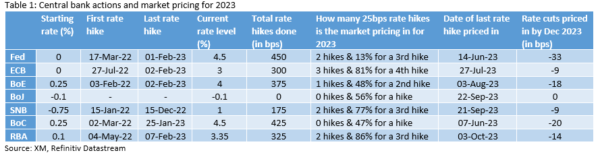

The first round of central bank meetings for 2023 has been completed. The RBA was the latest one to meet and, as widely expected, it announced a 25bps rate hike, carrying the torch from the ECB. A total of 175 bps of rate hikes have been announced since the start of 2023 by the seven central banks we have analyzed in this report, and the plan for most central banks is to continue tightening their monetary policy. Now that the dust has settled from last week’s key rate decisions and the recent surprisingly strong US data releases, we have had a look at what the market is pricing in for the remainder of 2023. Is the market expecting the key central banks to remain at full throttle for 2023 or are we getting close to the peak of central bank rates?

We have separated the seven central banks examined in three groups based on the market pricing for 2023. The exact categorization has been made on the number of rate hikes expected by the market.

Maybe one rate hike in remainder of 2023 – BoC, BoJ

Both the BoC and BoJ belong to this group. The former has been aggressively hiking since March 2022 and it has delivered 425 bps of monetary policy tightening. The market thinks that BoC is close to its peak, and it is currently pricing in a 47% probability for a 25 bps move at the June 7 meeting. However, a total of 20 bps of easing is then seen by year-end, which means that the BoC could opt for a rate cut at the December 2023 meeting. On the other hand, the BoJ is a completely different “animal”. Apart from the small change in its yield curve framework at the December meeting, it has not managed to hike rates in the current global tightening cycle. We are certain that Governor Kuroda would have liked to finally utter the rate hike phrase, but the Japanese economy has not been plagued by the skyrocketing inflation rates seen elsewhere. However, the recent improvement in the economic data has allowed the market to cautiously price in 14 bps of rate hikes by year-end.

Most likely two rate hikes left and then possibly a rate cut – Fed, BoE

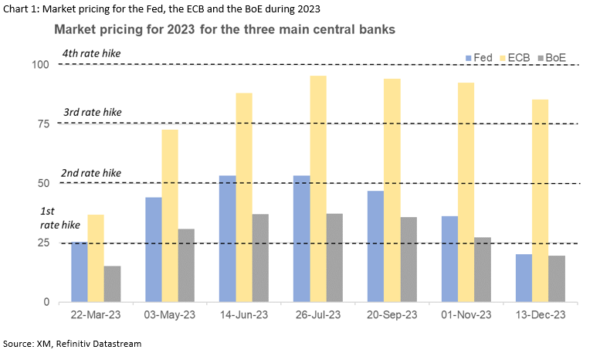

The Fed and the BoE feature in this category. Following last week’s rate hike and the moderately hawkish tone by Chairman Powell, the market is currently expecting two additional 25 bps rate hikes by the June 14 meeting. This means that the Fed Fund rate target range could rise to the 5-5.25% range, close to the median rate forecast seen at the December dot plot. However, until the end of 2023 a total of 33 bps of rate cuts are penciled in by the market, partly reflecting market fears for a possible recession ahead. Similarly, Governor Bailey et al announced another 50bps rate hike at last Thursday’s gathering. The UK is facing the strongest and most stubborn inflation, but the market is only pricing in 38 bps of rate hikes during 2023. The current state of the economy, especially the housing sector, and the overall BoE rhetoric appear to hold back the hawkish expectations. On top of that, the market is already pricing in a 72% probability for a rate cut by year-end, revealing the market angst about the UK economy.

Tightening to continue with around 3 or more rate hikes – ECB, SNB, RBA

The third group includes the ECB, the SNB and the RBA. Last week President Lagarde appeared adamant about the ECB’s strategy, repeating their intention to hike by 50 bps at the next meeting. Based on the current economic state of the euro area countries, the ECB seems determined to continue its tightening campaign post-March and the market appears to be convinced. Almost 96 bps of rate hikes are priced in by the July 27 meeting with just 9 bps of easing expected in the latter part of 2023. Similarly, both the SNB and the RBA are expected by the market to deliver around three rate hikes by their September and October meetings respectively. Thereafter, there is a 30-55% probability of a 25bps rate cut to take place by year-end for both central banks.

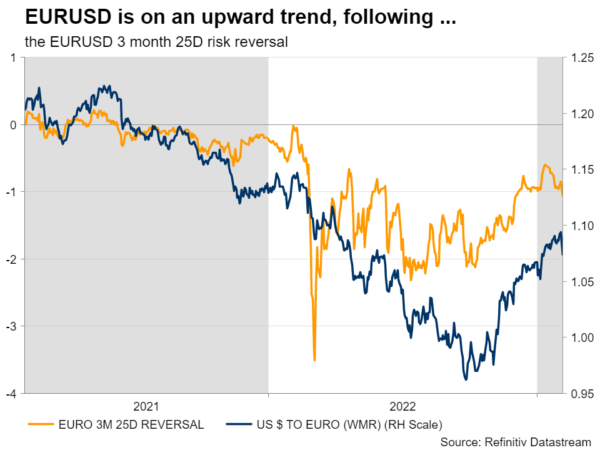

To sum up, the market has been busy plotting different paths for the main central banks. The Fed is expected to hike twice before unwinding at least 33 bps of tightening by year-end. On the other side, the ECB has convinced the market for a more aggressive action plan in 2023. Almost four rate hikes are currently priced in, with just 38% probability of a 25 bps rate cut in December 2023. EURUSD has been moving aggressively higher since October 2022, but following last week’s rate announcements, it has been experiencing a sharp correction. Using the 3-month 25 delta Risk Reversal – an option structure measuring volatility but also used as a sentiment metric for a specific currency pair – we can see that the market appetite for the euro has turned more bearish since January 13. This could potentially reflect waning confidence on the euro’s future performance, despite the market anticipating a more aggressive ECB path.