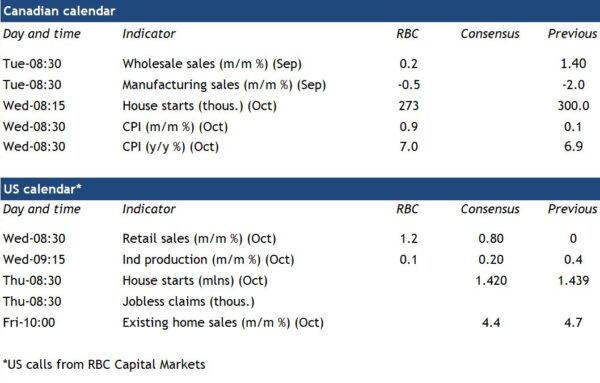

Consumer price growth in Canada likely ticked higher in October. We expect the annual rate to have risen to 7%, up from 6.9% in September but still down from the 8.1% recent peak in June. Driving the increase was a resurgence in gas and fuel oil prices. These prices, declining for months, had been the main factor pulling overall CPI growth readings lower. At 10.3% in September, food inflation was already the highest it’s been since 1980s—and that momentum likely extended into October. Inflation growth excluding more volatile food and energy products was likely little changed from a 5.4% annual increase in September as weakness tied to home-owning related expenses is offset by strength seen elsewhere.

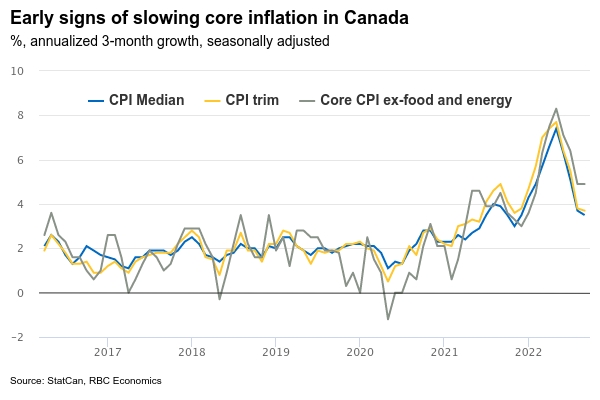

Still, broader ‘core’ inflation measures—designed to provide a better gauge of underlying inflation trends—have shown some very early signs that the breadth of inflation pressures may be easing. The Bank of Canada’s preferred ‘trim’ and ‘median’ core CPI measures are still very high versus a year ago, but the pace of monthly growth moderated in August and September. By our count, 63% of the CPI basket was still growing at an annual rate above the BoC’s 1% to 3% target range over the three months to September. That’s down from 77% in July. Those green shoots were cited as a key reason for the BoC’s decision to go with a 50 basis point hike in October (below market expectations).

Outside of inflation readings, global supply chain constraints have continued to ease. A variety of shipping indicators have improved. Commodity prices, while still high, are lower than earlier this year. But labour markets are still very tight and consumer demand remains strong. While there are signs that inflation is past its peak in Canada, it will likely take a sustained period of higher interest rates and a weaker economy for price growth to ease fully back to central bank target rates. Our forecast assumes one additional 25 basis point increase in the BoC’s overnight rate in December before it pauses to assess the impact of its rate hikes so far. And risks to that interest rate outlook remain tilted to the upside.

Week ahead data watch:

We expect manufacturing sales declined half a percent in September—in line with early estimates from Statistics Canada. A large drop in petroleum sales was likely price-related, although we expect overall sale volumes to also decline by 0.3% with Statistics Canada noting lower transportation sales.

Housing starts likely slowed but to a still relatively strong 273,000 in October from the 300,000 annualized pace in September. Residential building permit issuance slowed to 258,000 in September from the outsized 307,000 in August.

A jump in U.S. unit auto sales in October is flagging a solid 1% increase in U.S. retail sales. We expect U.S. industrial production edged up 0.1% in October, with higher manufacturing output (+0.4%) offsetting a pullback in utilities output (-1%).