Key Highlights

- The Aussie Dollar after forming a bottom, traded higher and broke a major resistance at 0.7800 against the US Dollar.

- There was a break above a crucial bearish trend line at 0.7800 on the 4-hours chart of AUD/USD.

- Australia’s Home Loans in August 2017 increased 1%, more than the forecast of +0.5%.

- Today in the US, the Initial Jobless Claims (Oct 7, 2017) will be published, which is forecasted to decline from 260K to 251K.

AUDUSD Technical Analysis

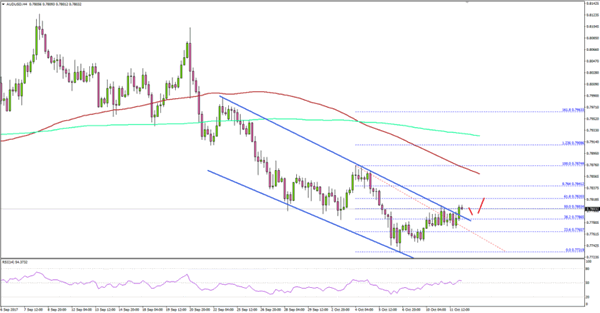

The Aussie Dollar after steady decline found support at 0.7720-00 against the US Dollar. The AUD/USD pair recovered well this week and recently broke a major resistance at 0.7800.

There was a nice recovery above the 23.6% Fib retracement level of the last decline from the 0.7875 high to 0.7719 low.

Looking at the 4-hours chart, there was a break above a major bearish trend line at 0.7800. The trend line resistance was also near the 50% Fib retracement level of the last decline from the 0.7875 high to 0.7719 low.

At the moment, the pair is struggling to gain momentum above 0.7800. Therefore, there is a chance of a minor dip before the pair resumes its uptrend towards the 0.7850 level.

Australia’s Home Loans

Today in Australia, the Home Loans figure for August 2017 was released by the Australian Bureau of Statistics. The forecast was slated for a rise of 0.5% in loans compared with the previous month.

The actual result was above the forecast, as there was a rise of 1% in the home loans. On the other hand, the last reading was revised down from 2.9% to 2.8%.

The report added that:

The trend estimate for the total value of dwelling finance commitments excluding alterations and additions rose 0.6%. Owner occupied housing commitments rose 0.9% and investment housing commitments rose 0.2%.

The result had a positive impact on AUD/USD and the pair was able to move above the 0.7800 resistance.

Other Economic Releases to Watch Today

Euro Zone Industrial Production for August 2017 (MoM) – Forecast +0.5%, versus +0.1% previous.

US Producer Price Index Sep 2017 (MoM) – Forecast +0.4%, versus +0.2% previous.

US Producer Price Index Sep 2017 (YoY) – Forecast +2.5%, versus +2.4% previous.

US Initial Jobless Claims – Forecast 251K, versus 260K previous.

ECB President’s Draghi’s Speech.