- While markets have reacted very positively to the October CPI print, we continue to see further risks of more persistent inflation and think it is too early to trade a clear Fed pivot.

- Still elevated underlying price growth, tight labour markets, inflationary market reaction and China reopening risks all favour remaining cautious on inflation.

- The figures challenge our hawkish call for a 75bp hike in December, but Fed’s focus remains on terminal rate level and maintaining financial conditions restrictive. Slower hiking pace could extend the cycle further into 2023.

The details of the CPI release were mixed. Admittedly, the recent uptick in oil prices and lagged rise in shelter inflation contributed positively to the CPI, which means that the headline figures partly understate the slowdown in inflation in October. That said, over half of the negative contribution from core goods CPI was explained by a 2.4% drop in used car prices, which have not been a key inflationary driver since late 2021. Similarly, majority of the decline in services CPI ex. shelter was explained by an unexpected drop in health care prices. Dallas Fed estimates that lagged impact from past wage rises should continue to lift health care prices well into 2023, suggesting that the drop might have been a one-off.

Excluding shelter and healthcare, core services prices rose 0.49% m/m, or around 6% annualized. In line, Atlanta Fed’s sticky price inflation remained at 5.5% annualized m/m. Together with the September uptick in job openings and October rise in wage inflation, broad-based price pressures remain way too high for the Fed to feel comfortable yet.

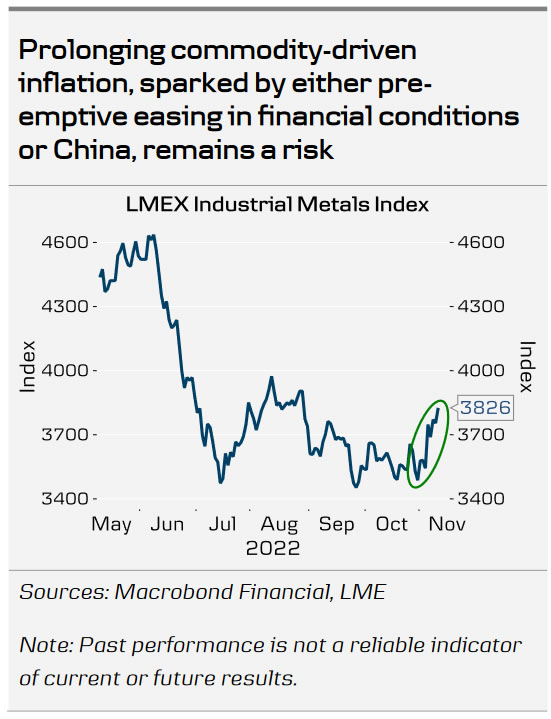

Another challenge for the Fed is the inflationary nature of the market reaction. Lower real yields, weaker USD and higher commodity prices reflect easing financial conditions. If Fed, over the coming days, clearly communicates more dovish rates outlook, they risk fuelling the market rally and prolonging inflation. This is exactly what Powell sought to avoid just last week (see our Fed Review for details, 2 November), and also, why we think the Fed is unlikely to give strong signals for lower terminal rate following just one low CPI print. Back in August, the market reaction only lasted 3 days after a downside CPI surprise.

In addition, the early signs of easing Covid-strategy in China are increasing the inflationary risks for the Western economies. While we remain sceptical that a near-term reversal in the policy stance is imminent, it could gradually progress towards 2023, and the recovering demand from China could provide another boost to global commodity markets. Copper prices have already risen from recent lows and especially the already tight energy markets remain vulnerable to further price upticks.

Even though inflation has likely rolled over its peak, risk of prolonging elevated inflation still persists. Cost of overtightening the economy into a recession is still lower than allowing inflation to become entrenched, and as before, Fed’s focus remains on the terminal rate and maintaining financial conditions restrictive towards next year. Our hawkish call for a 75bp hike in December is under clear pressure, but we think that if Fed prefers to moderate the pace of hikes to 50, the hiking cycle could extend well into 2023.