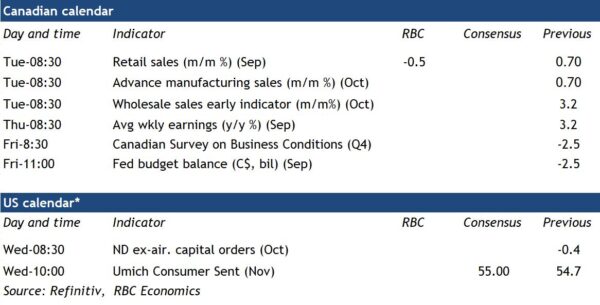

Canadian retail sales likely fell by 0.5% in September, in line with an advance estimate from Statistics Canada a month ago. Retail sales have remained very strong and most of the expected September decline may have been from lower gasoline prices rather than a drop in the volume of purchases.

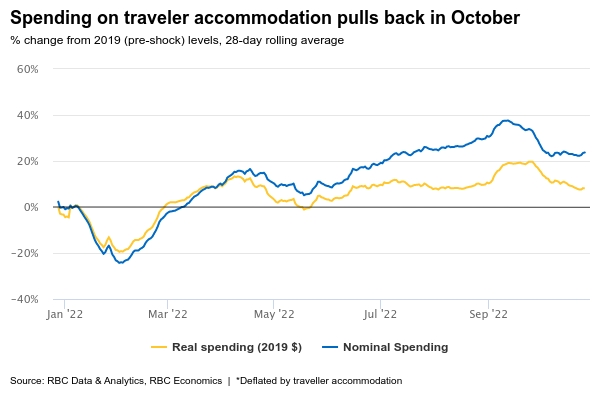

But our own tracking of credit and debit card transactions is pointing to a plateauing in overall household spending, including services not covered in StatCan’s monthly retail sales data. New vehicle purchases ticked higher in September and October as the supply of vehicles improved. But spending on furniture has lost steam as housing markets cool. And spending on some travel and hospitality services—like traveler accommodation—appears to have flagged in October following a summer surge.

We expect discretionary purchases to slow more substantially as rising debt servicing costs and inflation cut further into household purchasing power. But that turning point isn’t likely to show up in September data. That’s largely due to job markets, which have remained very strong. We anticipate next week’s SEPH labour market survey to show another tick lower in job vacancies. The number of job openings will continue to moderate through the rest of the year but for now, demand for workers is still easily outpacing available supply and wage growth has strengthened.

Week ahead data watch:

Wage growth from the SEPH data will be closely-watched given earlier data from the monthly Labour Force Survey that showed accelerating wage growth in September and October.

We expect the advance estimate of October Canadian manufacturing sales to remain relatively firm. The outlook for the manufacturing sector has dimmed as business surveys—including the Canadian Manufacturing PMI and the CFIB’s business barometer—point to a deteriorating outlook. But, for now, hiring demand in the sector continues to outpace supply. Manufacturing hours worked rose 0.7% from September in October.