This week has all the makings of being vital for the coming weeks and months, with the most important publications for the market in focus.

The week’s main event will undoubtedly be the Fed’s interest rate decision. More specifically, the comments on the decision and the press conference will follow, where investors and traders will look for answers on when the Fed will stop raising rates. In addition, the ECB and the Bank of England will present their rate decisions, setting the overall agenda for the major central banks. Typically, the other central banks are moving in the same direction, albeit with some deviations.

On the economic data front, the most important releases will be the eurozone inflation figures for January and the US employment figures, which have often set the tone in the past.

As is often the case, the market moved to key levels just before important events. The dollar index fell to 101.60. The local correction in May also ended near the same level. But more importantly, this is the multi-year “ceiling” area in the dollar from which the DXY turned lower in 2017 and 2020.

Earlier last year, the opportunity to rewrite multi-year highs was provided by the Fed’s decisive moves, which hiked three times by 75 points each, something not seen in over twenty years. It will probably take an equally fundamental change in Fed policy to change the market’s mode.

As we enter the fourth month of an active dollar sell-off, the market has accumulated fatigue with the trade. This is reflected in the sideways movement of the index over the past two weeks. The lull also sets the stage for a corrective pullback of 3-4%, allowing participants to take medium-term profits and rebalance portfolios.

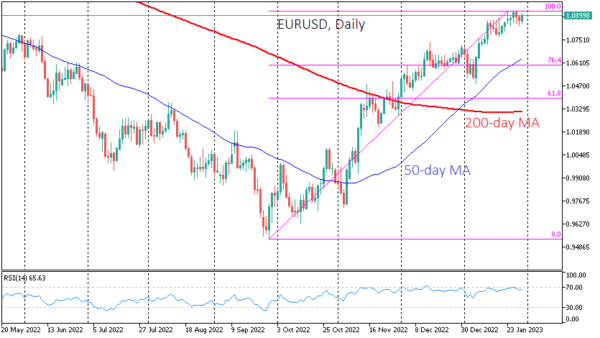

The potential correction could take the Dollar Index to 104.5, the level at the start of the year and the 76.4% Fibonacci recovery line from the decline from the September high of 114.73 to the January low of 101.26.

However, there is reason to believe that the recovery in the Dollar Index will be more significant, taking it back to the 106.30 area, which is the 61.8% retracement level from that decline and the 200-day moving average.

In terms of the major pairs, a potential dollar correction pullback would take EURUSD from the current 1.09 to 1.06 in a shallow correction and 1.04 if the Fed forces the market to revise its monetary policy expectations. The GBPUSD could then fall to 1.1900 and 1.1630, respectively. Gold, which the dollar has primarily driven over the last quarter, could fall to around $1870 in the event of a recovery in the dollar and as low as $1820 in a pessimistic scenario.