Following last week’s robust US data, the dollar surged against all its major counterparts, gaining the most against the risk-linked currencies aussie and kiwi. Investors revised up their expectations with regards to the Fed’s future course of action, admitting for the first time that they were probably wrong in pricing in a lower peak in interest rates and around 50bps worth of rate cuts later this year. Does this mean that the US dollar is staging a solid comeback?

Dollar laggard among majors on Fed pivot view

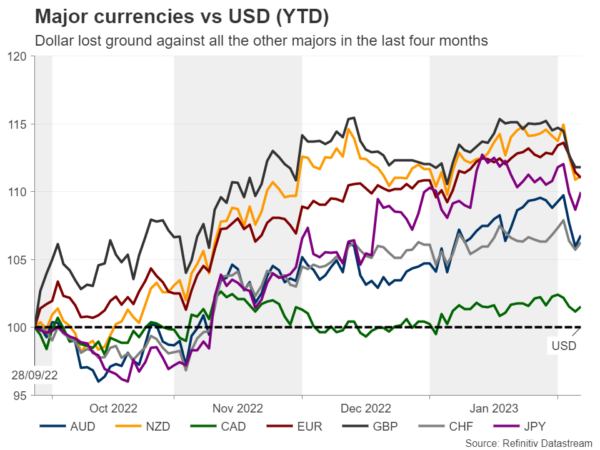

Since September 28, when it hit a more-than-twenty year high, the greenback has been suffering against all the other major currencies. It still holds the last place, even following Friday’s surprisingly upbeat economic releases, losing the most ground against the pound, the euro and the aussie.

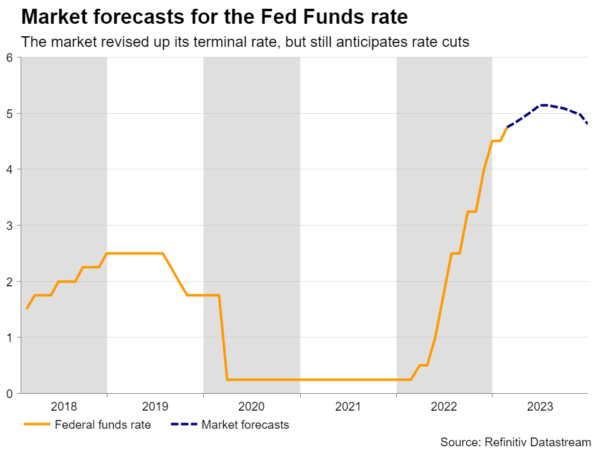

This was due to market participants adopting the view that, with inflation slowing down faster than estimated, the Fed may not raise rate as high as it has itself projected and that it may be forced to push the cut button later this year; and all this despite policymakers adamantly sticking to their guns that interest rates will rise to slightly above 5% and that no rate cuts are on their playbook for this year.

At the latest meeting, Fed Chair Powell reiterated that same view but added that the disinflationary process has started and that if inflation comes down faster, that will be incorporated into their policy. So, with inflation consistently missing estimates lately, market participants became more confident that the Fed may soon admit that rate reductions could be possible towards the end of the year, and thereby added to their dollar short positions.

Dollar shines on robust jobs and ISM data

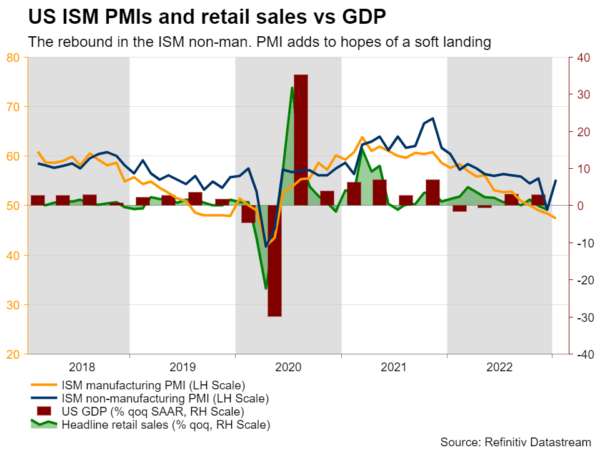

However, the dollar took a 180-degree spin on Friday and rebounded strongly against all its counterparts, after the US employment report showed that the economy added an astounding 517k jobs in January, with the unemployment rate hitting a more than a 53-1/2-year low of 3.4%. On top of that, just after the jobs data, the ISM non-manufacturing PMI rebounded strongly back into expansionary territory, adding to hopes that the US economy may eventually avert a recession.

The massive buying of the dollar following Friday’s numbers confirms the notion that the market pays more attention to data rather than to Fed communication. Even when the Fed was sounding ultra-hawkish, the market was not listening. But after the data, they were pricing in a terminal rate of around 5.12%, more or less in line with the Fed’s median projection of 5.15%, while they saw only one quarter point rate cut later this year.

Is the king back?

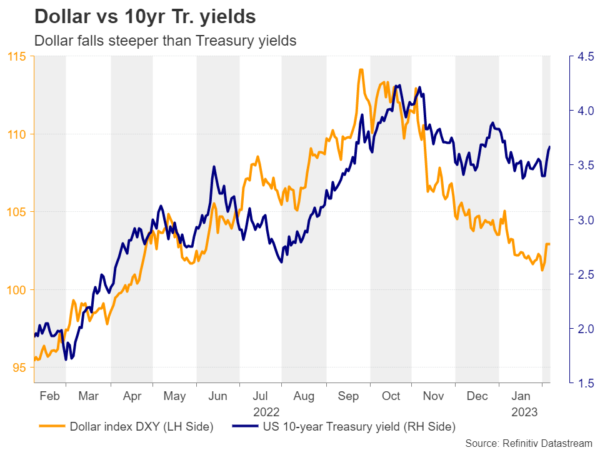

Does this mean that the dollar is back? That it reclaimed its throne as a king? What supports the case for some further recovery in the short run, may be that the dollar has fallen much steeper than the US Treasury yields due to Fed pivot bets, so when something points in the other direction, the currency may have some room to cover. Nonetheless, even if it strengthens a while longer, calling for a long-lasting recovery sounds premature at the moment. After all, just on Wednesday, Fed Chair Powell reiterated his disinflation remarks, prompting market participants to add back some rate-cut points.

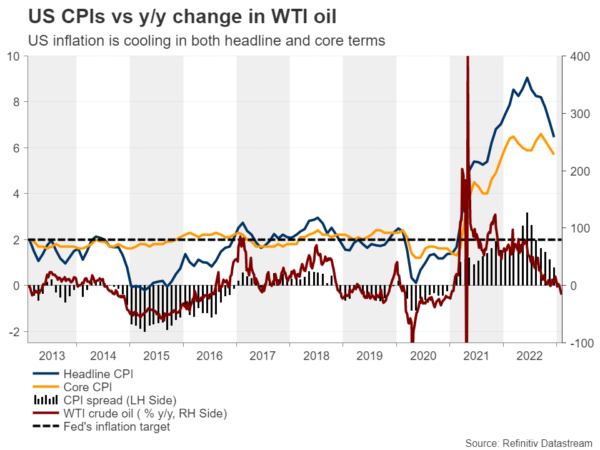

Also, with more crucial data coming out next week, any further recovery may be at risk. On Tuesday, the inflation data is expected to show that both the headline and core CPI rates continued to decline, and with the y/y change in oil prices dipping further in the negative territory, the headline CPI rate may fall more than the core. This could revive speculation about a lower peak in US interest rates as well as more rate cuts for later this year. US Treasury yields may come under renewed pressure and thereby the dollar could be sold again. The currencies that may take the most advantage of a potential downtrend continuation in the greenback are the euro, the aussie and the yen.

Getting the ball rolling with the common currency, the first reason is because the ECB is still expected to continue hiking more aggressively than the Fed, even after Friday’s stellar data, and the second is hopes that the Euro area is on track to avoid recession.

As for the aussie, the RBA turned hawkish again at its latest meeting, removing from its guidance the wording that they are not on a “pre-set course’ and instead emphasizing the need to continue with rate hikes moving forward. A potential increase in risk appetite due to investors’ potential repricing after the CPIs could also help the risk-linked currency, whose tanks are also receiving fuel from the reopening of the Chinese economy.

Last but not least, with wages in Japan accelerating strongly, speculation that the BoJ may eventually need to abandon its yield curve control may soon resurface, which will result in further narrowing between the Treasury and JGB yields and thereby translate into a lower dollar/yen.

More upside surprises may be needed

Now, in the case that the CPIs surprise to the upside and retail sales for January rebound (also scheduled to be released next week), investors may price out more basis points worth of rate reductions. The dollar may gain, and perhaps perform best against the Canadian dollar. Despite being a risk-linked currency, the Loonie gained the least against the greenback since its bearish reversal, perhaps due to the subdued oil prices. The BoC’s decision to signal that it may not hit the hike button again could also weigh on the Canadian currency should incoming data add credence to that view.

Dollar Index still in a downtrend

From a technical standpoint, the dollar index rallied after posting a false break out below the key support zone of 101.50. That said, it met resistance near the 50-day EMA on Tuesday, slightly above the key zone of 103.45, which provided support between December 14 and 30. This keeps the index in a downtrend.

Even if the recovery continues for a while longer, the bears may jump back into the action from near the 200-day EMA or the 105.50 zone marked by the high of January 6. If they are strong enough to take the action back below the 101.50 zone, they may dive towards the 99.35 barrier, or towards the 97.65 zone, which provided strong support between March 10 and 30.

The move signaling that the bulls have stolen all the bears’ swords may be a recovery above 105.50. The index will be back above both the 50- and 200- EMAs, encouraging advances towards the 107.90 zone, marked by the high of November 21. Slightly higher lies the inside swing low of October 27 at 109.45, which could provide resistance should the 107.90 zone fail to.