U.S. Highlights

- Since last Friday’s blockbuster employment report, market pricing on the peak fed funds rate has firmed to 5.25%. This aligns to the FOMC’s December projections, though markets still foresee the Fed cutting rates later this year.

- At an event on Tuesday, Fed Chair Powell did not pushback against investors’ diverging view, nor was his tone any more hawkish, despite last week’s strong reading on employment.

- With the FOMC now in the “fine turning” stage of the tightening cycle, policymakers have become increasingly data dependent. This means next week’s inflation report will be under the microscope..

Canadian Highlights

- This week was dominated by Canada’s own blockbuster jobs report. The economy added a hefty 150,000 jobs in January, and the unemployment rate held steady at 5% – near a record low.

- The Bank of Canada released its first-ever minutes from the Governing Council’s interest rate deliberations back in January. In them the Bank noted that inflation was heading in the right direction, but that growth and labour market continued to surprise to the upside.

- If the improvement in labour market and other indicators continues beyond a January bounce, the Bank of Canada indicated it will be ready to pick up the bat once again.

U.S. – Holding the Line… For Now

It was a very quiet week on the economic data calendar, giving investors a bit more time to digest last week’s blockbuster employment numbers. Since the jobs report, market pricing on the future path of the fed funds rate has firmed, with investors now anticipating two more 25 basis-point hikes by May, bringing the terminal rate to 5.25%. This aligns to FOMC’s last forecast outlined in the December Summary of Economic Projections. In contrast, markets differ from the Fed on the timing of rate cuts, with interest rate cuts priced in by financial markets for later this year, whereas the Fed doesn’t foresee that happening until 2024.

At an event on Tuesday, Fed Chair Powell did not pushback against the markets’ diverging view. Instead, he reiterated many of the same themes that he had emphasized in the press conference following last week’s interest rate announcement. The key message being that while the disinflationary process has begun, it remains very much in the early stages, and it will take “considerable time” before inflation returns to 2%. While financial markets initially rallied on the remarks, they later sold-off through the back-half of the week. At the time of writing, the S&P 500 is down 2%, while the 10-year Treasury edged higher by 15bps to 3.7% for the week.

When asked specifically about last week’s employment numbers, Powell said that it, “simply reaffirmed that the central bank has some way to go on raising rates” and that the strong numbers highlight that the adjustment process is unlikely to be linear. While there’s certainly validity to that argument, there’s also reason to believe that the January payrolls may be overstating the degree of strength in the labor market.

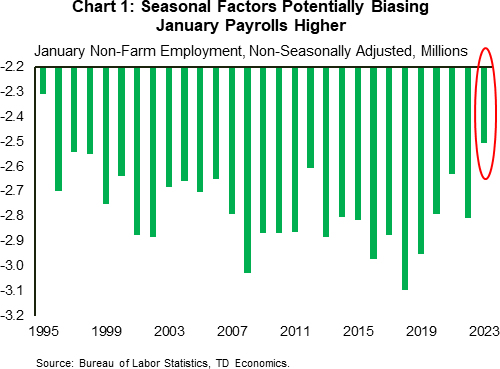

For starters, January was unseasonably warm across most of the U.S., which likely means there was a pull forward of economic activity. From that perspective, some of January’s gains may have been robbed from subsequent months – suggesting much weaker employment growth in the months ahead. Second, seasonal adjustment factors may have also played some role in biasing last month’s numbers higher. January is historically a month where non-seasonally adjusted payrolls record a massive decline in absolute terms (Chart 1). While this remained true last month, it did so by the smallest amount since 1995. This likely translated to an outsized gain in the seasonally adjusted figures.

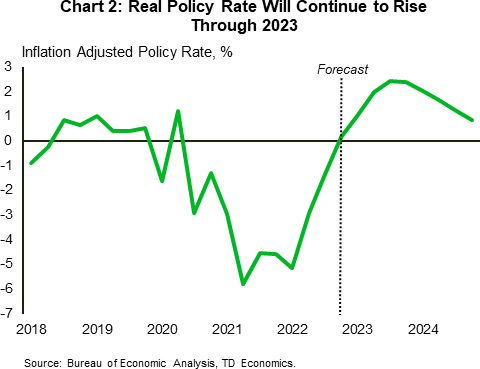

So, where does that leave us? It’s up for debate how much the January numbers are overstating the degree of underlying strength. But, at the end of the day, there is little doubt that the labor market remains incredibly tight. For now, Chair Powell seems content to not rattle expectations and watch how the data evolves. You can’t argue the logic. Monetary policy acts with considerable lag, and the cumulative effect of all the tightening done over the past 11 months is not yet being felt. Even once rate hikes are finished, the real effective policy rate will continue to rise through this year as inflation continues to decline (Chart 2). With the FOMC now in the “fine tuning” stage of the tightening cycle, data dependence will be the name of the game. With that, the focus now shifts to next week’s inflation report. Stay tuned!

Canada – Labour Market Slowdown Remains Elusive

This week was dominated by Canada’s impressive jobs report, which overshadowed the first-ever minutes from the Bank of Canada’s Governing Council’s interest rate deliberations. In its aim to increase transparency and following in the Federal Reserve’s footsteps, the Bank of Canada released an account detailing January monetary policy decision. In it the Bank noted that inflation was heading in the right direction. Globally as well as in Canada inflation has turned the corner as energy prices have declined from their peak and supply chain bottlenecks continued to ease.

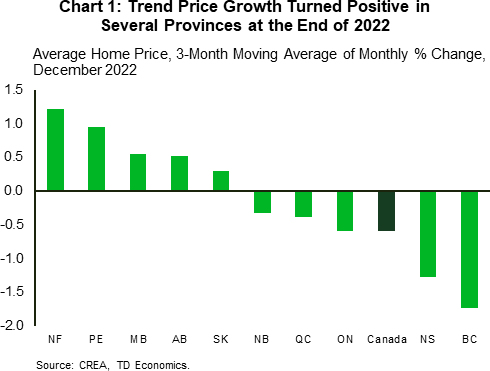

Growth-wise, however, things were not evolving entirely as expected. The Council noted that while economic growth has been slowing, both the economy and the labour market are putting up a fight, showing more resilience than anticipated. Third quarter GDP growth surprised to the upside, and outturn in the fourth quarter is also likely to come in above the Bank’s expectations. Indeed, indicators such as job growth and credit and debit spending fared better at the end of last year relative to the slowdown during summer months. Even the battered housing market appears to be finding its footing again. As we noted in this week’s report, on a three-month moving average basis house price growth was positive in half of all provinces in December (Chart 1).

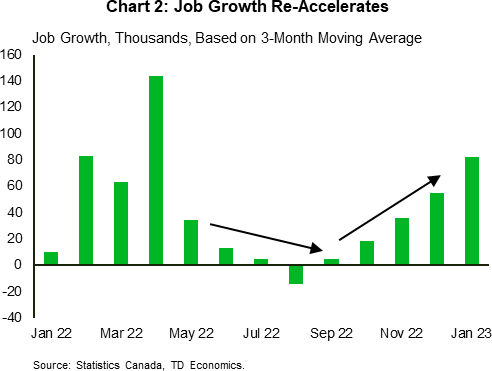

The ongoing tightness in the labour market could complicate the Bank of Canada’s job of taming inflation. Coming on the heels of already strong gain in December, today’s release showed that the economy added a blockbuster 150,000 jobs in January, most of them in full-time positions in the private sector (Chart 2). The unemployment rate held steady at 5% – near a record low, and hours worked also rose by 0.8% on the month.

Perhaps some slight consolation for the Bank could be found in the fact that wage growth continued to decelerate for the second consecutive month, slowing to 4.5% year-over-year (down from 4.8% December and 5.8% in November). Still at this level, it remains too strong. In the minutes of its January’s meeting, the Council noted that persistent wage growth in the 4%-5% range “was not viewed as consistent with achieving the 2% inflation target unless productivity increases to well above its historical trend.”

The Bank of Canada’s conditional pause on rate hikes is based on slowing economic growth and a cooler labour market, and the data recently has not been cooperating. The Labour Force Survey is notoriously volatile, and the Bank is not going to change course following one report. But, it has thrown a curve ball to the BoC, suggesting that upside risks to inflation remain. If the improvement in other indicators continues beyond a January bounce, the Bank of Canada indicated it will be ready to pick up the bat once again.