U.S. Highlights

- Real GDP eased modestly to 2.9% (q/q annualized) in the fourth quarter of 2022. The details of the report were less

- constructive, with underlying domestic activity showed much softer momentum.

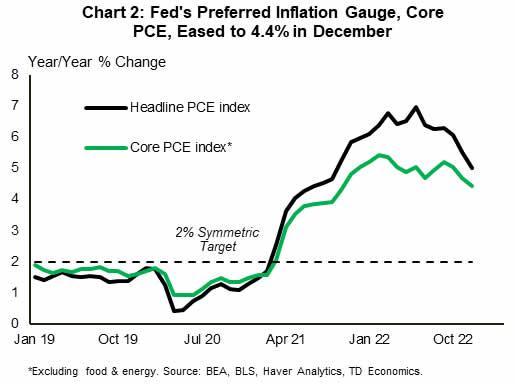

Real consumer spending fell by 0.3% month-on-month in December, with goods declining and services holding flat. - Core PCE inflation eased from 4.7% to 4.4% (y/y) in December.

- Housing market data are showing some improvement, with new home sales trending higher in each of the last three

- months through December and pending home sales increasing for the first time since May.

Canadian Highlights

- The Bank of Canada (BoC) hiked rates by an additional 25 basis points, but more importantly, announced a conditional pause in its rate hiking cycle.

- Accompanying the rate announcement, the BoC also released updated economic forecasts which showed a stalling

- in GDP growth and a meaningful deceleration in inflation.

- The recent drop in gasoline prices and easing supply chains will be a downward force on inflation, but the focus will

- be on wages to make sure inflation moves decisively to the Bank’s target.

U.S. – Slow Growth is Already Here

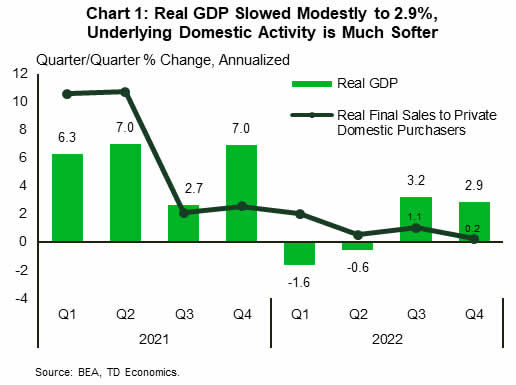

The U.S. economy grew by 2.9% quarter-on-quarter (q/q, annualized) in the fourth quarter of 2022 – an above-trend and slightly better than expected showing. However, the details were less constructive. For starters, inventory investment and net exports – two inherently volatile components – accounted for roughly two-thirds of the gain in the headline number. Meanwhile, fixed investment declined by 6.7% as another sharp pullback in residential (-27%) more than offset the modest gain in business investment (+0.7%). While household consumption held relatively steady, expanding by 2.1%, underlying domestic activity is looking much softer (Chart 1).

Digging further into consumption, another discouraging development was the fact that services spending slowed more than anticipated from 3.7% to 2.6%. Today’s personal income and outlays report helps shine additional light on more recent consumption trends. Real spending fell by 0.3% month-on-month (m/m) in December, ending the year on a sour note. As expected, goods spending was weak (-0.9%), but services also failed to make headway, holding flat on the month. This will provide a weak handoff to the first quarter of 2023, with consumption expected to stall or perhaps even print negative.

From that perspective, the broader demand adjustment appears to have already started towards the end of last year and is expected to intensify over the coming months as the cumulative impact of higher interest rates continues to bear down on the economy.

Today’s personal income and outlays report also provided an update on inflation. Overall PCE inflation decelerated from 5.5% year-on-year to 5.0% in December. The Fed’s preferred inflation measure, core PCE, slowed to 4.4% (Chart 2). Encouragingly, the 3-month annualized change on core PCE came in at 2.9% – a notable deceleration from the 5% pace seen during summer and early autumn. All in all, things appear to be moving in the right direction on this front. This is the last major inflation reading before next week’s FOMC decision. Market odds are overwhelmingly tilted toward a 25-basis point hike. Indeed, the Fed is nearing the end of its aggressive hiking cycle, though the policy rate is expected to remain elevated at 5% through much of this year as policymakers assess the passthrough to inflation.

Interest-sensitive areas continue to show plenty of bruising from last year’s sharp move up in interest rates, but some housing indicators are lightly glowing green. For instance, new home sales, which are down more than 10% from their pre-pandemic level, increased for the third consecutive month in December. In addition, pending home sales ticked up 2.5% in December – the first time since May. Echoing this theme are increases in weekly mortgage applications to purchase a home. All told, with mortgage rates falling by close to 100 bps since early November, sales activity does appear to see a bit of a bounce back. While we see scope for mortgage rates to trek moderately lower through the end of this year alongside long-term yields, we expect them to remain somewhat elevated relative to pre-pandemic levels. With new headwinds poised to emerge this year (i.e., increases in the unemployment rate), a ‘sustained’ turnaround in housing is likely still far in the horizon.

Canada – BoC Takes a Breather

The Bank of Canada (BoC) captured global headlines this week as it became the first major central bank to announce a pause to its rate hiking cycle. By bringing the policy lever to 4.5%, the BoC can now move to the sidelines and let the cumulative impact of its rate hikes over the last year take effect (Chart 1). With greater certainty on the peak policy rate, Canadian bond yields have steadily declined over the last month, easing financial conditions and putting a floor under equities.

The BoC updated its economic forecast with the release of its quarterly Monetary Policy Report. Economic growth is expected to “stall”, with real GDP averaging just 1% over 2023. That is a big drop from the 3.6% averaged over 2022. Governor Tiff Macklem even went so far as to say that 2023 could see a mild recession.

Weak consumer spending and business investment are the drivers of this slowdown, as “the effects of the rise in interest rates are expected to broaden.” This view mirrors the sentiment inferred in the BoC’s recent consumer and business outlook surveys. With most respondents expecting a recession within the next 12 months, declining spending and investment intentions are pointing to a slowing in growth prospects in the months ahead.

The expected slowdown reinforces the view that inflation will keep decelerating. The BoC’s new forecast points to CPI going from 6.3% in December to 3% by the summer. Falling gasoline prices, a further easing in supply chains, and less consumer demand are all factors expected to bring inflation down. Given that the BoC’s target range for inflation is 1% to 3%, getting inflation to the top of that range would be a huge accomplishment.

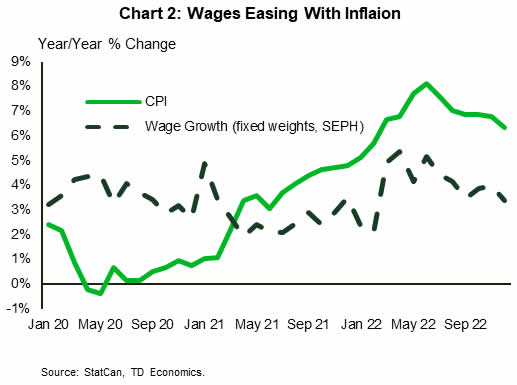

The key indicator for the BoC is wage growth. As the Bank highlighted in its report, the path of goods inflation looks set to continue exuding downward pressure on inflation. But at the same time, inflation in the service sector has been stickier. This is because price increases for services like eating at restaurants, education, and personal care are largely driven by labour costs, which are still running hot given the tightness in the jobs market.

We got a bit of good news on this front this week. In the Survey of Employment, Payrolls and Hours data released yesterday, underlying measures of wage inflation that adjust for the compositional effects showed wage pressures are coming down alongside inflation (Chart 2). Furthermore, it points to wages growing at an average of 4% over the last six months. This is more palatable than the 5%+ growth rate witnessed over that same period. Though the BoC will need to see a further easing in wage pressures to be confident that overall inflation will decelerate to its target, it appears the trend is moving in the right direction.