U.S. Highlights

- Republicans look to have won control of the House in this week’s midterm elections. The Senate race remains too close to call. With Washington more divided, major spending and tax changes are less likely, while some risks increase (i.e., the potential for a government shutdown).

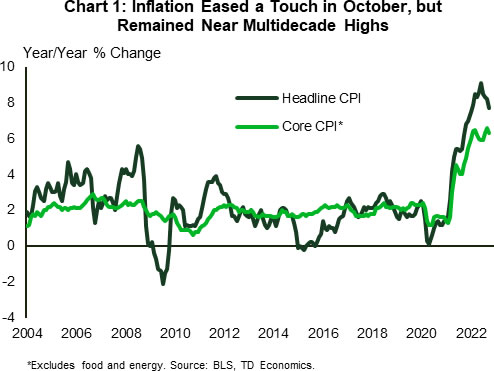

- CPI inflation eased in October, with headline CPI decelerating to 7.7% y/y (from 8.2%) and core CPI cooling to 6.3% y/y (from 6.6%). Shelter costs remained a key contributor to inflation.

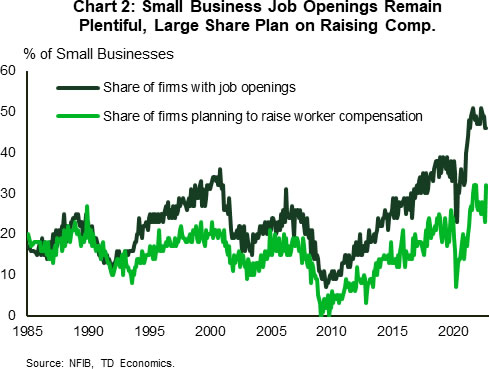

- Small business confidence pulled back a bit in October, but job openings remained unchanged near record highs.

Canadian Highlights

- It was a quiet week in Canada data-wise ahead of next week’s flurry of data. The CPI report is expected to show modestly easing inflation, while existing home sales will likely show that the housing market is nearing its bottom.

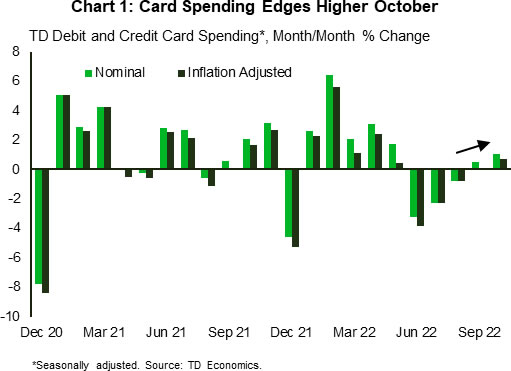

- Despite significant financial headwinds hitting consumers’ budgets, aggregate spending on debit and credit cards edged slightly higher in September and October after trending lower over the summer months.

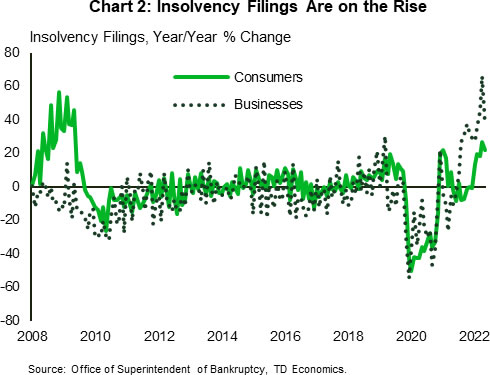

- However, rising financial hurdles are leading to higher insolvency filings. Consumer insolvencies are up 22% from a year ago, while filings were up 37% y/y for businesses.

U.S. – Markets Cheer Inflation Easing a Touch

The midterm elections took center stage for much of the week, although markets were most encouraged by good news on the inflation front on Thursday. Republicans look to have won control of the House, capturing an estimated 208 seats thus far (vs. 185 for Democrats), while the Senate remains too close to call. We may need to wait until Georgia’s runoff election on December 6th, to know the final result, depending on races in Arizona and Nevada.

Either way, Washington is looking more divided than it was a week ago, and the chance that new major policy measures get the three required checkmarks – House, Senate and White House – have diminished. Indeed, large scale fiscal spending measures and major tax changes seem unlikely over the next two years. In this vein, the midterms should not have a major impact on economic growth. There are, however, risks that come with a divided Congress. One concerning aspect is the potential for a lack of agreement to fund government programs in the near-to-medium term, which could lead to a government shutdown, or debt-ceiling standoff, which raises the (unlikely) risk of a default on debt or leave other bills unpaid. These issues, which have the potential to significantly disrupt financial markets, as they’ve done in the past, are added risks for a slowing economy in the year ahead.

Inflation was likely top of mind for many voters as they headed to the polls, as it has been taking a sizable bite out of consumers’ wallets this year. The Consumer Price Index (CPI) showed that inflation eased in October, for both headline and core CPI, with the latter decelerating to 6.3% year-on-year (y/y) from 6.6% in the month prior (Chart 1). In month-over-month (m/m) terms, core CPI decelerated meaningfully to 0.3% in October from 0.6% previously. Core goods prices declined 0.4% (m/m) amidst a pullback in several categories such as appliances, apparel and used car prices. Price growth across core services (0.5%) also moderated from last month’s gain of 0.8%, driven by a notable pullback in health care services (-0.6%). However, shelter costs (0.8%) remained a meaningful contributor.

All in all, inflation has eased a bit, in part because of the pullback in core goods prices. However, it remains well above the Fed’s comfort zone, and (without wanting to sound like a broken record) we’re likely to see continued gains in the shelter component over the near term (see here). So, we’re not out of the woods just yet.

As Fed Chair Powell noted recently, the Fed has reached a point where it will dial back the pace of rate hikes, but there’s quite a bit more to be done in raising rates. Underpinning this hawkish tilt is the broad resilience in the labor market. Job openings for instance, have eased a bit, but remain plentiful – a message echoed by the NFIB small business survey (Chart 2). Still, cracks continue to form in some corners of the economy, case in point the tech sector. Layoffs at Meta and Redfin (online real estate broker) amounting to 13% of their workforces added to the string of cuts announced in the tech space this year. Meanwhile, the higher interest environment is expected to continue weighing on the housing market, with weak prints likely to follow in next week’s housing starts and existing home sales reports. Bringing inflation down comes at a cost.

Canada – Economy Still in Excess Demand, but Cooling

It was a quiet week in Canada data-wise, nonetheless the past few days were marked with volatility in financial markets. Midterm elections in the U.S. and turmoil in cryptocurrency markets made waves. Following a selloff on Wednesday, markets surged higher today following the release of U.S. inflation numbers, which showed a larger than-expected slowdown in price growth in October. It’s been some time since U.S. inflation surprised to the downside and this news lifted investors’ spirits, with hopes that inflationary pressures south of the border are finally starting to ease.

Here in Canada next week’s CPI report is expected to show modest improvement on inflation front in October as well. Following a 6.9% year-over-year (y/y) increase in September, headline inflation is expected to have eased to 6.7% last month. However, all eyes will be on core inflation, which has so far remained stubborn. Not helping the cause, both the labour market and spending data have showed renewed resilience in the fall months. Last week’s blockbuster employment report showed that after a summer lull, the economy added 100k new jobs in October. Consumer demand too has also shown more life in the past two months. Despite significant financial headwinds hitting consumers’ budgets, aggregate spending on debit and credit cards edged slightly higher in September and October after trending lower over the summer months (Chart 1).

No doubt the resilient labour market has been helping to partially mitigate the financial pain that consumers are facing due to high inflation, rising interest rates and thinning wealth cushions. With unemployment near a record low, a tight labour market continues to add upward pressure on wages. The BoC governor Tiff Macklem also discussed labour market imbalances and its implications for inflation in his speech today, stating that “vacancies are elevated, businesses are reporting widespread shortages”, and “wage growth has increased and broadened across the economy”. However, he also stated that the Bank is seeing early signs of that the labour market is starting to loosen, particularly in interest-rate sensitive sectors, such as manufacturing and construction.

All in all, despite the aggressive monetary tightening, the Canadian economic engine appears to still has some steam left in it. But likely not for long. Monetary policy works with lags, as such we are only starting to see the impact on real economic activity. The full cumulative effect of higher interest rates on consumers will materialize only toward the end of 2023, after significant share of borrowers have been exposed to higher rates either due to mortgage renewals or higher rates on new credit. However, rising financial hurdles are already leading to higher insolvency filings. Consumer insolvencies (which include both bankruptcies and debt-restructuring proposals) are up 22% from a year ago, while filings were up 37% y/y for businesses (Chart 2). Both are rising from low levels, but will likely continue to increase as the labour market cools and higher debt servicing costs extend their reach to a larger number of households.