Bank of England Review: A One-off 75bp Hike

-

- In line with our expectation, the BoE today hiked policy rates by 75bp, bringing the Bank Rate to 3.00%.

- We expect fiscal tightening and recession to weigh on the economy, which in our view, supports a slower hiking pace going forward.

- We maintain our call for a 50bp hike in December and 25bp in February with risks to our call skewed towards additional hikes in 2023.

In line with our expectation, the Bank of England (BoE) hiked the Bank Rate by 75bp to 3.00% with 7 members voting for a 75bp hike, one member voting for 50bp and one member voting for 25bp. As expected, there was no news in regards to QT-communication as outright selling of government bonds commenced on 1 November.

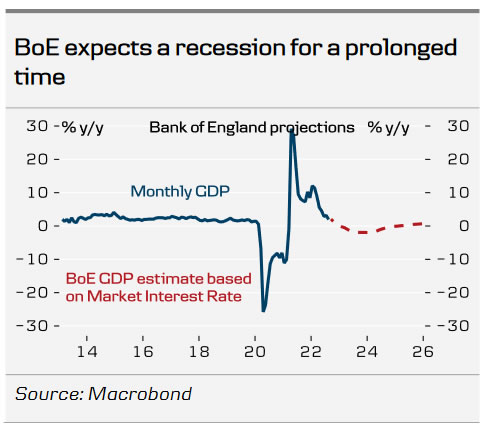

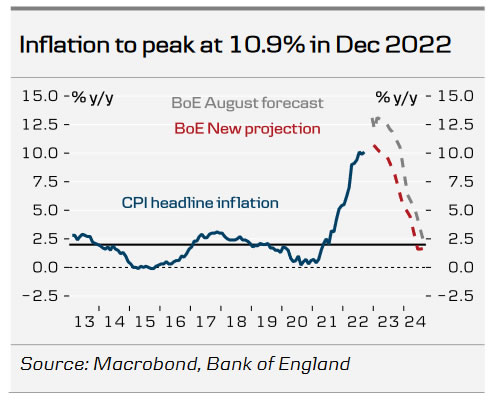

Inflation forecasts were revised downwards across the line since the August meeting, as the Government’s Energy Price Guarantee is set to lower and bring forward the expected peak of CPI inflation. The Bank now expects inflation to peak around 11% in Q4 2022 as “CPI inflation remains elevated at over 10% in the near term.” On growth, the MPC’s latest projections describe a very challenging outlook for the UK economy, where it now expects the UK “to be in a recession for a prolonged period.” This supports our expectation of the Bank returning to a slower hiking pace as tighter financial conditions and the recession tear on the economy leaving a worsening growth outlook ahead. We thus keep the rest of our forecast unchanged, expecting a 50bp hike in December followed by a final 25bp hike in February 2023.

In terms of fiscal policy, we see an increased focus on closing the fiscal gap with the new government led by PM Rishi Sunak. We thus see fiscal policy as being less inflationary as expected under former PM Liz Truss. In turn, this could result in inflation becoming less persistent, which in our view makes a less aggressive rate path more likely. We receive further details in the governments Autumn Statement on 17 November.

Rates: Longer gilts ticked slightly higher on the announcement while the peak rate was pushed 10bp lower to 4.65% in June next year. Investors’ took note of Governor Bailey comments that rates are to increase less than markets are currently pricing in noting that “best guess is closer to constant rate curve (3.0%) than market (5.25%)”. Our base case remains that of a peak in the Bank Rate of 3.75%.

FX. EUR/GBP initially moved higher upon announcement to 0.8700 from 0.8650 and continued its move higher to 0.8730 during the press conference, as expected. We see a case for EUR/GBP to remain elevated in the near-term, but in the longer-term expect the cross to move lower as a global growth slowdown and the relative appeal of UK assets to investors are a positive for GBP relative to EUR.

Our call. We still expect BoE to deliver more rates hikes. We pencil in another 50bp rate hike in December and finally a 25bp hike in February. Our expectations fall below current market pricing (currently 245bps until June 2023) as we expect BoE to eventually turn less hawkish amid a weakening growth backdrop.