- We expect the Bank of England (BoE) to hike the Bank Rate by 25bp.

- We expect this to mark the peak in the Bank Rate of 4.25% as the BoE is set to signal a pause in the hiking cycle.

- EUR/GBP is set to move lower upon announcement – yet we highlight that changes to systemic risk fears will remain the key driver of the cross short-term.

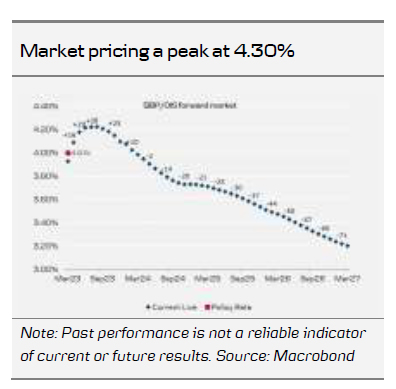

BoE call. We expect the Bank of England (BoE) to hike the Bank Rate (key policy rate) by 25bp on 23 March bringing it to 4.25%. Markets are currently pricing around 15bp for the meeting, thus close to an equal implied probability for an increase of 25bp in the Bank Rate and an unchanged decision. While the latest UK economic data releases, in our view, still support a 25bp hike on Thursday, we acknowledge that the probability of the BoE keeping the policy rate unchanged has risen considerably amid rising systemic risk fears. This risk is only supported by what we consider to be a fairly cautious Monetary Policy Committee (MPC).

We do not get updated projections at this meeting nor a press conference.

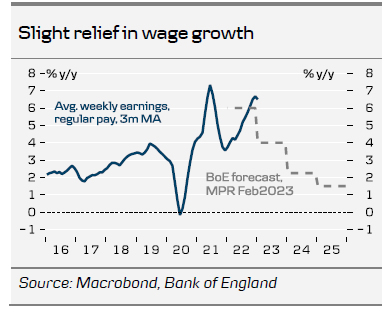

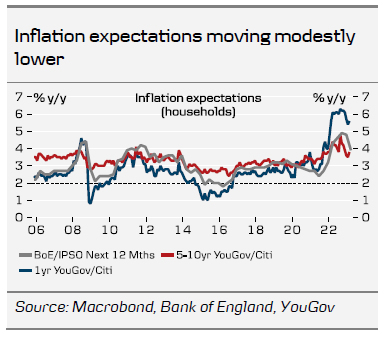

Since the last monetary policy decision on 2 February, both wage growth and inflation releases should have eased BoE fears of inflation spiralling out of control. The latest labour market report showed continued tightness as unemployment remained unchanged at 3.7% and unfilled vacancies moved only modestly lower. However, wage growth showed signs of slowing, supporting the BoE’s monthly Decision Maker Panel (DMP) survey which showed that expected year-ahead wage growth seemingly has peaked. Combined with core inflation, this remains a key release for the MPC in order to determine persistency of inflation pressures. Although inflation figures for February will not be published until the day before the rate announcement, the figures from January came in lower than expected for both headline and core inflation, with core printing below 6% for the first time since last June. Most importantly, a key data input for the BoE, core service inflation, ticked sharply lower.

We expect this to be the final hike before the BoE turns to a more wait and see approach. This is slightly fewer hikes than priced in markets (currently 30bp until September 2023). Also we do not expect rate cuts to be delivered by BoE before 2024.

Growth outlook. The UK economy narrowly avoided negative GDP growth in Q4. This was not least due to stronger than expected growth during October and November, while data has pointed to weaker signals for December. This, however, does not mean that the UK economy will avoid a recession, but merely that it will come later than originally pencilled in.

FX. In our base case of a 25bp hike, we expect EUR/GBP to move slightly lower upon announcement. In its statement we expect the BoE to prime markets for a pause in the hiking cycle as the central banks want to fully evaluate the effect from previous Bank Rate increases. Overall, we regard the relative central bank outlook to be a positive for EUR/GBP but with other factors acting as a headwind, we increasingly see a case for continued range trading in the cross.