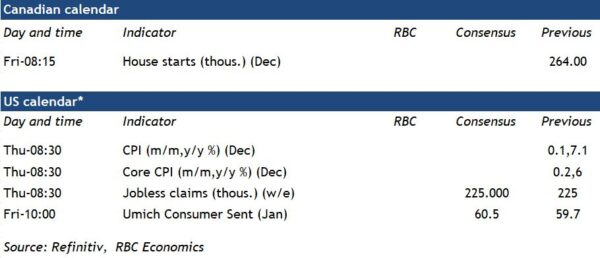

U.S. December inflation data will be watched closely next week for fresh evidence that early easing in price growth in recent months could be sustained. We expect year-over-year U.S. consumer price growth to slow significantly in December to 6.3% from 7.1% in November. That would be the lowest level of annual price growth since October 2021 and below the peak 9.1% rate in June 2022. The steep decline in headline price growth is largely thanks to a significant drop in energy prices. Average gasoline prices fell 10% (seasonally adjusted) in December from November on lower oil prices.

But broader measures of inflation have also shown signs of slowing. Grocery prices have continued to surge higher, but the pace of increase has pulled back. We expect ‘core’ (excluding food & energy products) price growth to slow to 5.6% year-over-year in December from 6.0% in October. By our count, almost half of the year-over-year increase in ‘core’ price growth is coming from higher home rents as earlier price increases pass through the CPI with a lag as leases are renewed. The rise in rents will moderate in the year ahead, reflecting significantly slower growth in the current rental market.

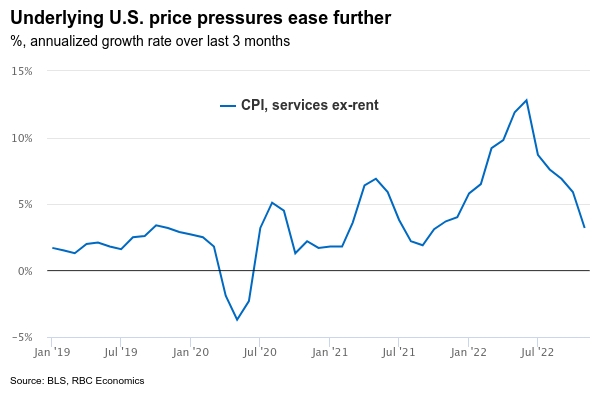

Federal Reserve policymakers will be paying more attention to signs that suggest the early softening in broader inflation pressures will persist. Price growth for purchased goods has been slowing as global supply chain and cost pressures ease. And prices of services excluding home rents (a key indicator of domestically driven inflation) has also been slowing over the second half of 2022.

Further signs of declining price growth would support further slowing in the pace of hikes from the Fed. We continue to expect 50 basis point of additional hikes to the Fed funds target range in Q1 before a pause at a terminal rate of 4.75% to 5.0%.

Week ahead data watch

- Housing starts likely remained steady at 260,000 units in December from the annual pace of 264,159 units in November. Residential building permit issuance was still strong in October, with a 3-month rolling average value of 266,000.