U.S. Highlights

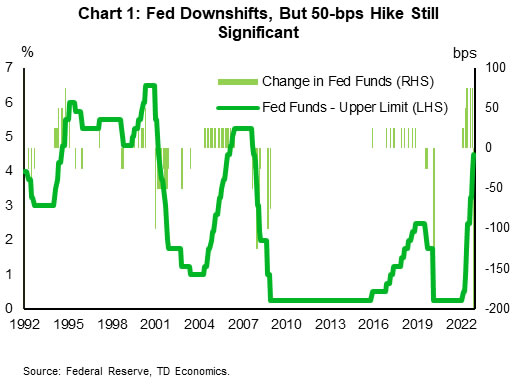

- The FOMC downshifted its tightening race in December, raising the policy rate by 50-bps, bringing the operating band to 4.25%-4.5%.

- The FOMC’s Summary of Economic Projections showed a less optimistic economic outlook, accompanied by higher inflation. The median consensus on the Fed Funds rate was lifted by 50-bps for 2023, implying a terminal rate of 5.25%.

- November inflation data showed a further softening in price pressures, with core CPI rising 0.2% m/m and the 12-month change falling to 6% y/y. Retail sales for November were weaker than expected (-0.6% m/m), recording its largest monthly decline in 11 months.

Canadian Highlights

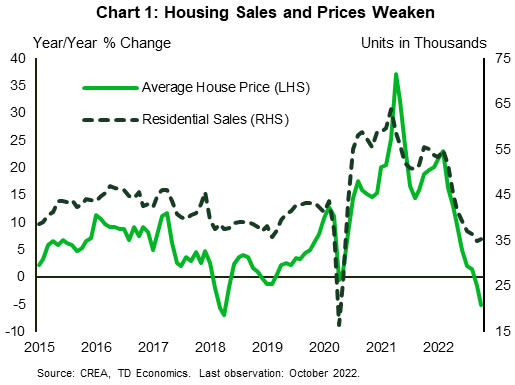

- Canadian existing home sales and prices declined again in November, as the market continues to recalibrate to higher interest rates.

- However, housing starts came in at a robust 264.2 thousand units. The pipeline of projects continues to be full, fueled by low supply and the prior run-up in house prices.

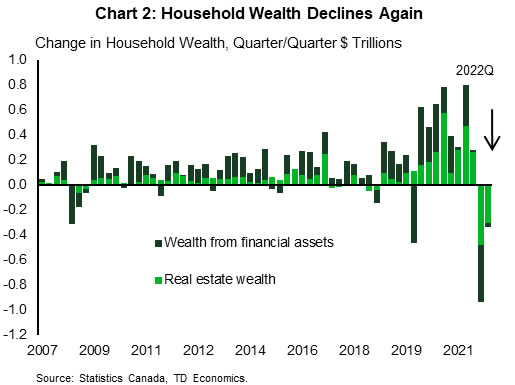

- The reading on household balance sheets gave us insight into the Canadian consumer. With house prices dropping, Canadians are less wealthy than at the beginning of the year.

U.S. – Slowing, But Not Stopping

Phew, whatta week! The headlines included further evidence of softening inflation, wanning consumer momentum and the much-anticipated December FOMC interest rate announcement. The Fed met market expectations, increasing the policy rate by “only” 50 basis-points (bps), bringing the upper-bound to 4.5%. That marked a slowdown from the 75-bps pace undertaken at the four prior meetings, but still stands as a historically fast pace of policy adjustment (Chart 1).

Beyond the interest rate announcement, the FOMC also released updated economic projections. Relative to the September assessment, Committee participants now expect growth to be considerably weaker in 2023 (0.5% vs 1.2%) and the unemployment rate slightly higher (4.6% vs. 4.4%). Despite the more downbeat outlook, policymakers view price pressures as having become more entrenched, and upgraded the inflation outlook through 2024. As a result, the FOMC signaled rates are likely to move at least 50-bps higher than previously expected next year – implying a terminal rate of 5.25% – with cuts not beginning until 2024.

In the press conference, Chair Powell struck a somewhat hawkish tone. When asked about the recent easing in financial market conditions, Powell stated that the Committee looks through near-term swings, but emphasized the importance of market conditions aligning to the Fed’s intentions. Moreover, Powell was quick to direct focus to the upward revision to the “dots”, reiterating that the Committee’s view on inflation remains skewed to the upside and thus future projections could still show an even higher terminal rate. Despite this deliberate signaling, market participants still believe that the Fed will begin cutting rates late next year.

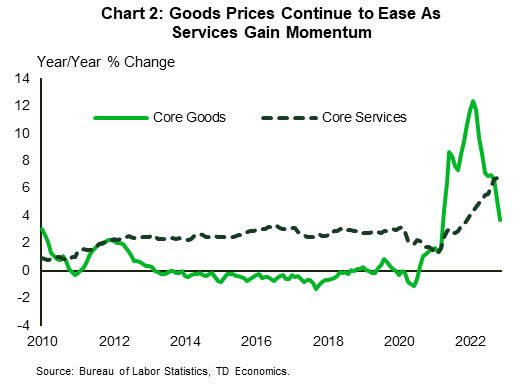

Investors current assessment might be somewhat biased by November’s CPI data, which showed a further cooling in inflationary pressures. Core inflation rose by 0.2% m/m – a tick below market expectations – bringing the 12-month change to 6.0%. Core goods prices declined for a second consecutive month, while price growth across services continued to be led by outsized gains in shelter. That said, even after removing its effects, most other service categories continue to show strength. This cuts to the heart of the issue. With goods prices appearing to have rolled over and the shelter component expected to slow in H2’2023, the move down towards 3% inflation by the end of next year is feasible. However, until we see a more meaningful slowdown in hiring activity, leading to a cooling in wage pressures, many labor-intensive service sectors will continue to run hot – preventing inflation from moving back to 2%.

Though the cumulative impact from higher rates hasn’t yet hit hiring intentions, November retail sales showed consumer momentum may be wanning. Sales fell 0.6% m/m – its biggest monthly drop in nearly a year – with notable declines in holiday categories including, electronics, clothing, and sporting goods. As we noted in our Quarterly Economic Forecast, it was unrealistic to assume the recent strength in spending would continue indefinitely. A broader demand adjustment needs to occur over the coming quarters in order to restore price stability. It would appear we are nearing the precipice of that adjustment.

Canada – Housing Drop Hits Household Wealth

It was a volatile week for financial markets, with negative sentiment south of the border pushing Canadian equities and bond yields lower. Canadian economic data didn’t help sentiment either as readings on home sales and prices continued to fall (Chart 1). The national household balance sheet data showed another leg down in real estate wealth for Canadians. Though this decline was expected, it encapsulates the impact of the Bank of Canada’s historic rate hiking cycle on the finances of Canadians.

Overall activity in the resale market fell again in November, with existing home sales declining 3.3% month-on-month (m/m). At the same time, new property listings also fell 1.3% m/m. With the drop in sales once again outpacing listings, the sales-to-listings ratio is now below the 50% level which defines the midpoint of a balanced market. That is good news for buyers. However, with the month’s supply of housing inventory remaining at a very low 4.2 months, supply fundamentals suggest a floor in prices may be coming sooner rather than later. This is the main reason why housing starts – which held at a solid 264.2k annualized units in November – have held up so well amidst this market adjustment.

Speaking of attracting buyers, the like-for-like MLS home price index was down over 1% on the month, putting the peak-to-trough decline at 11.5%. In terms of average house prices, the year-on-year drop now stands at 12%. With the BoC having hiked its policy rate again last week, housing activity is likely to show another decline in December, though a trough is expected to form in early 2023.

The 2022 drop in Canadian housing values is hitting household balance sheets. Canada’s national balance sheet accounts for the third quarter of 2022 were released this week and showed that household wealth declined by 2.1% (Chart 2). This marks the second straight quarterly drop in wealth, bringing the total decline to 7.7% over the last six months. In dollar terms, Canadians lost approximately $1.3 trillion in wealth, with the decline in real estate values being the biggest contributor. This has and will have a far-reaching impact on the Canadian economy. When people feel less wealthy, they tend to spend less. No wonder we saw a significant pull-back in consumer spending over the summer.

We will get more insight on the Canadian consumer next week when retail sales data are released. We are expecting a temporary bounce-back in consumer spending during the holiday shopping season given the rise in employment and wages over the last two months. However, we foresee a consumer led drop in spending in the economy through 2023 (See our latest forecast). We will also be watching for CPI next week, which is expected to show a further deceleration on the back of falling gasoline prices in November – a nice reprieve for the constrained Canadian consumer.