- We expect the Bank of England (BoE) to hike the Bank Rate by 75bp on Thursday 3 November, but in our view it is a close call between 50bp and 75bp.

- We keep the rest of our forecast intact, expecting the Bank Rate to peak at 3.75%.

- We expect fewer hikes than priced in markets as we emphasise the weak growth outlook. In our base case, we expect headwinds for GBP upon announcement.

BoE call. We expect the Bank of England (BoE) to hike the Bank Rate by 75bp on 3 November bringing it to 3.00%. Markets are currently pricing close to 75bp. Given the past months immense sell-off in gilt markets, we see the hawkish camp prevailing as an opportunity to restore market credibility as inflation remains significantly above target.

However, we expect the Bank to return to its more dovish stance as recession risks are becoming more pronounced and the growth outlook is increasingly becoming weaker. Likewise, the BoE tends to ear on the side of caution, why we expect a return to smaller increment hikes. BoE’s Broadbent said that market pricing was too aggressive further highlighted this. For these reasons, we also see it as a closer call between 75bp and 50bp than what markets are currently pricing. We keep the rest of our forecast unchanged, expecting a 50bp hikes in December followed by a final 25bp hike in February 2023, which is fewer hikes than priced in markets (currently 270bps until August 2023).

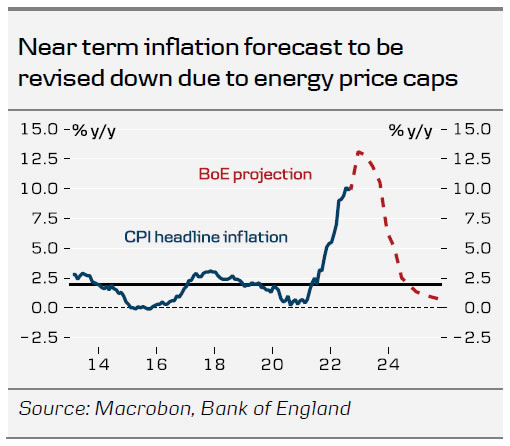

Note, that there will be updated inflation and GDP forecasts published at this meeting.

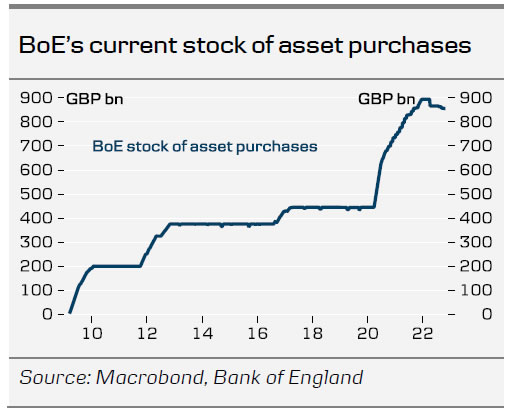

After initially delaying its outright selling of government bonds by a month due to market conditions, we expect no changes regarding the QT-communication. We thus expect that BoE will continue with the planned reduction of GBP80bn over the next 12 months starting 1 November. During 2022, sales are set to be in short- and medium term (up to 20Y).

Fiscal policy. Chancellor Jeremy Hunt recently announced that energy support measures will be scaled back, now only capping yearly energy bills for the next 6 months instead of previously for two years. Targeted support is set to kick in after the 6 months, with no further details presented at this point. With increased focus on closing the fiscal gap, we see fiscal policy as being less inflationary as expected under former PM Liz Truss. In turn, this could result in inflation becoming less persistent, which in our view makes a less aggressive rate path more likely.

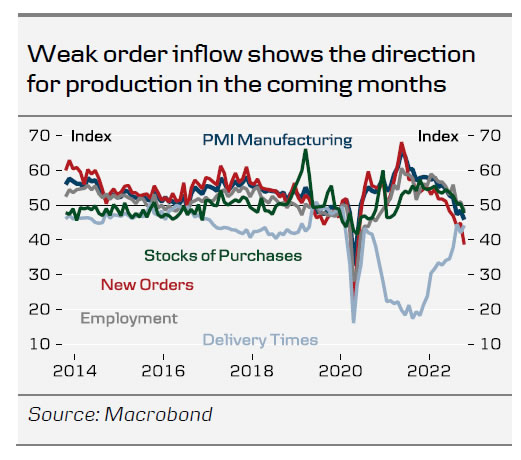

Growth outlook. We continue to expect the UK to head into recession but earlier than expected with the first negative p GDP growth print as early as Q3. The fiscal stimulus will slightly dampen the fall, although it will not be enough to fully offset the erosion of real wage growth. PMIs are now showing weakness across the line, with all components posing values below 50. Likewise, the labour market remains very tight with high wage pressure.

FX. In our base case of a 75bp hike, we expect EUR/GBP to move slightly higher on announcement. As we expect the BoE to highlight the gloomy growth outlook for the UK economy amid rising recession risk, we expect EUR/GBP to continue its move higher during the press conference.