Key Highlights

- USD/CHF declined below the 0.9400 and 0.9350 support levels.

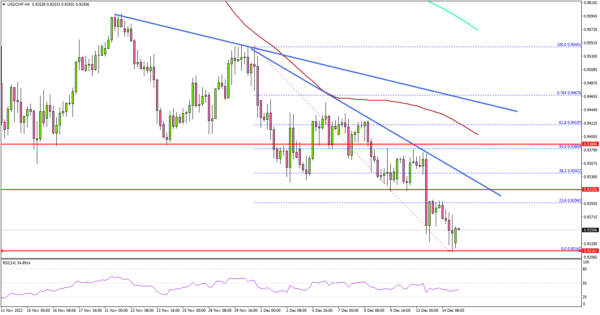

- A major bearish trend line is forming with resistance near 0.9320 on the 4-hours chart.

- The Fed increased interest rate by 0.50 percentage point.

- The BoE interest rate decision is scheduled today (forecast 3.5%, versus 3.0% previous).

USD/CHF Technical Analysis

The US Dollar started a fresh decline from well above the 0.9500 level against the Swiss Franc. USD/CHF gained pace below the 0.9400 and 0.9380 support levels.

Looking at the 4-hours chart, the pair settled well below the 0.9400 level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

It even broke the 0.9300 level and tested the 0.9230 support zone. It is now consolidating losses and remains at a risk of more losses below the 0.9200 support zone. The next major support is near the 0.9165 zone.

Any more losses might send the pair towards the 0.9120 support zone. On the upside, the pair is facing resistance near the 0.9320.

There is also a major bearish trend line forming with resistance near 0.9320 on the same chart. The next major resistance may perhaps be near 0.9350. A clear move above the 0.9350 resistance might start another decent increase.

In the stated case, USD/CHF may perhaps test 0.9400. Any more gains could set the pace for a move towards the 0.9500 resistance zone.

Looking at EUR/USD, the pair gained pace above the 1.0620 level and dips likely to remain supported in the coming days.

Economic Releases

- SNB Interest Rate Decision – Forecast 1%, versus 0.5% previous.

- BoE Interest Rate Decision – Forecast 3.5%, versus 3.0% previous.

- US Retail Sales for Nov 2022 (MoM) – Forecast -0.1%, versus +1.3% previous.