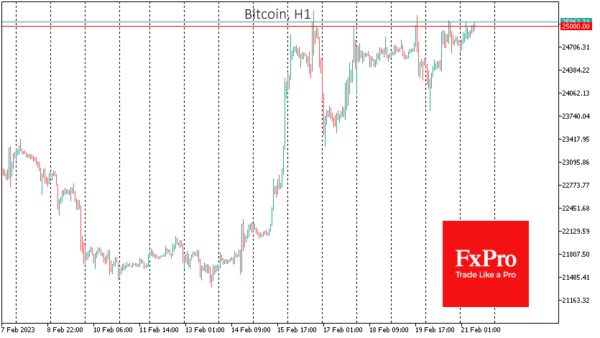

Market Picture

Bitcoin continues its attempts to break through resistance at $25K. Volatility was muted on Monday as the primary driver of it – US equity markets – was closed yesterday. Cryptocurrency market capitalisation rose 1.2%.

According to CoinShares, investments in cryptocurrencies fell by $32 million last week, the second consecutive week of declines and the highest in seven weeks. Investments in Bitcoin fell by $25 million and Ethereum by $7 million. Investment in funds that allow to short bitcoin increased by $4 million.

Despite bitcoin’s unsuccessful attempts to consolidate above $25K, intraday pullbacks from this resistance are becoming smaller, indicating a continued buying-the-dip pattern. A break above $25K is only a matter of time, potentially opening the door to $28K.

News Background

Galois Capital, one of the world’s largest cryptocurrency-focused hedge funds, announced its closure. The fund lost around half of its capital after the FTX collapse.

The next cryptocurrency bull market will start in the East. The US will only have two options: embrace cryptocurrencies or be left behind, said Gemini exchange co-founder Cameron Winklevoss. Such comments came amid moves by US regulators against cryptocurrency companies.

The G20’s Financial Stability Board (FSB) intends to draw up standards for cryptocurrency regulation by July.

Hong Kong will allow retail investors to trade cryptocurrencies on exchanges. Trading venues will be subject to mandatory licensing.

Meanwhile, Binance’s introduction of a zero fee for bitcoin trading and the collapse of the FTX exchange allowed it to capture 98% of the BTC spot trading market.