What will happen?

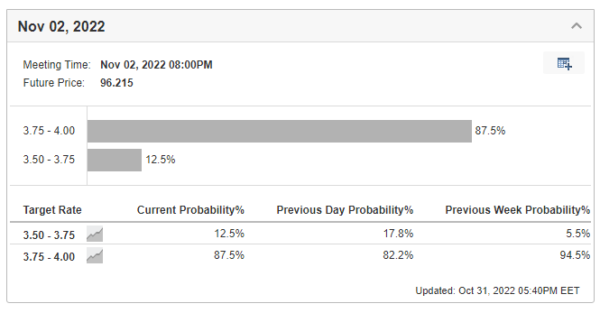

On November 2, the Federal Reserve will make an update on the interest rate and publish the Rate Statement with commentary on economic conditions that influenced their decision. According to the analysts, the Fed will come up with a 75-basis-points rate hike raising the rate to 4%.

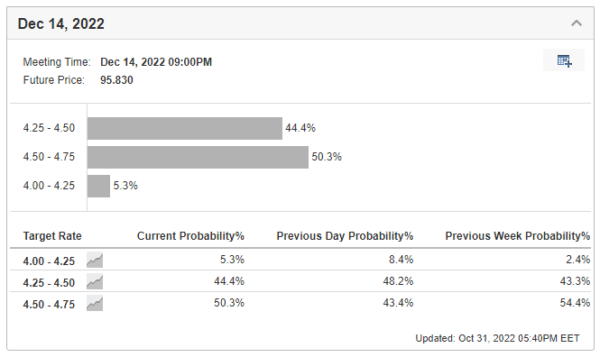

Markets are already pricing in this decision. Thus, all attention will be drawn to Powell’s rhetoric regarding the next decision at the December 14 meeting. Currently, the chances of another 75-bps hike in December are estimated by the markets at 50.3%. Another 44.4% relates to a 50-point rate hike. Therefore, the Powell Speech can significantly turn the markets one way or another regarding the future actions of the Fed.

However, despite Powell’s remarks, the main driver of dollar volatility will be the NFP and the CPI report on November 4 and November 10, respectively. This time, according to analysts’ forecast, 200K new jobs are expected in October, against 260K a month earlier. These are rather low expectations. Therefore, as in previous times, the actual result may exceed expectations and boost the US dollar index in the short term. Nevertheless, we have to mention that the previous three times, the USD has fallen two days after the NFP release.

FBS analysts’ prediction

We expect the US dollar to stay under pressure until the CPI release on November 10. Jerome Powell might give a fresh breath to the stock and crypto markets ahead of the 2022 United States elections on November 8, where all 435 seats in the House of Representatives and 35 of the 100 seats in the Senate will be contested. Moreover, as recent history shows, NFP results might boost the greenback, but it usually falls after.

Thus, until the CPI release, we await a bullish rally in XAUUSD, EURUSD, GBPUSD, US100, US500, and crypto coins.

Technical analysis

US500, weekly timeframe

Buyers are trying to push the US500 index above the 3900 resistance. After the breakout, the way to 4075 will be open.

EURUSD, Daily timeframe

EURUSD broke above the descending trend line and the 50-day moving average. Moreover, at this moment, the price is testing this breakout, and it seems like the retest will be successful. We expect the pair to reverse toward the 100-day MA, which is currently moving between 1.0050 and 1.0090. Moreover, if the price breaks above this MA, it will move higher to 1.0200.