Gold prices started the year with a powerful rally, capitalizing on hopes that the Fed is approaching the end of its tightening cycle. Looking into 2023, the prospects for the yellow metal seem bright in a macroeconomic environment characterized by heightened recession fears. The main downside risk is probably a resolution to the Ukraine war, which does not seem imminent.

Dissecting gold’s comeback

The world’s oldest safe-haven closed 2022 essentially flat, staging a late rally to recover most of the losses it suffered earlier in the year. This advance has extended into the new year, propelling the precious metal to multi-month highs with a little help from macroeconomic developments.

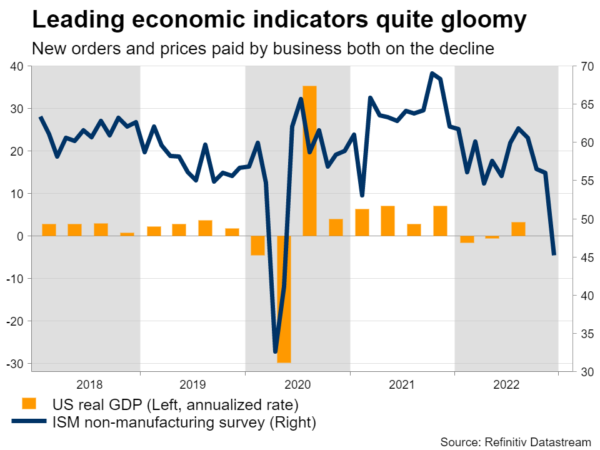

Chief among those was speculation that the Fed is almost done with rate increases. With inflation grinding lower and US business surveys pointing to a sharp slowdown in economic growth, perhaps even a recession later this year, the dollar has lost its shine and Treasury yields have edged lower.

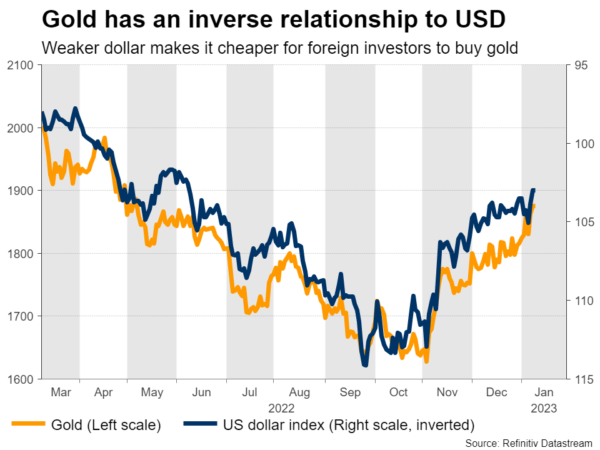

Any moves in the dollar and yields are crucial for gold prices. This is because gold is priced in dollars, so when the currency depreciates, it becomes cheaper for investors using foreign currencies to buy the metal. Similarly, since gold pays no interest to hold, it becomes more attractive by comparison as yields on government bonds edge lower.

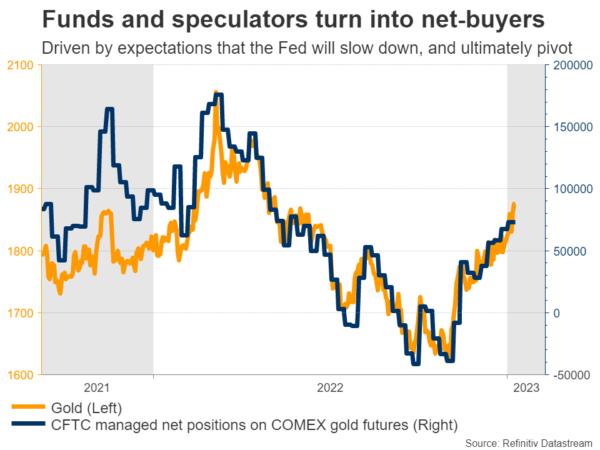

In other words, the expectation that the US economy is losing power was the main catalyst behind gold’s surge, as that implies a more cautious Fed profile. Market pricing currently suggests the central bank will roll out its final rate increase by March, before cutting rates towards the end of the year.

This was the driving force for speculators to enter long positions again, but it wasn’t the only catalyst pushing gold higher. Other important buyers were central banks, which loaded up on bullion at a historic pace. Although data on central bank reserves is not published immediately, it seems that China and Turkey accumulated quite a lot last year.

There are also some seasonal factors at play. The months around the turn of the year – November, December, and January – are usually the strongest for gold prices. Several explanations exist for this phenomenon, ranging from holiday demand for jewelry to portfolio rebalancing around year-end.

Last but not least, flows coming out of crypto might have helped gold demand. There is some overlap between crypto and gold investors – money flowing into crypto was often cited as a reason for gold’s underperformance after the pandemic. But with crypto prices crashing, this process might have gone into reverse, directing money back towards gold.

The outlook in 2023

Looking into this year, the prospects for bullion seem favorable. Inflation has started to cool across the world, which suggests that central banks are in the final chapter of their tightening cycles. The market is looking ahead to lower rates next year, and is potentially front-running this theme.

With most forward-looking economic indicators deteriorating sharply, recession risks have also started to intensify. The European Commission and the Bank of England already expect a recession in their respective economies, while even the Fed admitted in its latest minutes that a recession has become a ‘plausible alternative’.

This outcome would imply greater demand for gold through the safe-haven channel, and it would also make central banks more likely to cut rates. If the US dollar softens in the process, it would be a trifecta for bullion. The chart is quite bullish too, with gold putting in a triple bottom last quarter, although a decisive move above the $1,875 region is required to boost momentum.

Central bank purchases could be another persistent theme. After the invasion of Ukraine, the dollars and euros that Russia held as FX reserves were frozen by America and the European Union, leaving gold as its primary reserve. This might be the reason why China has started to diversify and accumulate gold – to make sure it won’t suffer the same fate.

Downside risks

While the macroeconomic picture seems favorable, gold prices have already come a long way, rising by 16% from their lows last quarter. The chart seems overextended at this stage, so a short-term pullback wouldn’t be surprising.

Of course, there are fundamental risks for gold prices too. For instance, if inflation remains stubbornly high, that could lead the Fed to raise rates even higher and also diminish the prospect of rate cuts later this year. In turn, that could resurrect the dollar and yields, dealing a heavy blow to gold prices.

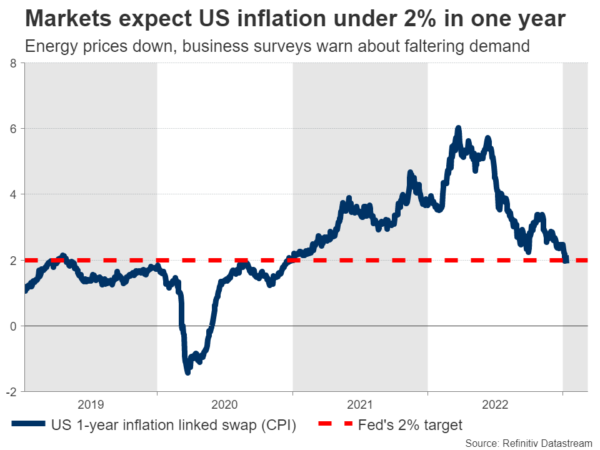

That said, this seems like a lower-probability scenario. Inflation swaps suggest that US CPI will be running under 2% in one year’s time, something corroborated by the decline in energy prices, the trends in house prices, and the gloomy signals in business surveys.

This leaves a resolution to the conflict in Ukraine as the main downside risk for bullion. Any signs that peace talks might begin could crush safe-haven demand, although that doesn’t seem imminent either. The two sides are too far apart on their red lines, while the United States and Europe are still sending Ukraine advanced weapons, alongside financial aid.

Therefore, a diplomatic solution is unlikely for now. Instead, the path for gold might depend mostly on how quickly inflation subsides, whether there is a recession, and how central banks deal with that.