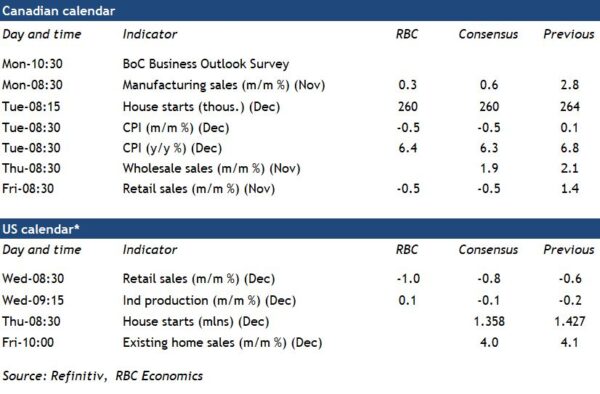

The final Canadian inflation reading of 2022 will arrive next week. With the Bank of Canada’s highly-anticipated interest rate decision looming on Jan. 25, all eyes will be on this report and the BoC’s Q1 Business Outlook Survey (BOS). A very strong December labour market report has tilted odds towards the BoC hiking the overnight rate by another 25 basis points on January 25th (adding to the 400 basis points of hikes in 2022). But any downside surprise in the CPI data or a dovish tone in the BOS could make that decision a closer call. Either way, it is increasingly likely that the Bank of Canada is close to the end of the current interest rate hiking cycle.

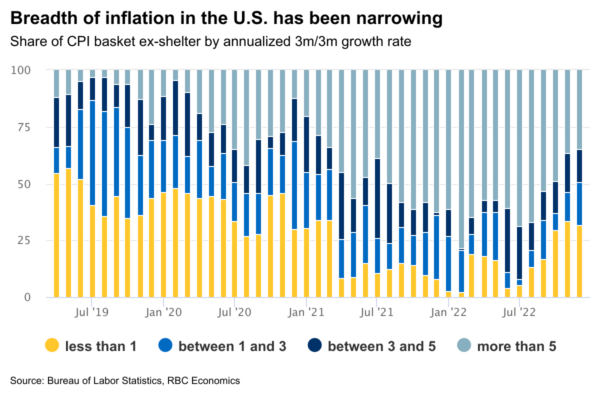

We expect headline CPI growth slowed to 6.4% in December from 6.8% in November (sinking even further below the 8.1% peak in June of last year). Grocery prices continued to surge higher, rising 11.4% year-over-year in November. But food price growth should start slowing in 2023 as the delayed impact of lower global agricultural commodity prices feeds through and supply chain disruptions continue to ease. What’s more, prices at the pump slumped by 13% month-over-month in December. Shelter costs are likely among those where price growth accelerated, driven by surging rents and mortgage interest costs and only partial offsets from lower home-buying related expenses. Still, broader measures of inflation have shown signs of cooling off. Month-over-month increases in the BoC’s preferred CPI-Median and CPI-Trim ‘core’ CPI measures have slowed. And the share of the price basket seeing inflation above the central bank’s 1% to 3% target range has edged down to 60% over the last three months from over 75% in the summer.

We expect the BOS to show an ongoing deterioration in the outlook for future sales as of late last year. This would be consistent with softer business sentiment in manufacturing PMI data. While broader global supply chain disruptions have continued to ease, labour shortages remained acute with job openings still high and the number of available unemployed workers low. The BoC will be watching longer-run business inflation expectations and wage plans—particularly after both measures showed signs of easing in the prior BOS. Comments on businesses’ price-setting behaviour will also be closely scrutinized after the Q3 release flagged that more businesses were resorting to pre-pandemic practices of raising prices less frequently. Firms were also responding more directly to signs of rising costs and competition.

Week ahead data watch

We expect manufacturing sales to tick up 0.3% in November, slightly below the flash estimate of 0.6% from StatCan. Motor vehicle, petroleum, and coal products accounted for the largest share of growth. Prices rose in the month and sale volumes likely edged lower.

StatCan’s preliminary estimate on November retail sales showed a 0.5% decline. We expect the same for sales volume with prices little changed. Auto sales ticked higher but other sales likely declined. Our own spending data was flagging strong holiday spending in that month and into December, but with sales plateauing after that.

Housing starts likely remained steady at 260,000 units in December from an annual pace of 264,159 units in November. Residential building permit issuance was still strong in November, with a 3-month rolling average of 249,000 units.

The slowdown in U.S. unit auto sales, combined with a drop in gas station sales in December, was likely to result in a 1% drop in U.S. retail sales. We expect a 0.1% increase in industrial production in December, with lower manufacturing output (-0.2%) offset by a second consecutive large increase in utilities output (1.8%).