Summary

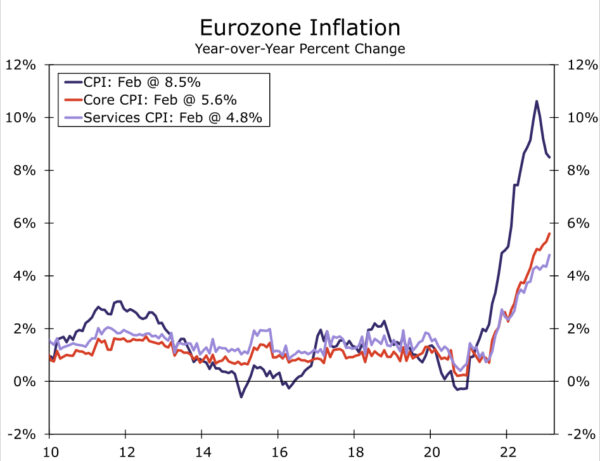

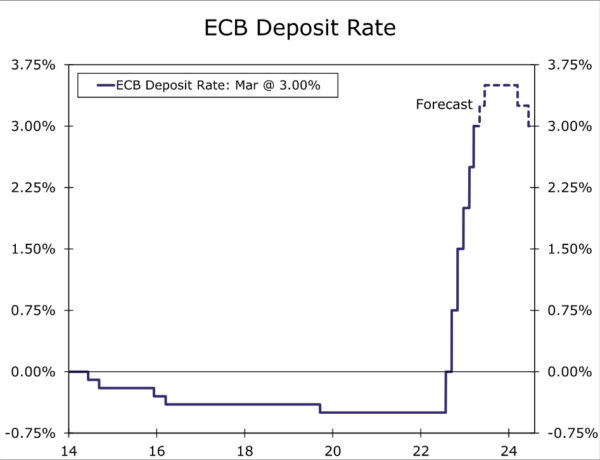

- In a widely anticipated monetary policy announcement, the European Central Bank (ECB) raised its Deposit Rate 50 basis points to 3.00%. In raising interest rates, the ECB said “inflation is projected to remain too high for too long.” Indeed, we observe the ECB projects headline and core inflation to remain above target over its entire forecast horizon.

- In a nod to recent financial market strains, the ECB highlighted elevated uncertainty, emphasized a data-dependent approach to policy rate decisions, and refrained from signaling any future rate moves in its statement.

- That said, should market strains ease and volatility recede in the weeks and months ahead, persistent inflation should in our view be enough to elicit further European Central Bank tightening. We still expect the ECB’s Deposit Rate to peak at 3.50% by June this year. In that context, market pricing, which currently implies a peak policy rate of around 3.09%, appears light to us.

European Central Bank Delivers, Again

In a widely anticipated monetary policy announcement, coming amid financial market strains seen in recent days, the European Central Bank held true to its pledge and delivered another large policy rate hike at this week’s meeting. The ECB raised its Deposit Rate 50 basis points to 3.00%, following through on the strong signal it had sent at its early February meeting. In raising interest rates, the ECB said “inflation is projected to remain too high for too long.”

In fact, updated projections show inflation is forecast to remain above the ECB’s inflation target essentially through its entire forecast horizon. Headline CPI inflation is seen at 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025. Excluding food and energy, inflation is projected at 4.6% in 2023, 2.5% in 2024 and 2.2% in 2025. Meanwhile, Eurozone GDP growth is expected to remain quite resilient at 1.0% in 2023 and 1.6% in 2024 and 2025. Keep in mind, however, these projections were finalized before the emergence of recent tensions.

ECB policymakers did acknowledge recent market developments, saying it “is monitoring current market tensions closely and stands ready to respond as necessary to preserve price stability and financial stability in the euro area.” However, the ECB added the Eurozone “banking sector is resilient, with strong capital and liquidity positions. In any case, the ECB’s policy toolkit is fully equipped to provide liquidity support to the euro area financial system if needed and to preserve the smooth transmission of monetary policy.” We broadly concur with this statement, having recently published a report that shows in aggregate, the Eurozone banking sector remains in reasonably solid shape.

One important takeaway from today’s announcement, in the context of current elevated level of uncertainty, was the ECB’s “data dependent” approach to policy rate decisions. In that sense, and unlike its announcement in February, the ECB refrained from signaling any future rate moves in its statement this month. Still, despite the lack of guidance, the ECB’s above target inflation forecast provides some insight into potential future moves. Should market strains ease and volatility recede in the weeks and months ahead, persistent inflation should in our view be enough to elicit further European Central Bank tightening. Accordingly, after today’s decision, our near-term outlook for ECB monetary policy remains unchanged. We expect a further 25 basis point rate hike in May followed by a final 25 basis point rate hike in June, which would see the ECB’s Deposit Rate for the current cycle peak at 3.50%. In that context, market pricing, which currently implies a peak policy rate of around 3.09%, appears light to us. Our more forceful outlook for ECB policy is an important factor supporting our outlook for medium term strength in the euro versus the U.S. dollar.