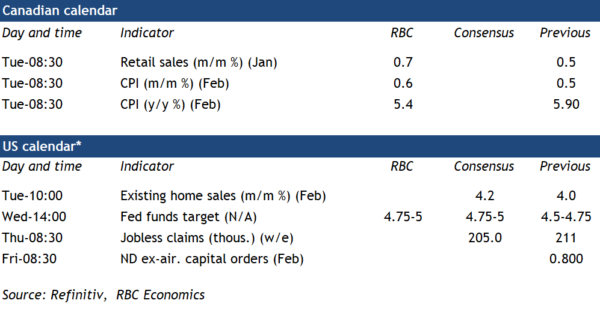

The Bank of Canada already announced a pause in interest rate hikes in January and followed through by leaving the overnight rate unchanged in March. That pause however is contingent on inflation pressures continuing to ease, and we expect Canadian headline CPI growth slipped to 5.4% year-over-year in February from 5.9% in January. Lower gasoline prices in February (down 3.6% monthly) could push energy CPI below year-ago levels for the first time in two years. Food inflation is still exceptionally high, and likely remained elevated in February. Shelter CPI is expected to have trended over, though accelerating mortgage interest costs partially offset weaker price growth for expenses related to home-buying. More importantly, the BoC’s preferred core measures – CPI trim and median – are expected to continue to moderate on a three-month moving average basis. That together with narrowing breadth of inflation pressure suggests persistent easing in fundamental price pressure, which should be enough to keep the BoC on hold through the end of this year.

Week ahead data watch

Next Friday, StatCan will release January’s retail sales estimate, where we look for a 0.7% monthly increase driven mostly by higher gas station sales, in line with StatCan’s advance estimate. Motor vehicle and parts sales likely eked out a small increase after a surge in January. New estimates next week will be based on the updated 2022 North American Industry Classification System (NAICS) and should better reflect sales made within the digital economy.