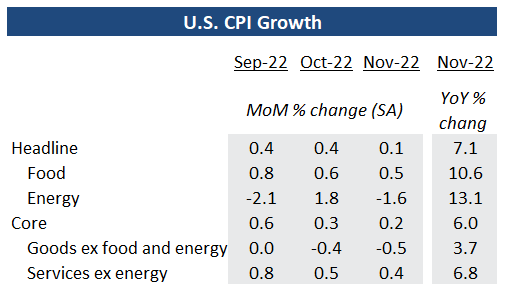

- Headline U.S. inflation further slowed to 7.1% year-over-year

- Food, energy, and ‘core’ CPI growth (+6%) all decelerated

- Home rents increasingly driving headline inflation rates, offsetting easing / narrowing price pressures among other products and services

- Fed to hike by 50 bp tomorrow; more encouraging inflation signs make a pause in early 2023 more likely

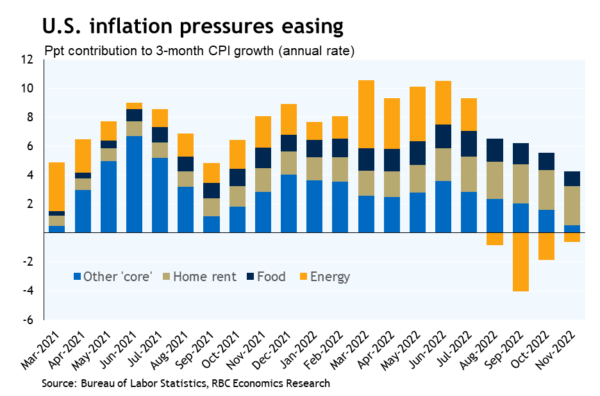

November’s U.S. inflation report brought more green shoots that broader inflation pressures are easing. The headline CPI rate slowed to 7.1% from 7.7% year-over-year in October as price pressure for all major categories slowed. Unsurprisingly, a 2% monthly decline in gasoline prices pushed energy inflation down further to 13.1% year over year. CPI for food also slowed to 10.1% from a year ago in November. That rate itself is still very elevated compared to an average rate of just 1.6% over the five years before the pandemic. But improvement in global supply chain conditions as well as lower food commodity prices should see the positive trend persist into 2023. Easing food and energy inflation means an increasingly larger share of inflation in the U,S, – we counted just under a third of the headline year-over-year growth rate in November – was driven by surging rent costs. Most of that however, reflects increases in market rents over the last year feeding through to leases with a lag. Those pressures will start to moderate soon given a slowdown in current market rents since this past summer.

Even accounting for the outsized monthly gain in rents (+0.8%), broadening moderation in price pressure across other non-food and energy items meant ‘core’ inflation slowed again in November. The 0.2% monthly increase in CPI ex-food and energy was markedly slower than the 0.5% average pace year-to-date, and the smallest since August 2021. Notable moderation was again seen in new and used cars as well as other durable goods. Growth in services CPI ex-rent (a measure Fed Chair Powell has identified as an important indicator for underlying inflation trends) slowed to an annualized 3.2% over the last three months by our count after peaking as high as 12.8% in June. Needless to say, despite green shoots in the near-term, price growth has further to fall before reaching the Fed’s 2% target. And consumer demand has been more resilient, adding some tailwinds to inflation trends. Still, higher interest rates will cut into household purchasing power in the year ahead and we look for inflation to continue to creep broadly lower. Overall, a smaller 50 bp hike is expected for the Fed’s meeting tomorrow, to be followed by another 50 bp over the first quarter next year before the Fed feels comfortable to pause the current cycle and reassess.