U.S. Highlights

- Somewhat unexpectedly, the ISM services index accelerated in November, with the business activity sub-index expanding to a level last seen in 2021.

- The services sector continues to struggle with elevated inflation as the prices paid component of the ISM services index and the services side of the producer price index showed no signs of price relief.

- Despite higher rates, consumers continued to borrow to support their spending. This underscores the degree of resilience of the U.S. consumer but increases prospects for a weaker economy next year as the Fed will have to move into more restrictive territory.

Canadian Highlights

- The Bank of Canada delivered another 50-basis point hike, raising the overnight rate to 4.25%. There was also a notable shift in the Bank’s forward-looking language, which removed any reference to further hikes being needed.

- Next week’s release of the national balance sheet accounts is expected to show that consumers spent more of their income on debt servicing costs in the third quarter as higher interest rates began to reach some households.

- Activity in the housing market continues to be depressed by high borrowing costs, but the correction may be nearing the end. Next week’s release of November’s housing data is expected to echo this, showing relatively modest drag on activity and prices.

U.S. – Waiting for the Fed

A slow week on the economic data front gave markets time to reflect and prepare for the FOMC meeting next week, which will include an update to the Fed’s economic projections. The consensus has solidified for a 50-basis points (bps) hike, but the Wall Street jury is out on how far the Fed will have to raise policy rates this cycle. Price volatility this week underscores increasing concerns that higher policy rates could tip the U.S. economy into recession.

On Monday, the ISM Services index reported an acceleration in the services sector. Somewhat unexpectedly, the business activity sub-index expanded by whooping nine percentage points lifting it to a level last seen in 2021. This is in stark contrast with the manufacturing sector’s production index, which moved into contractionary territory. The pick-up in services activity was backed by remaining pent up demand, further boosted by the start to the holiday season as industries like Accommodation & Food Services and Retail Trade entered their busiest month of the year.

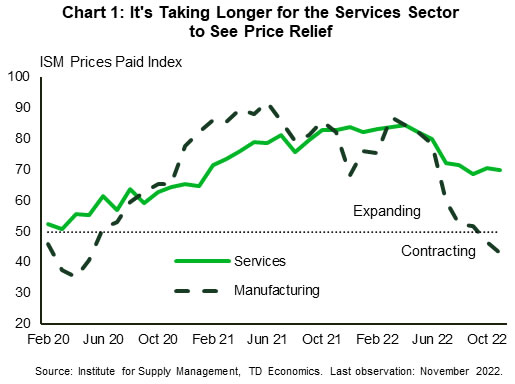

The prices sub-indexes reinforce the contrast between the two sectors. While the manufacturing sector has seen a significant deterioration in the prices paid component, which contracted in November with a reading of 43, it’s taking much longer for the services sector to see signs of price relief, with the sub-index remaining mired around 70 (Chart 1). Higher prices also appear to be broad-based with 16 out of 18 industries reporting higher prices. The Producer Price Index (PPI) for November provided another example of the sectoral divergence in price pressures. The PPI advanced by 0.3% month-on-month in November, driven by a 0.4% increase rise in services prices.

Tuesday’s trade data showed that goods exports declined in October, with a notable weakness in industrial supplies and materials (includes petroleum products), providing more evidence of dwindling demand from overseas. This contributed to a widening in the trade deficit to $78.2 billion. Imports also improved marginally supported by an increase in domestic demand for foreign goods, partially offset by weaker services imports from abroad.

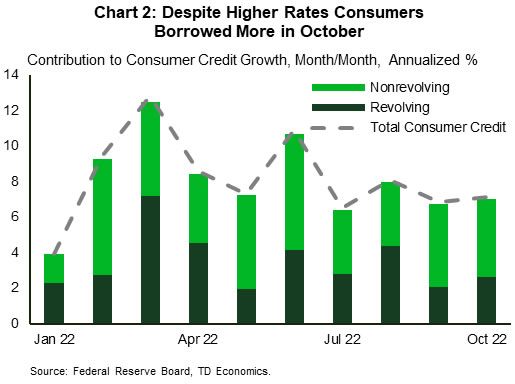

Consumer demand has proven a bit more resilient recently, and it looks to have been supported by consumer credit, which continued to expand in October despite higher interest rates. Consumer credit outstanding increased by $27.0 billion on the month (7.1% annualized), driven by nonrevolving credit, which gained $17.0 billion (Chart 2). Revolving credit added $10.1 billion, reflecting consumers stronger reliance on credit card debt as pandemic savings continue to dwindle. We think that consumers will add more leverage to support real spending growth of roughly 1.5% in 2023 – a step down from 2.8% expected in 2022.

That forecast underscores the degree of resilience coming from the U.S. consumer, but the cumulative effect of higher interest rates may create stronger headwinds than currently anticipated. Stronger domestic demand and higher inflation increases prospects that the Fed will have to move rates into more restrictive territory. Wednesday’s FOMC decision will feature the dot plot, so we won’t have to wait much longer to see the Fed’s latest thinking.

Canada – The End of the Hiking Cycle Is In Sight

This week’s economic highlight was the Bank of Canada interest rate announcement. As expected, the central bank delivered another 50-basis point hike, raising the overnight rate to 4.25%. As a justification of its decision, the Bank stated that while there were signs that the economy was slowing, particularly in the interest-rate sensitive areas such as housing and consumption, it was still in excess demand territory and that further cooling was required. Ditto for inflation. While acknowledging that supply chain bottlenecks have improved and the three-month rate of change in core inflation has come down, overall inflation remained high and inflation expectations elevated.

However, perhaps more interesting than the interest rate decision itself, was the notable shift in the Bank’s forward-looking language, which removed any reference to further hikes being needed. This suggested that the Bank is nearing the end of its rapid-fire hiking cycle. This was re-affirmed by Deputy Governor Sharon Kozicki in her speech on Thursday, where she said that the central bank thinking was “moving from how much to raise interest rates to whether to raise interest rates” and that future decisions will be “more data-dependent”.

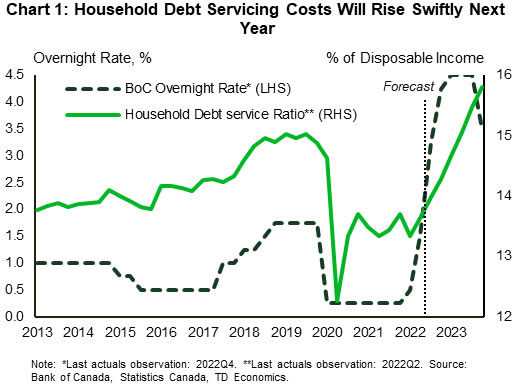

Indeed, given the lagged effects of the past interest rate increases, much of the impact of higher policy rates, particularly on consumer spending, is yet to come. Next Monday’s release of the national balance sheet accounts is expected to show that consumers spent more of their income on debt servicing costs in the third quarter as higher interest rates began to reach some households. This is likely just a start of a lengthy process. Our estimates suggests that the drag from higher debt servicing costs on household finances and spending will continue to intensify next year, long after the Bank of Canada ends rate hikes in Q1 of 2023 (Chart 1). Given these headwinds, we expect consumer spending and the economy to come to a near standstill next year.

While financial headwinds are still looming large, at least consumers have been getting some reprieve at the gas pump. Gasoline prices dropped by about 35 cents per liter since the start of November, and continued to edge lower this week as oil prices remained under pressure amid worries about the next year’s global economic outlook.

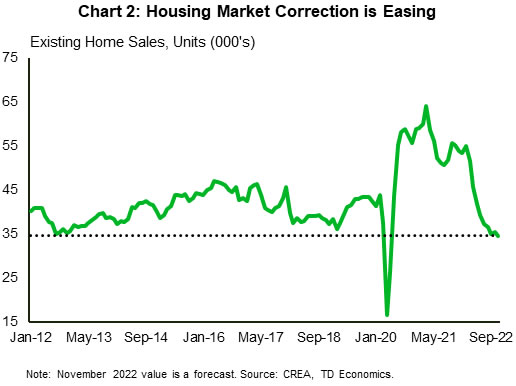

Activity in the housing market continues to be depressed by high borrowing costs, but the correction may be nearing the end, with the market expected to bottom at the start of next year. The impact of higher rates on the housing market so far has been dramatic. Sales crated by 35% since February and are now at level last consistently seen in 2012. The MLS home prices index, which adjust for the composition of home sales, is down 11% from its peak. However, declines have been moderating recently. Next week’s release of November’s housing data is expected to echo this, showing relatively modest drag on activity and prices (Chart 2).