Summary

- Recent developments hint at some improvement in the outlook for what will still be a challenging 2023 for the Eurozone economy. A sharp drop in energy prices is driving a slowdown in headline inflation. Against this backdrop, real household incomes and consumer spending could be more resilient than previously expected and, indeed, Eurozone PMI surveys have already improved in recent months.

- Many Eurozone governments have also announced fiscal measures to shield European households and businesses from higher energy prices, suggesting fiscal policy could be modestly expansionary this year. Together, lower inflation and fiscal stimulus mean the risks are tilted towards a smaller 2023 Eurozone GDP decline than our current forecast for a 0.6% contraction.

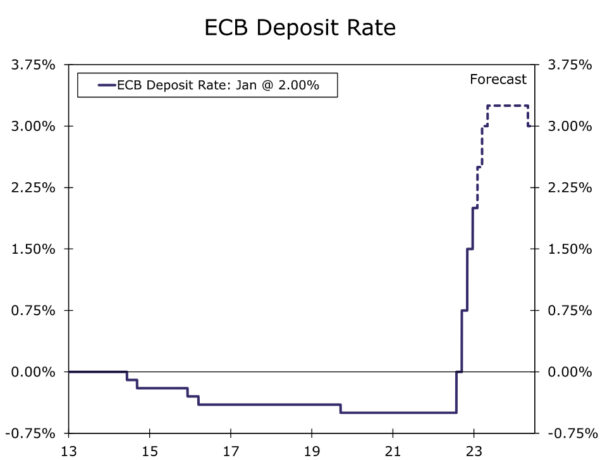

- Meanwhile, Eurozone policymakers have made it clear that inflation remains much too high, and remain concerned at the persistence of core inflation pressures. The European Central Bank’s policy outlook has turned notably more hawkish since December (we now forecast a policy rate peak of 3.25%), at a time when the Fed’s policy monetary policy outlook has started to shift in a less hawkish direction.

- From a currency perspective, a more resilient Eurozone economy and more hawkish European Central Bank clearly offers a more supportive mix for the euro. With respect to our base case forecast, it is quite possible that some of the weakness we had anticipated in the EUR/USD exchange rate in early 2023 may in fact not eventuate. In addition, the risks to our Q1-2024 target for the EUR/USD exchange rate of $1.13 are clearly tilted to the upside.

Eurozone Growth Outlook Becoming Somewhat Less Dim

The momentum of the Eurozone’s economic expansion slowed as 2022 progressed and, given historically elevated energy prices, rapid inflation and rising interest rates, we have long believed the region would fall into recession, beginning around the turn of this year. To be sure, we still expect the Eurozone economy to experience contraction. That said, recent developments hint at some improvement in the outlook for what will still be a challenging 2023.

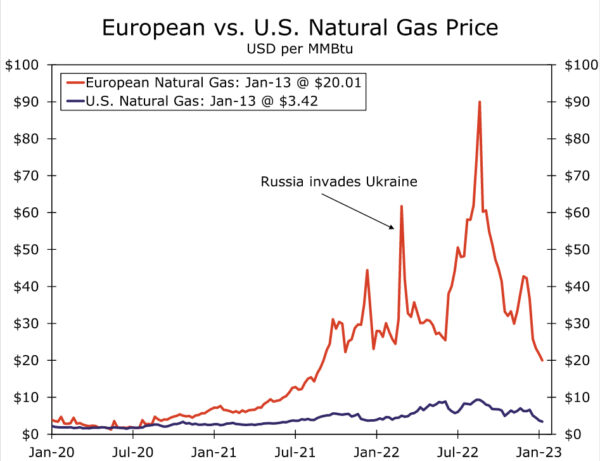

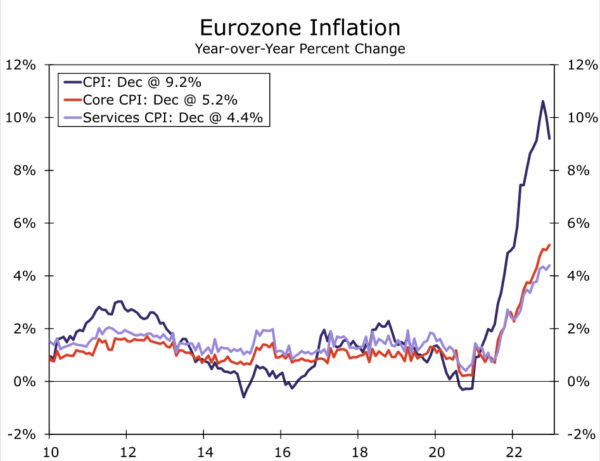

Most importantly, a sharp fall in energy prices offers potential relief for households, and could help the consumer sector to remain more resilient than previously forecast. European natural gas prices are down more than 75% from their August 2022 peak, while Brent crude prices have also fallen almost 35% from their March 2022 peak. To be sure, there remains some concern about a renewed rise in energy prices given the disruption of supply from Russia. By Q3-2022, the European Union sourced 15% of its natural gas imports from Russia (down from 39% for all of 2021), while the European Union sourced 14% of its oil imports from Russia (down from 25% for 2021). But for now at least, falling energy prices also offer the prospect of significant inflation relief for Eurozone households, a trend that is already underway. In December, the Eurozone headline CPI slowed to 9.2% year-over-year, down from a peak of 10.6% in October. Importantly however, there has not yet been any easing in broader underlying prices pressures, with core CPI inflation quickening further to 5.2% year-over-year in December.

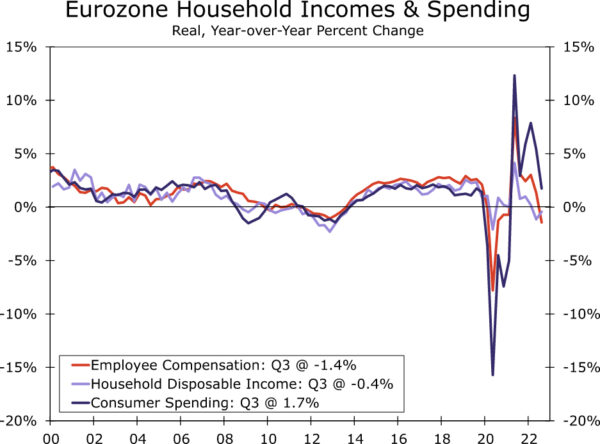

That said, the slowing in headline inflation is potentially very significant for the consumer spending outlook. Although Eurozone household disposable incomes have risen in nominal terms for seven quarters in a row, they have not kept up with the pace of inflation, meaning that adjusting for price increases, real income growth turned negative around the middle of 2022. Still, there are already hints in the latest available data that the drag on Eurozone real incomes may be waning. Based on preliminary figures from Eurostat, we estimate that Eurozone real household disposable income fell 0.4% year-over-year in Q3-2022, less than the 1.1% decline seen in Q2. While Q4 might be too early to see further inflation relief (average Eurozone inflation was actually higher in Q4 than Q3), it is possible that growth in real incomes could turn less negative, or even positive, by early 2023. The preliminary Eurostat figures also indicate the Eurozone household saving rate fell only slightly to 13.2% in Q3-2022, and is broadly in line with levels that prevailed prior to the pandemic. Overall, considering trends in real incomes and household savings, consumer spending may prove to be more resilient in 2023 than previously anticipated.

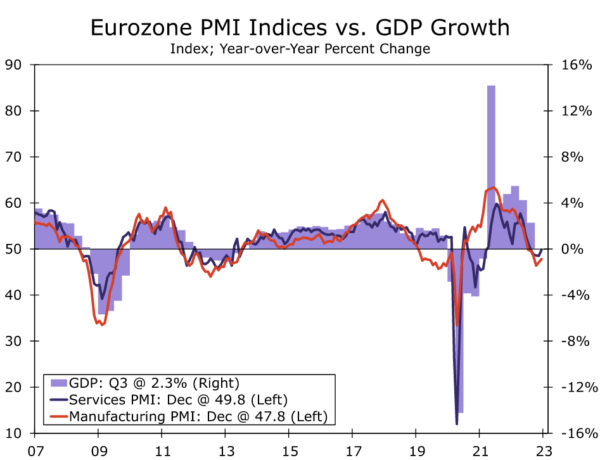

These improving (or at least less negative) economic prospects are also reflected in recent confidence surveys, as Eurozone PMI indices have gained in recent months. Notably, the services PMI rose to 49.8 in December from its recent low of 48.5 in November. The manufacturing PMI also rose to 47.8 in December, from its recent low of 46.4 in October. Those readings are historically consistent with a contracting Eurozone economy, though at the same time consistent with only a moderate contraction. For now, we maintain our forecast for Eurozone GDP to contract by a 0.6% for calendar year 2023, but taking into account developments in inflation, activity data and confidence surveys, we believe the outlook is potentially moving in the direction of a smaller 2023 GDP decline.

The Push and Pull of Eurozone Fiscal Policy

Much has also been made of Europe’s fiscal policy response to the region’s energy crisis, and measures that have been put in place to shield European households and businesses from higher energy prices. In late November 2022, Bruegel (a Brussels based economic think-tank) offered estimates for the European Union (of which Eurozone countries comprise the dominant majority) of funds that have been earmarked or allocated by governments to address the energy crisis between September 2021 and November 2022. These measures, among other things, include reduced energy taxation, retail price regulations, transfers to vulnerable groups, and business support. Those funds amounted to €600B, of which €264B has been allocated by Germany alone. To put those numbers in context, that equates to around 3.9% of European Union GDP and 7.0% of German GDP, respectively. In isolation, the estimates suggest European fiscal policy could be somewhat supportive of economic activity.

Recent estimates of the broader fiscal position also indicate the fiscal policy stance could be modestly supportive of economic activity in 2023. In the European Central Bank’s (ECB) staff macroeconomic projections for December 2022, the ECB also sees total fiscal stimulus for the Eurozone related to the energy crisis and war in Ukraine at around 2% of GDP for 2022-23, with some of that fiscal stimulus projected to continue having a budget impact in 2024. Keeping in mind the energy related stimulus measures will be partly offset by withdrawal of previous COVID related fiscal support, the ECB projects the structural budget balance to narrow from 3.4% of GDP in 2021 to 3.0% in 2022, before widening to 3.3% of GDP in 2023. That is, the fiscal stance is seen tightening modestly in 2022, before loosening modestly in 2022. Overall, its appears the Eurozone fiscal policy stance should be mildly supportive of economic activity in 2023, reinforcing the outlook for Eurozone 2023 GDP to move in the direction of a smaller decline.

Eurozone Monetary Policy Turning More Hawkish

In addition to the outlook for Eurozone economic activity, ECB policymakers have made it clear over the past several weeks that their flight against inflation is far from over, and that Eurozone inflation remains much too high for comfort. The fact that core inflation pressures have not shown any lessening across the Eurozone is another reason we believe ECB policymakers are hesitant to let up on their inflation fight at this point. At its December announcement, the ECB raised its Deposit rate 50 basis points to 2.00%, and perhaps more importantly said that “interest rates will still have to rise significantly at a steady pace to reach levels that are sufficiently restrictive to ensure a timely return of inflation to the 2% medium-term target.” ECB President Lagarde also said we should expect the ECB to raise rates at a 50 basis point pace for a period of time, and that the ECB needs to do more on interest rates than what was implied by market pricing at the time.

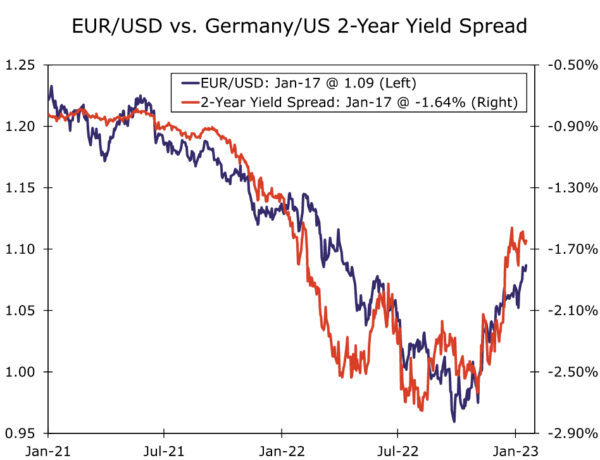

In response, we raised our forecast for the ECB’s peak policy rate during the current cycle to 3.25%, and ECB policymaker comments in subsequent weeks have generally continued to highlight the need for steady and sustained rate increases. In contrast, with U.S. inflation slowing and based on evolving hints from some Fed policymakers, we now expect the Fed to raise rates by an even smaller 25 basis points at its early February meeting. Indeed, from current levels we expect a further 125 basis points of ECB rate hikes compared to just a further 75 basis points of rate hikes from the Fed. In effect, the ECB is turning more hawkish at a time when the Fed is starting to turn less hawkish. These dynamics have led to a meaningful narrowing in the large negative yield gap that previously existed between the Eurozone and the U.S. The two-year government yield spread between Germany and the U.S. has narrowed to -159 basis points, from as wide as -264 basis points as recently as early November.

From a currency perspective, a more resilient (albeit still subdued) Eurozone economic outlook and a more hawkish European Central Bank monetary policy outlook clearly offers a more supportive mix for the euro exchange rate against the U.S. dollar. With respect to our base case forecast, it is quite possible that some of the weakness we had anticipated in the EUR/USD exchange rate in early 2023 may in fact not materialize. In addition, the risks to our Q1-2024 target for the EUR/USD exchange rate of $1.13 are clearly tilted to the upside. In the context of recent developments, our outlook for the euro versus the U.S. dollar is shifting appreciably in the direction of a more constructive medium-term trend.