With the market dissecting BoJ governor nominee Ueda’s appearance at the House of Representatives, next week brings a rather busy schedule that includes retail sales and the Tokyo CPI. There is growing speculation about BoJ Governor Kuroda’s actions at his last meeting in charge in two weeks’ time. However, everyone acknowledges that a monetary policy tweak needs solid economic evidence. Could this set of data allow Kuroda to say “goodbye” with a loud bang?

Speculation is rife about the March meeting

The market loves big events and the speculation built around them. With the current BoJ governor preparing for his last gathering, the market is trying hard to predict the post-meeting announcements. Will the BoJ pull the plug on the yield curve framework and wipe the slate clean for the new governor or opt to do nothing, giving the opportunity to Ueda to decide the best course of action? Both sides have sound arguments, especially the “withdraw the yield curve control framework” camp as the BoJ head nominee comes from the pre-Kuroda era and as such he does not carry the current administration’s successes and failures on his record. However, whatever is decided depends on the economic undercurrents. There have definitely been some positive signs when examining the inflation metrics and the latest average earning prints, but there are still certain dark stains in the economy.

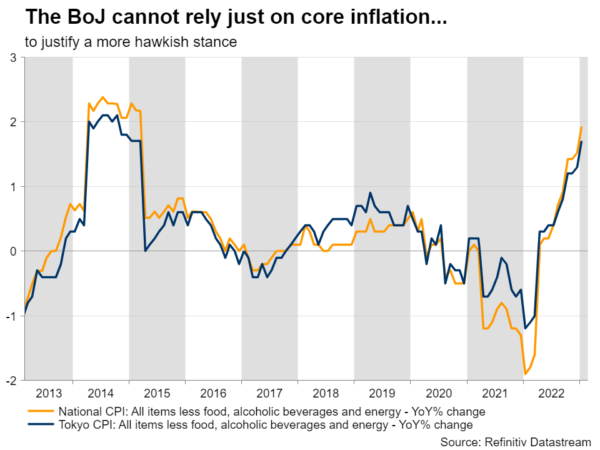

Tokyo CPI frontrunning the nationwide print

With most developed countries flirting with double-digit inflation rates, Japan’s nationwide headline CPI figure managed to reach the 4.3% level in January. Next week we get the February Tokyo CPI, an early preview of the ongoing inflation pressures. The January print came at 4.4%, the strongest yearly growth since June 1981, and hence another strong print on Friday could set the scene for a similar figure on a national level. While the headline inflation numbers look tempting for the BoJ, the core CPI, excluding food, energy, and alcoholic beverages remains disappointing, thus, potentially tying BoJ’s hand. Last month’s nationwide print came at 1.9%, below the artificially inflated March 2014 figures. Considering the global inflationary pressure, a core CPI print in the region of 1-2% is nothing to write home about, but clearly represents progress compared to the BoJ’s recent record.

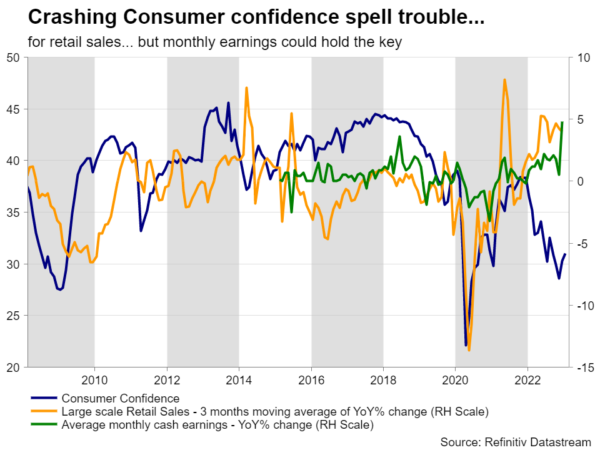

Decent retail sales growth despite low consumer confidence

While the market has been almost exclusively focusing on the CPI prints, the BoJ has been all over the consumer spending data. When examining the retail sales figures against the consumer confidence, we get an interesting disparity. While the latter has dropped aggressively, retail sales growth remains at elevated levels. This gap is even more evident when analyzing the large-scale retail shops data. Putting aside the volatile nature of the sales dataset, recent history points to a possible correction in retail sales ahead. However, the recent surprising jump in the average monthly cash earnings could mean that there is some underlying strength among consumers. If this strength gets confirmed at next week’s data releases, it could allow the BoJ to consider more aggressive scenarios for its 2023 strategy.

Industrial production raises question about GDP growth

With the fourth-quarter GDP report disappointing on February 14, the market would be looking closely at the preliminary February industrial production data on Tuesday morning. The January figure was equally disheartening and if we get another negative print, we could see the market pricing in an equally weak first-quarter GDP, potentially even negative. In addition, a weak industrial production result could raise questions on the expected impact of the Chinese reopening on goods demand and the supply lines in the region and globally.

Yen tries to recoup some of 2022 losses

The yen had a dreadful 2022 against the euro. A 19% rally pushed this pair to the highest level since December 2014, on the back of the divergent central banks’ policy stance and the overall economic developments. Yen bulls have been trying to stage a comeback since the October 21 high of 148.39, but the move lower has not been easy. The euro/yen pair continues to hover inside a descending broadening wedge as euro bulls seem to lack the appetite to push it above the upper boundary. The absence of a strong trend reveals the hesitance from both sides to make bold moves as they wait for the appropriate trigger. Yen fans would enjoy a drop towards the 141.04 area, but would loathe a break above 144.24 that could potentially open the door to a much stronger rally.