In line with our expectation, the BoE today hiked policy rates by 50bp, bringing the Bank Rate to 3.50%.

We expect the increasingly weak growth outlook to support a near-term ending to the hiking cycle.

We maintain our call for a 25bp hike in February with risks to our call skewed towards additional hikes in 2023 if inflation pressures show increasing persistence.

In line with our expectation, the Bank of England (BoE) hiked the Bank Rate by 50bp to 3.50% with 6 members voting for a 50bp hike, one member voting for 75bp and two members voting for keeping the Bank Rate unchanged. As expected, there was no news in regards to QT-communication as outright selling of government bonds commenced on 1 November.

Overall, the December meeting offered little news, as the MPC judged that there has been limited news in economic data since the projections presented in the November Report. The BoE thus continues to expect a challenging growth backdrop where the UK is “to be in a recession for a prolonged period.” This supports our expectation of the Bank nearing the end of its hiking cycle as tighter financial conditions, easing in labour market and the recession tears on the economy. Likewise, the two most dovish members that preferred to leave the Bank Rate unchanged at 3.00% referred to “increasing signs that the downturn was starting to affect the labour market” and the lag in effects of monetary policy as past rate increases “were still to come through”. We expect this view to transmit onto the rest of the MPC in the coming months and thus keep the rest of our forecast unchanged, expecting a final 25bp hike in February 2023.

The increased focus from the government led by PM Rishi Sunak on closing the fiscal gap was broadly confirmed by the Autumn Statement on 17 November. On fiscal policy, the MPC thus estimates that “the overall impact on CPI inflation projection at all of these horizons is estimated to be small”.

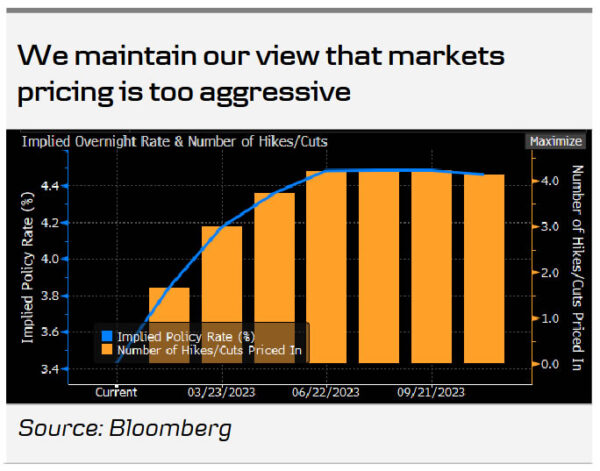

Rates. Gilts yields on all horizons ticked lower on announcement, although seemingly reversing at the time of writing with 2Y and 10Y now trading at respectively 3.4% and 3.3%. Like us, investors seem to interpret today’s meeting as dovish as the peak rate was pushed lower to 4.5% in June/August 2023 from 4.57% yesterday. Our base case remains that of a peak in the policy rate of 3.75% in February 2023.

FX. EUR/GBP initially moved modestly higher upon announcement to 0.8630 from 0.8600, as expected but partly retraced the move afterwards. We see a case for the EUR/GBP cross to move modestly lower as a global growth slowdown and the relative appeal of UK assets to investors are a positive for GBP relative to EUR.

Our call. We continue to expect the BoE to deliver a final 25bp hike in February. Our expectations fall below current market pricing (currently 100bps until August 2023) as we expect the rest of the BoE committee to eventually turn less hawkish amid a weakening growth backdrop and easing labour market conditions.