The Bank of Canada will likely keep its promise to declare a pause in monetary tightening during Wednesday’s policy meeting, although other major central banks are still debating higher rates. The policy announcement could cause more shorting of the battered Canadian dollar, unless policymakers signal a conditional halt, leaving the door open for additional rate increases later in the year.

BoC to take break from rate hikes

After a record pace of rate hikes, which pushed interest rates from nearly zero to 4.50% in just eight meetings during the past year, the Bank of Canada decided to diverge from its peers and set its tightening campaign on pause as of March while assessing the impact of cumulative rate increases. The message was clear in January and doing otherwise would damage its credibility, with investors widely expecting stable rates at the moment.

Reasons to pause

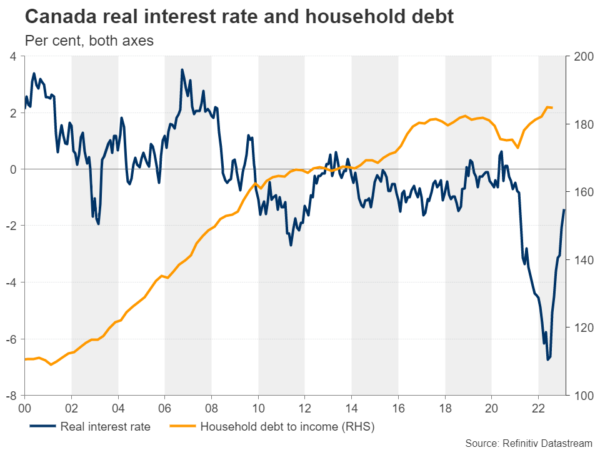

The negative surprise in Q4 GDP growth figures, which revealed a flat economy after five consecutive quarterly increases versus estimates for a 1.5% expansion, as well as the sharp decline in housing starts in February, could excuse a break in monetary tightening for now. Canadian households are among the most indebted in the world, with debt-to-disposable income standing at 180% at the end of 2022. Hence, the central bank is reasonably taking a more careful approach than the Fed.

Will there be more tightening?

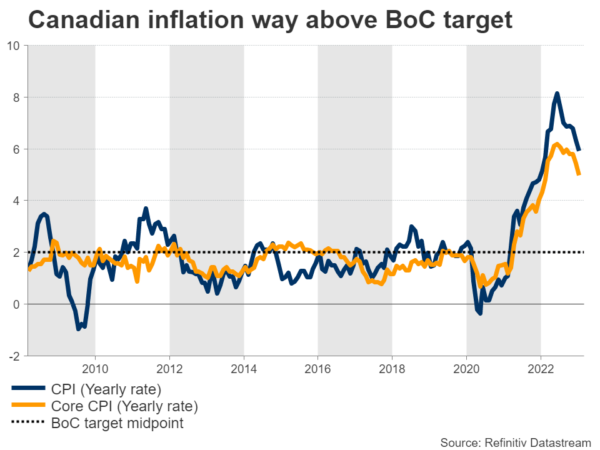

Nevertheless, it might be premature to exclude additional tightening in the year ahead, as inflation is still triple the central bank’s 2.0% target. The core measure, which excludes volatile food and energy prices, is also a problem at 5.0% y/y, and could remain sticky at an elevated level if the resilient labor market keeps driving demand.

Recall the outsized job addition of 150k in January, which beat analysts’ pessimistic expectations for a 15k employment growth and was the largest in almost a year. The next update will be on Friday, with forecasts pointing to a negligible 10k employment increase and a slight pickup in the unemployment rate to 5.1%. Still, February used to deliver upbeat employment reports over the past two years. Hence, another positive surprise cannot be ruled out.

USD/CAD

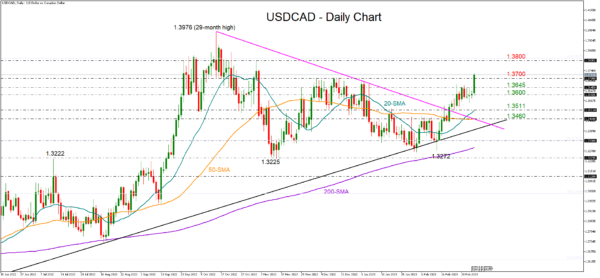

Futures markets are currently pricing out rate increases above 5.0% by the end of the year, while foreseeing a cut in January 2024. If policymakers keep rates unchanged but see a strong chance to drive interest rates above that peak, while playing down the rate cut scenario, the loonie could recoup some lost ground. In this case, dollar/loonie could retest the 1.3645 -1.3600 constraining zone before tumbling towards the 20-day simple moving average (SMA) at 1.3511. A more aggressive decline could even reach the 50-day SMA at 1.3460.

Alternatively, if the central bank judges that a potential break from pause may not be more than 50bps, remaining confident that the existing tightening will push inflation towards 2.0% by 2024, dollar/loonie could spike towards 1.3800. Should the US nonfarm payrolls further confirm a widening Fed-BoC rate divergence later in the year, the loonie could get another hit.

It’s also worthy to note that Canada’s distorted political relations with China over election meddling probes and investment laws in the mining sector could make it harder for Canadian producers to benefit from the reopening of the Chinese economy.

CAD/JPY

In other pairs, loonie/yen will be another interesting pair to watch as expectations for a hawkish shift within the Bank of Japan gain traction. A decisive close above the 100.80 ceiling could stage an exciting rally towards the 200-day simple moving average at 103.50.