Investors will receive another dose of crucial data releases next week that can fuel FX volatility. The highlight will be the minutes of the last FOMC meeting, where there’s a risk that policymakers strike a different tone than Powell did back then. Over in New Zealand, the central bank is about to roll out another rate hike. Meanwhile, the latest set of business surveys will provide a timely update on the health of the global economy.

Dollar tries to capitalize on Fed bets

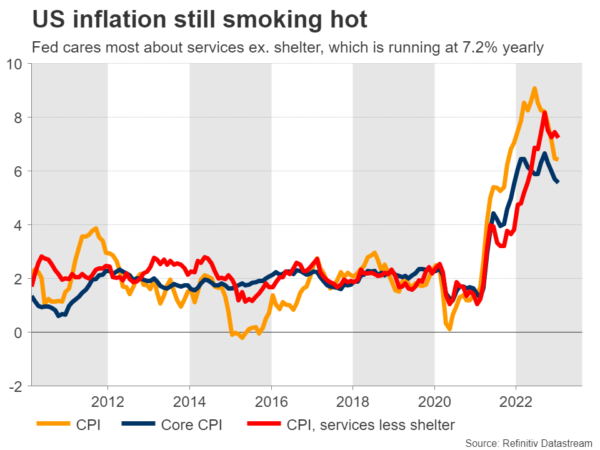

A lot has happened in US markets over the past week, mainly pointing in the direction of tighter Fed policy for a longer period. Inflation came in hotter than expected in January, and the part that was especially hot was the metric the Fed cares most about.

Services inflation excluding shelter clocked in at 7.2% from last year, suggesting that there’s still a long road before inflation is crushed as the stickier categories and producer prices are not really cooling down. Supporting this notion was the latest batch of retail sales, which revealed that consumer demand is still in good shape.

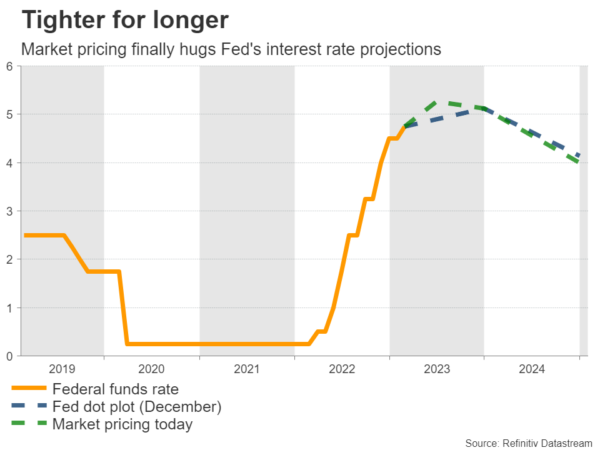

Markets responded by pushing up the expected ‘peak’ in Fed rates to a new cycle high of 5.28%, and by pricing out the rate cuts that were anticipated at the end of the year. That propelled US yields higher, yet the dollar’s advance was not impressive. It outperformed the yield-sensitive yen, but it barely edged out new highs against the euro.

We’ll find out whether this was just a short-term trading anomaly or something more worrisome next week, when a storm of US data is released. The show will start on Tuesday with the business surveys for February, ahead of the Fed minutes on Wednesday. Then on Thursday, the second estimate of GDP for Q4 is out, before the week concludes with the latest core PCE price index on Friday.

Most of the focus will be on the FOMC minutes. This was the meeting when the Fed chief signaled that a ‘disinflationary’ impulse had started to emerge, sending the dollar tumbling. That said, the tone of Fed officials since this meeting has been much more hawkish, with many stressing that rates might need to go higher than previously envisioned.

If something similar is reflected in the minutes, it could reinforce the upward pressure on US yields, although whether the dollar can capitalize properly this time remains to be seen.

RBNZ: Not the time to pause

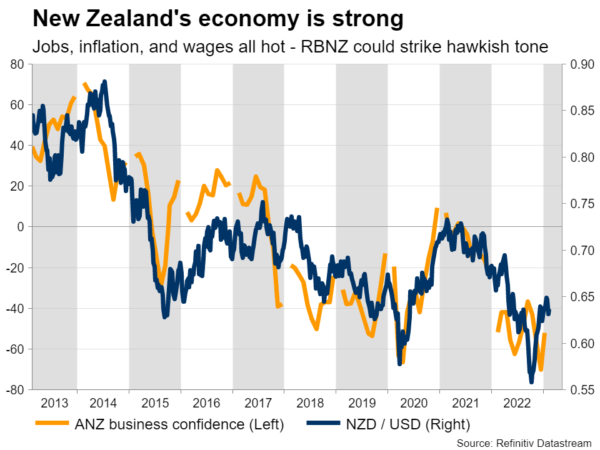

The Reserve Bank of New Zealand meets Wednesday for its first rate setting decision of 2023. With all other major central banks having kicked off the new year with rate hikes, the RBNZ is not about to buck the trend. Policymakers are widely anticipated to raise borrowing costs by a further 50 basis points, taking the cash rate to 4.75%.

Even more crucial will be whether policymakers raise their projected terminal rate even higher than the lofty 5.50% they estimated back in November. If they leave this number unchanged, the New Zealand dollar’s best chance of finding some upside will be some hawkish commentary, particularly the language around inflation.

Recent data suggests it’s too early for the RBZN to ease up on its tightening campaign – unemployment remains very low, wages are rising at a record pace, inflation has only recently started to plateau, and inflation expectations are elevated. The RBNZ will therefore likely be wary about cornering itself by talking about a pause, maintaining some flexibility in case rates have to be raised even higher than 5.50%.

Eurozone and UK business surveys eyed

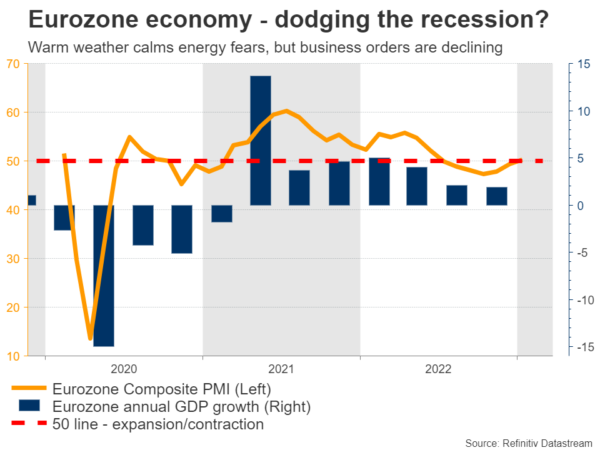

Crossing into Europe, the latest business surveys from the Eurozone and United Kingdom will hit the markets early on Tuesday. As always, these will be crucial in shaping the outlook for investors, providing an early glimpse into how corporations view the economic landscape.

In the euro area, the previous round of these surveys painted a rosier picture, highlighting an improvement in growth momentum and suggesting the region might escape a recession after all. These hopes underpinned the euro, but it’s important to stress that most of this progress was due to warmer weather conditions.

New business orders kept falling, which suggests that economic growth will likely be anemic in the coming quarters, even if the Eurozone ultimately dodges a recession. Whether this pattern continues in the February surveys could decide the longevity of the euro’s recovery.

Germany’s inflation report will be released Wednesday, after it was delayed earlier this month.

Over in the UK, the situation appears even worse. Britain has a greater inflation problem to deal with, as electricity bills have surged more than most of Europe and post-Brexit worker shortages have added upward pressure on wages. Meanwhile, the economy is teetering on the verge of recession, something both the IMF and the Bank of England already expect in their forecasts.

As for sterling, the outlook is quite gloomy. The UK is probably the weakest major economy right now, market pricing suggests the Bank of England will pause its tightening cycle soon, and the pound’s sensitivity to stock markets leaves it exposed considering the expensive valuations in US markets while earnings growth has turned negative.

Elsewhere, traders of commodity-sensitive currencies will keep a close eye on Canada’s inflation and retail sales stats on Tuesday, ahead of Australian wage numbers on Wednesday. Finally in Japan, the inflation report that’s out on Friday will likely confirm that price pressures are firing up, feeding speculation for further policy adjustments by the Bank of Japan.