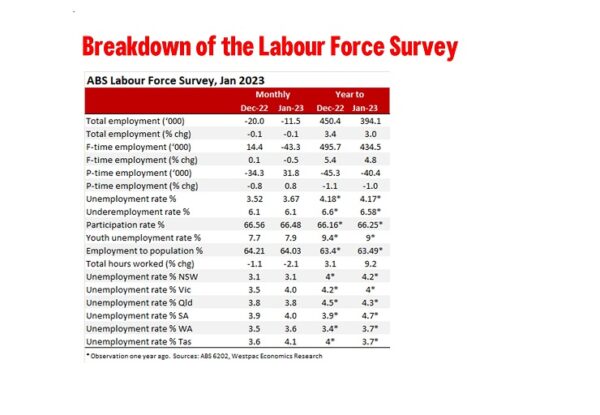

Total employment: -11.5k from -20k (revised from -14.6k); unemployment rate: 3.7% from 3.5% (unrevised 3.5%); participation rate: 66.5% from 66.6% (unrevised 66.6%). We had expected a softening in employment growth through 2023 and as the ABS suggests the recent softer than expected outcomes are due to one off factors associated with annual leave and illness we have not revised our forecast for unemployment be around 4¾% by end 2023.

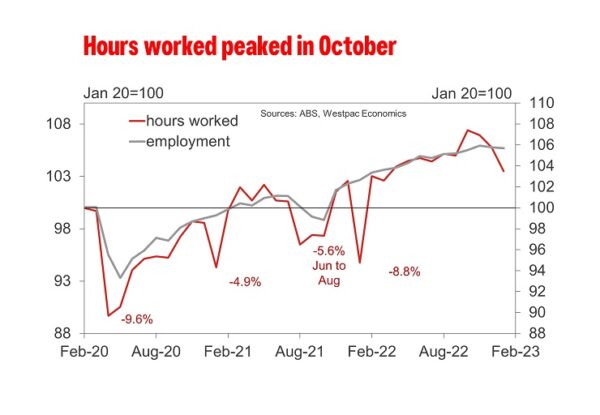

Total employment fell almost 12k in January following on from a 15k decline in December shifting the three-month average change in employment from 45k in November to 33k in December then down to 1k in January. Annual growth in employment has moderated from 6.8%yr in October to 3.4%yr in December then 3.0%yr in January highlighting a significant step down in the pace of employment growth.

The employment to population ratio fell 0.2ppt to 64.0% in January. While it is still 0.5ppt higher than January 2022 it is also consistent with the moderation in the annual pace in employment growth. The annual change in employment to population peaked at 2.9ppt in October moderating to 0.8ppt in December then down to 0.5ppt in January.

While we agree that there has been a clear step down in employment growth, something we expected to see as the surge out of the COVID recovery lost momentum, the big question for us is: should we take this significant shift in employment growth at the end of 2022 and in early 2023 as the start of new softer trend, or even a correction in employment, despite business and household surveys still pointing to robust labour demand?

We don’t think so, as the ABS noted some factors that would make you want to see more data before you accept the past few months being indicative of a new softer trend.

The ABS noted that along with a larger-than-usual increase in unemployment in January, there was also a similarly larger-than-usual rise in the number of unemployed people who had a job to go to in the future. January is the most seasonal month of the year (employment fell 343k in original terms) with people not just leaving jobs but also getting ready to start new jobs or return from leave. In January 2023 the ABS noted that more people than usual with a job, indicating they were starting or returning to work later in the month.

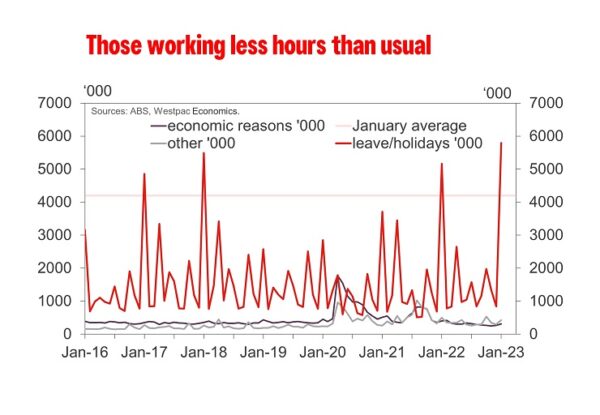

And as we suspected in our preview there was a greater than usual ‘holiday effect’ while the rate of illness improved from December. Seasonally adjusted monthly hours worked declined 2.1% which reflected a higher-than-usual number taking annual leave in January. Early January is the seasonal peak in people taking annual leave. As in 2021 and 2022, January 2023 again saw more than usual taking annual leave with around 43% of those employed working reduced or no hours because they were on leave, compared with around 41% of those employed over the same period before the pandemic.

In January 2023, the proportion of people away from work on sick leave was back around the average, pre-pandemic level, unlike January 2022, when more people than usual were away from work on sick leave.

By state, it is interesting that the unemployment rate lifted in all states expect for NSW and Qld. The unemployment rate was flat in NSW, well below the national average of 3.7%, but we should note that NSW employment contracted 5.1k in January on the back of a 17.2k contraction in December. Unemployment was also flat in Qld at 3.8%, higher than the national average, which is interesting given that employment lifted 17.6k in January in that state.

The unemployment rate lifted to 4.0% from 3.5% in Victoria, it rose from 3.9% to 4.0% in SA and from 3.5 to 3.6% in WA.