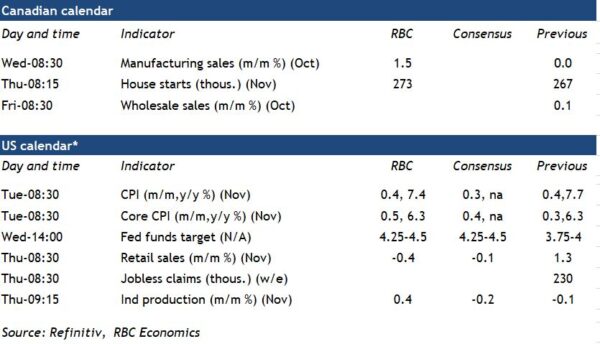

A drop in gasoline prices in November has likely sent U.S. inflation growth lower. We expect next week’s U.S. CPI reading to come in at 7.4%. That’s down from 7.7% in October and a 9.0% peak in June. Food inflation was still likely running almost 11% year-over-year. But a decline in commodity prices means that measure has finally started to turn a corner. Excluding more volatile food and energy products, we expect core CPI held flat on a year on year basis at 6.3% while accelerating on a month over month basis following a surprise decrease in October. A 0.5% rise in November core prices from October will match the average monthly change this year. But that’s still double the average pre-pandemic pace. Much of that strength continues to reflect surging rent prices from a year ago as higher market asking rents flow through to the CPI rent index. An easing in current market rent prices means those CPI increases will slow in the year ahead.

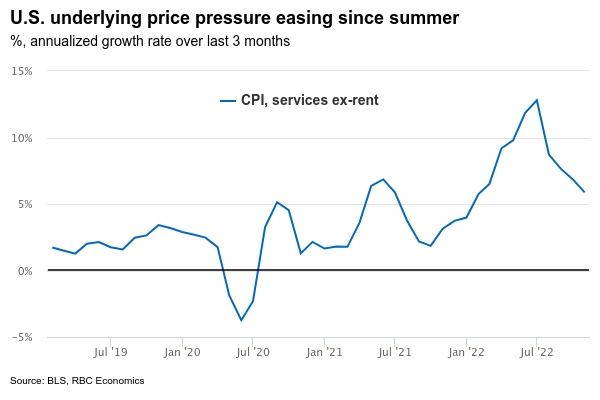

We expect the Fed to hike the fed funds target range by another 50 points at next week’s policy decision (the day after the November CPI data), a step down from 75 bps at each of the past four meetings. Fed Chair Powell said in earlier press conference that services CPI ex-rent “may be the most important category for understanding the future evolution of core inflation.” And growth in that measure has shown signs of slowing—to an annualized 5.9% on average over the last three months from a peak of 12.8% in June. But that pace is still well above the Fed’s target. And the central bank‘s latest rate announcement cautioned against reading too much into softening inflation pressures. What’s more, recent data showed too much momentum in labour markets and consumer spending to avoid additional rate hikes.

Still, some early signs of easing in price pressures could mean interest rates are nearing sufficient levels to bring inflation back towards the Fed’s 2% inflation objective. As focus shifts from the pace of rate hikes to a possible landing spot, updated economic projections from the Federal Open Market Committee will be closely watched for changes in the expected terminal level of the fed funds target. Overall, we still think the Fed will hike by another 50 basis points in the first quarter of 2023 before pausing at the 4.75% to 5% range.

Week ahead data watch

- We expect a 1.5% increase in Canadian manufacturing sales, slightly less than the 2% early estimate from Statistics Canada. A surge in petroleum, and coal prices boosted nominal sales. Sale volumes likely edged lower.

- Canadian Housing starts likely ticked higher to 273,000 units in November, up from 267,055 units in October. Residential building permit issuance slowed to 241,000 units in October, but that’s still strong and higher earlier issuance means there’s still substantial building activity in the pipeline.

- Declines in unit auto sales and gas prices likely led to a 0.4 percent drop in U.S. retail sales in November. We expect U.S. industrial production increased by 0.4% in November thanks to a jump in utilities output while manufacturing output held flat.