U.S. Highlights

- Minutes from the November FOMC meeting showed a sizeable majority of members were receptive to the idea of slowing the pace of rate hikes in the near-term.

- New home sales jumped 7.5% month-on-month (m/m), far outpacing expectations for a moderate decline, but remain down 5.8% year-on-year (y/y).

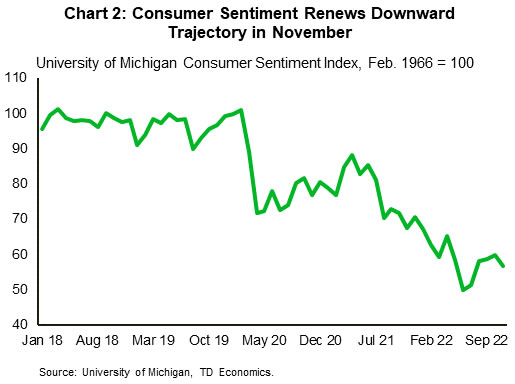

- Consumer sentiment declined in November for the first time since June, marking a return to the downward trend which started in the third quarter of 2021.

Canadian Highlights

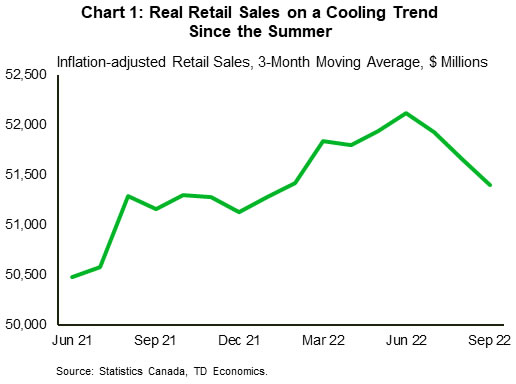

- We expect Canadian consumer spending to post tepid growth moving forward. September’s weak print for retail sales volumes (released this week) is consistent with this view.

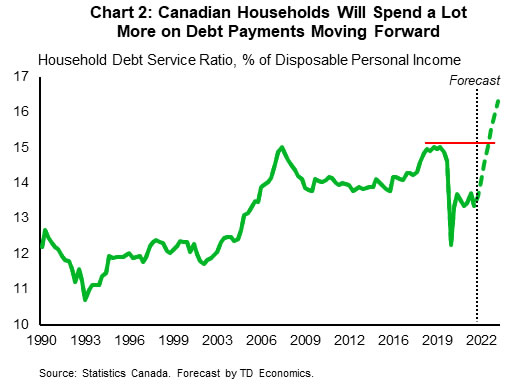

- The consumer is facing several headwinds next year, including the lagged impact of higher rates. Household debt servicing costs will likely rise to a new high in 2023.

- The vulnerability caused by elevated household debt was noted in a speech by Senior Deputy Governor Rogers this week, and is a key reason why the Bank’s rate hike campaign is likely nearing its end.

U.S. – FOMC Eyes Half-Point Hike

The holiday-shortened week was quiet overall, but did provide a healthy dose of Fed speak, new home sales data, and updated consumer sentiment readings. Due to lower trading volumes and shorter trading hours in the lead-up to the holiday, market movements this week were muted. The S&P 500 rose 1.5% on the week, while Treasury yields continued their gradual decline, with the 10-Year yield dropping 9 bps to 3.73% as of the time of writing.

October’s CPI report has been the centerpiece of market thinking since its release two weeks ago. Fed speakers this week attempted to strike a balanced tone. San Francisco Fed President Daly started the week stating, “although one month of data does not a victory make, the latest inflation report had some encouraging numbers”. Cleveland Fed President Mester in a separate media appearance added that more work still needed to be done, but that “it makes sense that we can slow down a bit”.

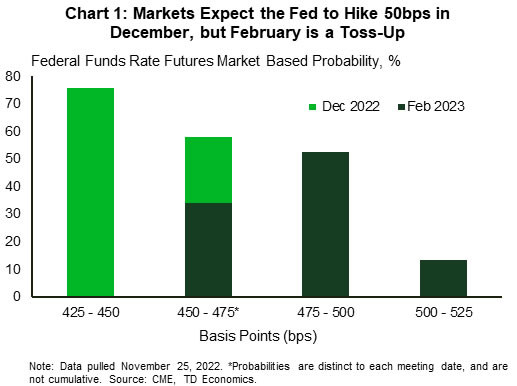

The November FOMC minutes released on Wednesday echoed this sentiment, noting that “a substantial majority of [FOMC] participants judged that a slowing in the pace of increase would likely soon be appropriate”. As of the time of writing, markets are expecting the Fed to raise rates by 50bps in December (Chart 1). Next week’s October PCE inflation and November jobs reports should provide further clarification on the Fed’s progress thus far and how much further it may have to go.

November new home sales surprised to the upside, rising 7.5% month-on-month (m/m) versus an expected decline. However, sales are still down on the year (-5.8% year-on-year, y/y). We don’t expect November’s uptick to be sustained. Mortgage rates remain elevated, homebuilder senitment is at its lowest level since June 2012 (excluding the early pandemic low), and existing home sales have declined for nine consecutive months as of November.

On the consumer front, we saw the University of Michigan consumer sentiment index reading for November drop 3.1 points to 56.8 (Chart 2). The index had previously notched four consecutive months of gains after a precipitous drop in the second quarter of this year, as the robustness of the labor market, combined with a build-up of savings had provided a cushion to consumers. However, with the unemployment rate ticking higher, job growth slowing, and excess savings winding down, the dual shock of higher rates and higher prices present a stronger headwind.

On a cheerier note, holiday air travel is expected to roughly return to its pre-pandemic level this week. Coupled with the expected spike in retail sales driven by Black Friday deals, the Thanksgiving holiday should provide partial short-term insulation from some aspects of the impending economic slowdown. Next week we’ll see whether job growth decelerated in November, or whether the Fed may have more to think about at its last meeting of the year.

Canada – Headwinds Mounting for the Consumer

Due to the U.S. Thanksgiving holiday, it was a lighter than normal trading week. Canadian bond yields traded slightly lower on the week (as of writing), while broad-based gains across major sub-indices were pushing the TSX higher. Oil prices were on track to end the week lower, partly on the back of concerns about Chinese demand. Prices dropped significantly early in the week on reports that OPEC+ was considering increasing production. However, they rebounded later on, as major producers refuted these claims.

The September retail sales report was this week’s marquee data release. Retail volumes were down 0.1% m/m, capping a weak third quarter (Chart 1). However, activity showed some signs of resilience in October, with Statistics Canada’s advance estimate of retail sales showing a 1.5% m/m gain. This should work out to an increase in volumes once the full report comes out, even with goods prices showing a large increase during the month. However, we doubt this resilience is sustainable as the Canadian consumer deals with high inflation, rising interest rates and declining wealth. Next year, we expect a weaker job market to be added to that list, with the pace of job gains to cool considerably.

Higher interest rates will be one of the main drags on household spending in 2023. The Bank of Canada has been hiking rates since March, but it can take 12-24 months for the full effects of policy tightening to be felt. Part of this story is the sizeable increase in mortgage payments faced by homeowners who took out variable rate mortgages when interest rates were at rock bottom levels last year. In a research note released this week, Bank of Canada staff indicated that 50% of outstanding variable rate mortgages (or 13% of all mortgages) hit their “trigger rate” at the end of October. This is the interest rate at which the entire payment on a variable rate mortgage (with fixed monthly payments) goes towards interest, with zero put towards principal. In some cases, when borrowers hit their trigger rate, their monthly payments go up automatically. For these borrowers who took out mortgages in 2021, the Bank estimates that their payment would have increased by about 20% by October’s end.

More broadly, our latest quarterly Q&A outlook report (see here) discussed how after spending an additional $18.6 billion on debt servicing this year, we estimate Canadian households will see their debt servicing costs increase by $34.4 billion in 2023 (Chart 2). This elevated vulnerability to interest rate increases is a key reason why the Bank of Canada opted to scale back the pace of rate hikes in October. In her speech on financial stability this week, Bank of Canada Senior Deputy Governor Carolyn Rogers stated that “the risk of a trigger that may affect financial stability has increased” due to elevated inflation and the higher interest rates that it’s brought on. Policymakers don’t want to under-tighten, but are wary of the risks of overtightening as well. With this in mind, Governor Macklem noted this week that, with respect to the end of the Bank’s tightening campaign, policymakers are “getting closer, but are not there yet”.