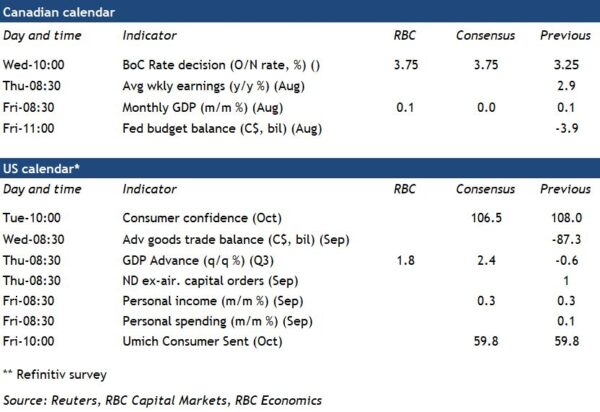

The Canadian economy is slowing, but inflation is still too high to prevent another aggressive interest rate hike from the Bank of Canada. We expect a 50 basis point increase next week to take the overnight rate to 3.75%. That’s smaller than the 75 basis point hike in September and the 100 basis point jump in July. But it’s still larger than ‘normal.’ And risks remain that the central bank could go bigger: markets are currently leaning toward a 75 basis point increase.

Economic growth has slowed into the summer. And we expect next week’s August GDP report will be little changed from July (in line with Statistics Canada’s early estimate.) That loss of momentum likely stretched into the fall as hours worked in September fell 0.6%. The BoC’s Q3 Business Outlook Survey also flagged softening business sentiment. Labour markets remain incredibly tight with job openings outpacing available unemployed workers. But inflation isn’t likely to return fully and sustainably to the central bank’s target range of 2-3% until the economy slows further. That’s keeping monetary policymakers firmly focused on rate hikes, even as the growth outlook softens.

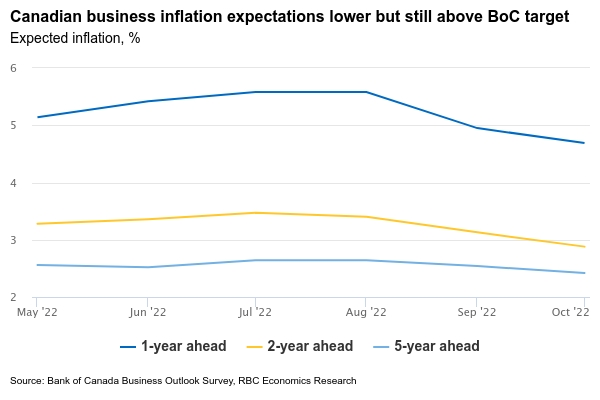

There are some early signs that broader measures of inflation are starting to ease. The BoC’s preferred ‘median’ and ‘trim’ CPI measures are still up 5% from a year ago but recent month-over-month increases have been smaller. And longer-run business inflation expectations have edged lower. But the 7% headline annual inflation rate in September is still more than twice the BoC’s inflation target range.

We continue to expect higher inflation and interest rates to push Canada into a moderate recession in the first half of next year. That would put the central bank in a position to pause interest rate hikes by the end of 2022. And indeed, we expect the overnight rate to end the year at 4%. But risks to that assumption are still tilted to the upside, and are contingent on broader inflation trends showing further evidence of slowing.

Week ahead data watch:

We expect Canadian GDP edged up 0.1% in August – consistent with Statistics Canada’s early estimate that output was “essentially unchanged” in the month. Manufacturing output likely edged lower and home resales continued to retrench, but retail and wholesale sale volumes increased in August.

We expect U.S. GDP increased 1.8% in Q3 – boosted by a surge in net trade and modest growth in consumer spending offset partially by weaker residential investment and a pull-back in inventories.