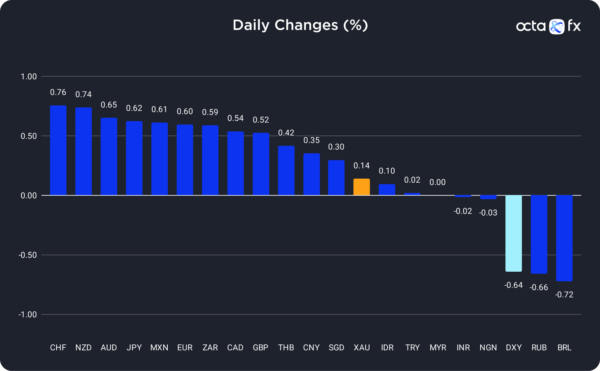

On Tuesday, the Swiss franc was the best-performing currency among the 20 global currencies we track, while the Brazilian real showed the weakest results. The Mexican peso was the leader among emerging markets, while the U.S. dollar underperformed among majors.

In focus today

U.S. Dollar Index

The U.S. Dollar Index (DXY) fell by 0.64% as U.S. Treasury yields continued to invert, fueling fears of a possible recession.

Possible effects for traders

Treasury yields are inverted since the difference between the yield on ten-year government bonds and two-year bonds turned negative. Such a situation signals that an economic recession is likely, and further monetary tightening is risky. According to Reuters, the market expects the U.S. interest rate to peak at 5% by mid-2023, and it starts to price in rate cuts after that. DXY has been stable during the Asian session as traders await the release of the Federal Reserve’s (Fed) policy meeting minutes. The report could offer clues to the outlook for inflation and interest rates. Fed minutes are due at 7:00 p.m. GMT today. Investors should look for any signs of discussions around moderating the pace of rate hikes.

XAUUSD

The gold price increased by 0.14% but closed below the important 1,750 level.

Possible effects for traders

XAUUSD received some support from the weakening U.S. dollar, but it is unclear if a rebound from 1,730 can be sustained. ‘I think the metals will eventually move higher. But right now it is a direct correlation with interest rates,’ said Daniel Pavilonis, senior market strategist at RJO Futures. XAUUSD has been trading in a narrow range during the Asian session as investors await the release of the Fed meeting protocols. Many analysts expect the Fed to remain hawkish, which is potentially bearish for gold. Kansas City Fed President Esther George said that the Fed might need to raise rates to a higher level and hold them longer to moderate consumer demand and successfully bring down high inflation. According to Reuters, the market is pricing in a 79% chance of a 50-basis point hike in December.

EURUSD

EURUSD traded in the positive territory, closing above 1.0300.

Possible effects for traders

The pair gained 0.60% intraday as the eurozone Consumer Confidence Index (CPI) came out better than expected, and the U.S. dollar retreated. EURUSD continued to increase during the Asian session and will likely retest 1.03600. The upcoming German and the eurozone PMI data due at 9:00 am GMT today may send the pair towards 1.03400 in case of good results. Alternatively, a disappointing figure will likely pause the rally and reverse the pair towards 1.02800.

Other events

GBPUSD

The British pound rose by 0.5% yesterday due to the better-than-expected UK government borrowing numbers. The general weakness of the U.S. dollar also provided some support.

Possible effects for traders

The data published on Tuesday showed that Britain’s government borrowed less funds than expected in October. However, the budget deficit is likely to increase in the months ahead due to energy bill support measures and slowing economy. Samuel Tombs, chief UK economist at consultancy Pantheon Macroeconomics, said that ‘the downturn in GDP will start to slow the growth rate of tax receipts, and put some upward pressure on benefits spending towards the very end of this fiscal year.’ According to Reuters, the UK economy is already in a recession and will shrink by 1.4% in 2023. Thus, the fundamental pressure on GBPUSD is rather bearish. Today, the UK will release its Manufacturing PMI data at 09:30 a.m. GMT. Higher-than-expected results may drive GBPUSD towards 1.19450, while the weaker numbers may push the pair towards 1.18000.