Market pricing in close to 90% probability of a December hike

The USD is weaker on Tuesday after American markets were off Monday due to the Columbus Day holiday. The currency had posted gains after a strong inflationary signal in the September jobs report but geopolitical risk over the weekend and the prospect of a declaration of independence Catalonia earlier today drove markets to seek safety. Hawkish rhetoric from the European Central Bank (ECB) about starting to scale back its stimulus program had the EUR bid. The USD will be looking at the Fed for support this week. The US central bank has already raised interest rates twice in 2017 and has signalled another rate hike could happen this year.

The U.S. Federal Reserve will release the minutes from its September Federal Open Market Committee (FOMC) meeting on Wednesday, October 11 at 2:00 pm EDT. The CME FedWatch tool is showing a 89 percent probability of a 25 basis points hike on December 13. FOMC members have been supported the move, with a few doves urging for more patience until inflation recovers.

Later this week the next hurdle for a December rate lift will come with the release of retail sales and consumer price index (CPI) data on Friday, October 13 at 8:30 am EDT. Inflation has met the flat expectations and given the market will be focusing on the CPI for clues that validate or weaken a case for a Fed December hike.

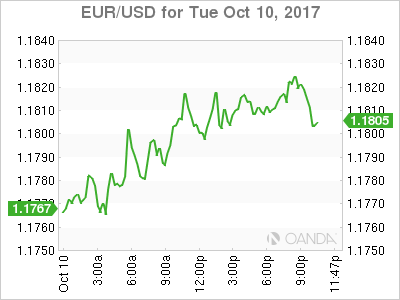

The EUR/USD rose 0.53 percent on Tuesday. The single currency is trading at 1.1803 after the end of the President of Catalonia speech before parliament where the decision to suspend the results of the referendum to set up talks with the central government of Spain. Earlier comments from ECB executive board member Sabine Lautenschlaeger about the tapering of the QE program in 2018 took the EUR higher. The European central bank appears ready to launch the program but has been uncomfortable with the naming and could rebrand it as something else to avoid triggering a “taper tantrum”.

US economic indicators have been impacted negatively by the tropical storms in September leaving the US dollar at the guidance of the Trump administration. The tax reform proposal is not seen as a slam dunk as it is facing criticism from both sides of the political spectrum and the President’s actions and comments on North Korea have further incensed the situation.

Market events to watch this week:

Wednesday, October 11

2:00pm USD FOMC Meeting Minutes

Thursday, October 12

8:30am USD PPI m/m

8:30am USD Unemployment Claims

10:15am EUR ECB President Draghi Speaks

11:00am USD Crude Oil Inventories

Friday, October 13

8:30am USD CPI m/m

8:30am USD Core CPI m/m

8:30am USD Core Retail Sales m/m

8:30am USD Retail Sales m/m