Summary

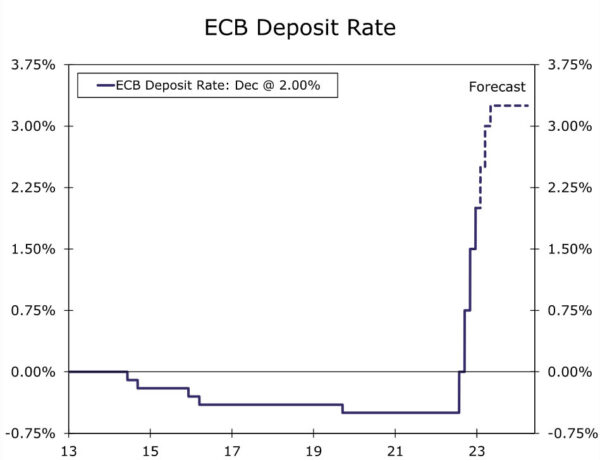

- The European Central Bank (ECB) delivered a 50 basis point hike, taking its Deposit Rate to 2.00% at today’s monetary policy meeting, while also announcing plans to begin quantitative tightening from March.

- The ECB’s accompanying commentary and press conference were also hawkish in tone. The ECB forecasts above target inflation over the medium term, while ECB President Lagarde signaled that interest rates would keep rising at a rapid pace for now, and perhaps by more than market participants expect. Accordingly, we now forecast another 125 basis points of rate hikes during the first half of 2023, which would see the Deposit Rate peak at 3.25%.

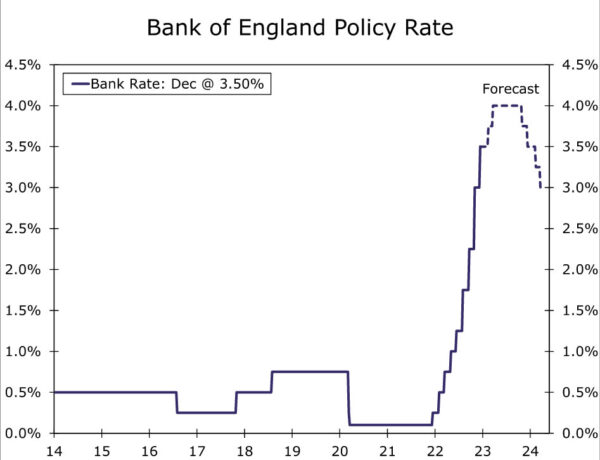

- The Bank of England (BoE) also raised its policy rate by 50 basis points to 3.50%, although the tone of its accompanying comments were more balanced. Still, the BoE said the labor market remains tight, wage growth is elevated, and that it will act forcefully as needed. That does not sound like a central bank that views an end to monetary tightening as imminent. We now forecast two more 25 basis point rate hikes from the BoE, which would see the policy rate peak at 4.00%.

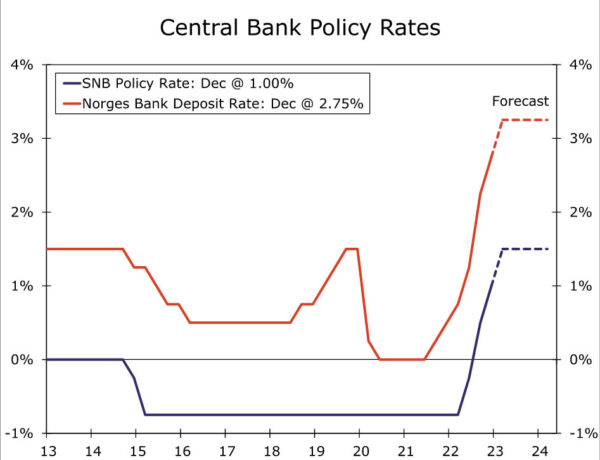

- The Swiss National Bank raised its policy rate 50 basis points to 1.00%. It’s accompanying comments leaned hawkish, and the central bank forecasts CPI inflation creeping back above the 2% inflation target by 2025. Against the backdrop, we expect a final 50 basis point rate hike from the Swiss National Bank in Q1-2023.

- Norway’s central bank raised its policy rate 25 basis points to 2.75%, while adding that inflation has been a bit higher than expected, the labor market has been sturdier than expected, and the outlook for mainland GDP growth is less pessimistic than previously. We remain comfortable with our forecast for two more 25 basis point hikes from the Norges Bank in January and March, which would see Norway’s policy rate peak at 3.25%.

ECB Hikes Again and Announces Quantitative Tightening

In what was a particularly busy day for central banks across Europe, the most significant announcement came from the European Central Bank (ECB). The ECB announced policy shifts on two fronts:

- Policymakers raised key policy interest rates by 50 basis points, including a hike in the Deposit Rate from 1.50% to 2.00%. The increase in interest rates was in line with the consensus forecast.

- It also announced plans to begin quantitative tightening, starting in March. The ECB’s holdings under its Asset Purchase Program (APP) will be allowed to decline at a measured and predictable pace, as the ECB will not fully reinvest principal payments from maturing securities. The decline in holdings will average €15B per month until the end of Q2-2023, with the subsequent pace to be determined over time. The pace of decline in the ECB’s balance sheet was at the more conservative end of market expectations.

With respect to the accompanying comments and projections, the ECB’s announcement was hawkish in tone. The ECB said that based on a substantial upward revision to the inflation outlook, it expects to raise interest rates further, adding:

“In particular, the Governing Council judges that interest rates will still have to rise significantly at a steady pace to reach levels that are sufficiently restrictive to ensure a timely return of inflation to the 2% medium-term target.”

In fact, in the post-meeting press conference ECB President Lagarde went further, saying we should expect the ECB to raise rates at a 50 basis point pace for a period of time, and that the ECB needs to do more on interest rates than what is currently implied by market pricing (note that as of yesterday, interest rate futures suggested a peak ECB Deposit Rate of just over 2.75%).

With respect to its economic projections, the ECB raised its CPI forecasts to 6.3% for 2023, 3.4% for 2024 and 2.3% for 2025. In addition, the ECB also sees CPI inflation excluding food and energy at 4.2% in 2023, 2.8% in 2024 and 2.4% in 2025. Notably, the outlook for inflation in 2025 is still above the ECB’s 2% inflation target. Finally, with respect to growth, the ECB projects a short and shallow recession beginning late this year, and sees overall Eurozone GDP growth at 0.5% in 2023, before rebounding to 1.9% in 2024 and 1.8% in 2025.

Overall, the tone of the ECB’s announcement along with the above-target inflation projections suggest the European Central Bank should raise interest rates further than we had previously expected. We still anticipate a 50 basis point policy rate increase in February, but now also expect a 50 basis point rate increase in March, and a final 25 basis point increase in May, which would see the ECB’s Deposit Rate peak at 3.25%. Considering the likelihood that the Eurozone economic downturn will be intensifying during the early part of 2023 and inflation should be receding, we expect the removal of policy accommodation to transition away from interest rate increases and towards balance sheet reduction beyond May next year.

Bank of England Raises Interest Rates and Strikes a Balanced Tone

Another central bank announcement that attracted plenty of attention today was that of the Bank of England (BoE). The BoE delivered, as expected in terms of its policy action, raising its Bank Rate by 50 basis points to 3.50%. However, there was a mildly dovish tilt around that rate increase action. While six policymakers voted to raise interest rates by 50 basis points, two policymakers voted for no change, and only one policymaker voted for a larger 75 basis point rate hike.

To be fair, some of the BoE’s other comments were supportive of further monetary tightening. The central bank said:

- The labor market remains tight, and domestic wage and price pressures are elevated. Wage growth has been around 0.5 percentage points stronger than projected as recently as November.

- It now forecasts a smaller 0.1% quarter-over-quarter decline in Q4 GDP.

- The fiscal consolidation announced by the government in the Autumn Statement will have little effect on U.K. GDP in the near-term, and instead a more restraining effect on U.K. GDP over the medium-term.

Overall the BoE’s Monetary Policy Committee said:

“Should the economy evolve broadly in line with the November Monetary Policy Report projections, further increases in Bank Rate may be required for a sustainable return of inflation to target. There are considerable uncertainties around the outlook. The Committee continues to judge that, if the outlook suggests more persistent inflationary pressures, it will respond forcefully, as necessary.”

To us, that does not sound like a central bank that believes an end to monetary tightening is imminent. As a result, we now see a slightly higher peak in Bank of England interest rates than previously. We expect that BoE to raise its policy interest rate by 25 basis points at both its February and March meetings next year, which would see the BoE’s policy rate peak at 4.00% by March next year, before the BoE embarks on rate cuts by the end of 2023.

Swiss National Bank Delivers a 50 Basis Point Hike, While Norway’s Central Bank Delivers 25 Basis Points

The rate hike action continued elsewhere today as well, with the Swiss National Bank raising its policy rate by 50 basis points to 1.00%. The increase was in line with the consensus forecast, but a bit less than the 75 basis point increase we had expected. The SNB’s accompanying comments leaned hawkish, as SNB President Jordan said:

- “It was pretty clear that 50 basis points is the right decision, If you look at our inflation forecasts over the medium term, inflation is still slightly above our 2% threshold.”

- “There is a danger that inflation could remain elevated in Switzerland in the medium term owing to second-round effects” and “The renewed tightening of our monetary policy is therefore necessary.”

The SNB projects inflation of 2.4% in 2023, slowing to 1.8% in 2024. However, by the middle of 2025 the SNB sees CPI inflation creeping back up above 2%. That’s in contrast to the central bank’s inflation target, which defines price stability as inflation below 2%. With respect to Swiss GDP growth, the central bank forecasts GDP growth of 0.5% in 2023, down from around 2% in 2022.

As in previous announcements, the SNB said “it cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term.” With concerns that inflation could otherwise remain elevated for longer, we forecast a final 50 basis point rate hike to the SNB policy rate, which would see a peak at 1.50% in Q1-2023.

Finally, Norway’s central bank (the Norges Bank), in what was a unanimous decision, raised its policy rate 25 basis points to 2.75% and signaled that rates will most likely be raised further in Q1-2023. The Norges Bank said that since its last Monetary Policy Report, inflation has been higher that it had forecast and is now expected to remain higher for longer. The central bank also observed that labor market trends have been sturdier than expected.

Thus, even with an outlook for an eventual slowing in Norway’s economy, the Norges Bank has become slightly less pessimistic on the prospects for economic activity. The Norges Bank now see a 0.2% decline in Norway’s mainland GDP in 2023, compared to a previously forecast fall of 0.3%. While Norges Bank Governor Ida Woldan Bache said the policy rate will be around 3% next year, given only modest (and mildly hawkish) changes in comments from the central bank in today’s announcement, we remain comfortable with our call for two more 25 basis point hikes from the Norges Bank in January and March, which would see Norway’s policy rate peak at 3.25%.