Headline CPI 1.8%qtr/7.3%yr; Trimmed Mean 1.8%qtr/6.1%yr; Weighted Median 1.4%qtr/5%yr.

It was a broad based upside surprise in the core measures highlighting accelerating inflationary pressures.

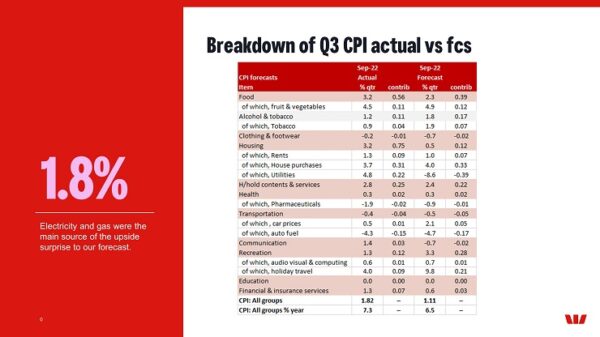

The CPI lifted 1.8% in the September quarter with the most significant contributions coming from new dwellings (+3.7%, 0.31ppt), gas (+10.9%; 0.10ppt) and furniture (+6.6 %, 0.09ppt).

Gas and furniture were upside surprises to us but the main difference between our 1.1% forecast and the 1.8% print was the +3.6% in electricity prices vs our forecast for -17% fall due to the state government rebates. Not only did we overestimate the impact of the rebates in Melbourne and Brisbane but we underestimate the 25% increase in Sydney power bills. The ABS estimates that excluding the effect of these schemes in WA, Queensland and ACT, electricity prices would have risen 15.6% in the quarter.

This 16.6% increase in electricity bill will have to appear in December quarter, and possibly into early 2023, as the use of these rebates fade. And this is before any further increase in power bills are applied.

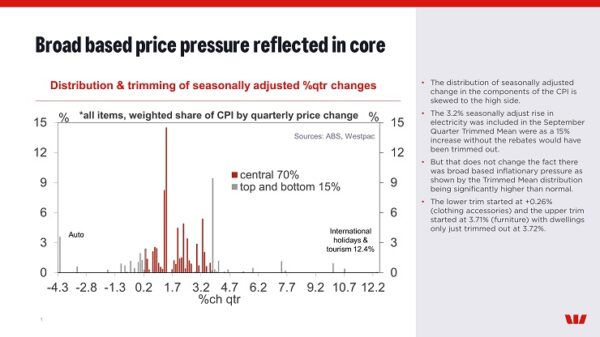

But the real surprise was the 1.8% increase in core inflation. You can argue that the rebates would have had a perverse effect in boosting the Trimmed Mean as the 3.2% seasonally adjust rise in electricity was included in the September Quarter Trimmed Mean were as a 15% increase without the rebates would have been trimmed out.

However, this would not be a valid assumption as it was the broad based nature of the inflationary pressure as shown by the Trimmed Mean distribution being significantly higher than normal. The lower trim started at +0.26% (clothing accessories) and the upper trim started at 3.71% (furniture) with dwellings only just trimmed out at 3.72%.

House price were a touch softer than we expected with the ABS reporting that rising labour costs along with continuation of material shortages added further price pressure. But the rate of growth has moderated reflecting a softening in new demand and some easing in supply constraints and this should continued as we head into 2023.

Food was close to our expectations (+3.2%) however fresh fruit & vegetables where not far off our forecast and the main surprise was the strong rise in meals out & takeaway foods (+2.9%) due to higher ingredient, wage and transportation costs.

Partially offsetting the September quarter rise was the expected fall in automotive fuel (-4.3% per cent), which fell in all three months of the quarter, reflecting falling crude oil prices. But we also note that car prices rose just 0.1%, softer than our expected 2.1% rise.

We are processing the numbers and working through how they will impact on our current inflation forecasts.