A central bank extravaganza lies ahead. The show will kick off with the Bank of Canada meeting, where markets expect another rate increase but are split on the size. Meanwhile in Europe, a triple-barreled hike by the ECB is already locked in, putting the emphasis on the press conference. Finally, the Bank of Japan is unlikely to throw a life jacket to the sinking yen.

ECB ready to swing big

With inflation running around 10%, the European Central Bank is widely expected to roll out another ‘turbo’ rate increase on Thursday. Markets have priced in a three-quarter-point boost to rates, after a swathe of ECB officials put their weight behind such a move. Since that’s already baked into the cake, the market reaction will come from President Lagarde’s commentary.

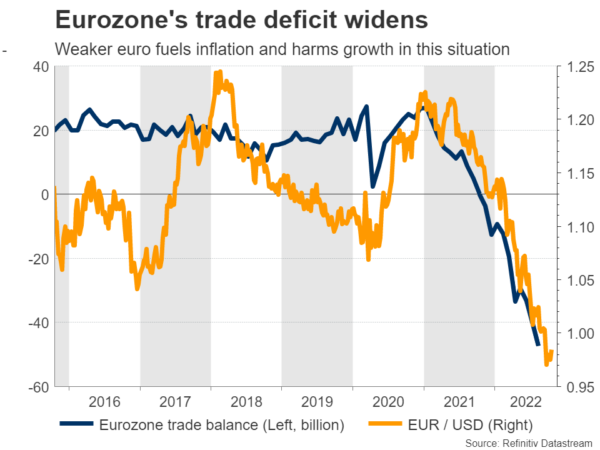

In this sense, Lagarde and her lieutenants might be inclined to strike a hawkish tone and attempt to defend the devastated euro. Since the Eurozone imports most of its energy, a falling euro makes power prices even more expensive, amplifying inflationary forces and crippling economic growth. Further currency depreciation is the last thing Europe needs.

There are two ways the ECB can ‘talk up’ the euro – either by signaling that interest rates could peak at a level higher than the 3% markets currently envision, or through the balance sheet by opening the door for quantitative tightening. The balance sheet route is unlikely after the UK bond market fiasco, and also considering the debt burden Italy faces. This leaves the terminal rate as the most realistic channel.

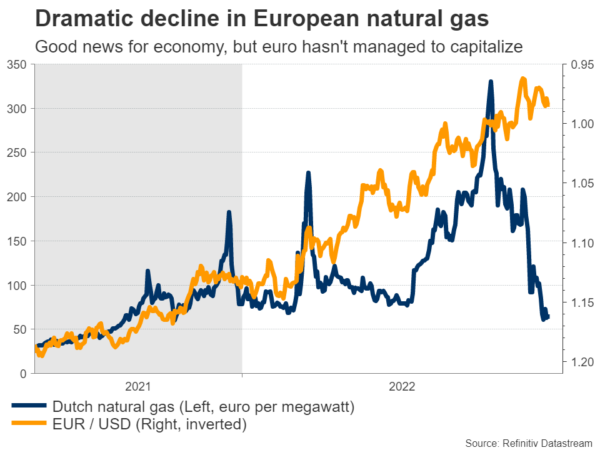

On a positive note, European gas prices have declined dramatically in recent weeks, after the EU intervened in the power market. With prices falling, the energy crisis seems to be calming down and the winter might not be Armageddon after all. A recession is still on the menu, but perhaps it won’t be as deep as investors feared.

This means there’s scope for a relief rally in the euro, as the ECB puts a floor under the currency and energy prices keep moving in the right direction. It’s still too early to envision a trend reversal though, as that would require a pivot from the Fed that weakens the dollar, which doesn’t seem imminent.

On the data front, the ball will get rolling on Monday with the preliminary PMI business surveys for October, which will reveal how close the economy is to recession and how inflationary pressures are evolving. Then on Friday, Germany’s preliminary GDP growth estimate for the third quarter and inflation stats for October will hit the markets.

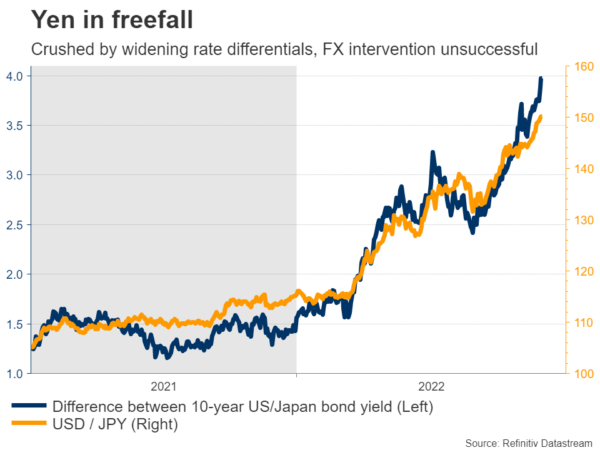

BoJ unlikely to rescue yen

Over in Japan, the central bank’s refusal to even consider higher interest rates has annihilated the yen, which has lost an incredible 30% of its value against the US dollar this year. Direct intervention in the FX market by the government and threats for more have not accomplished much, other than slowing the bleeding.

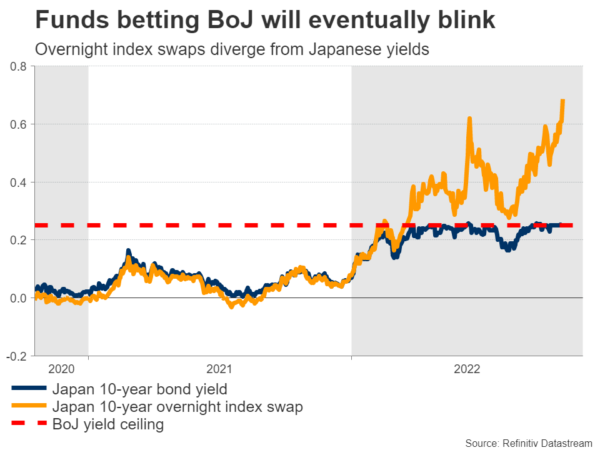

Heading into the Bank of Japan’s decision on Friday, the question is whether anything has changed to elicit a policy shift. The answer is probably not. Inflation has fired up and is running at 3%, but wage growth and inflation expectations are still muted, reinforcing the BoJ’s thinking that the current inflation wave is driven by supply factors that will fade away soon.

Funds are still betting that the BoJ will be forced to relax the ceiling it has imposed on Japanese yields, but the timing is highly uncertain. An acceleration in wage growth would be the signal such a move is coming. Without that, there’s a real chance nothing changes until April, when Governor Kuroda’s term expires.

As for the yen, the outlook remains gloomy. As long as the underlying force of interest rates is working against the currency, any rallies will likely remain shallow and any episodes of FX intervention might simply delay the inevitable. A trend reversal would require a change of heart from the BoJ or Fed, or both.

BoC – double or triple?

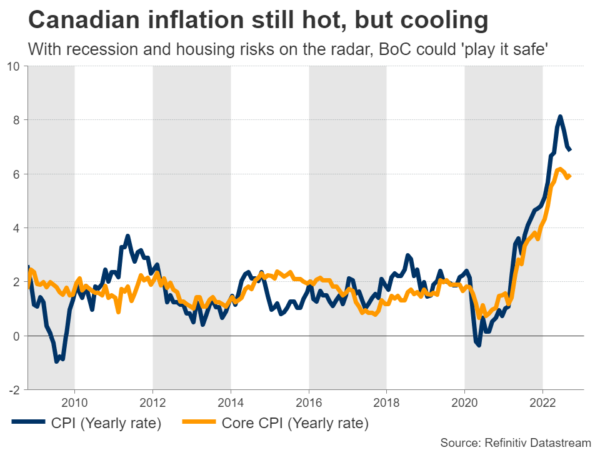

Crossing into Canada, a rate increase is almost certain when the central bank concludes its meeting on Wednesday. The question is how large the move will be, with investors split between half or three quarters of a percentage point.

There are solid arguments on both sides. Inflation is still hot and the labor market is in solid shape, which suggests the Bank can keep pushing. However, house prices have started to decline and the latest business survey from the central bank itself showed that most Canadian companies already expect a recession.

With oil prices also marching lower, the more prudent option seems to be a smaller, half-point rate increase. Pushing this ‘bubbly’ housing market too hard could spell disaster, so the BoC has an incentive to tread lightly. In this case, the initial reaction in the loonie would likely be lower.

With oil prices also marching lower, the more prudent option seems to be a smaller, half-point rate increase. Pushing this ‘bubbly’ housing market too hard could spell disaster, so the BoC has an incentive to tread lightly. In this case, the initial reaction in the loonie would likely be lower.

American, British, and Australian data

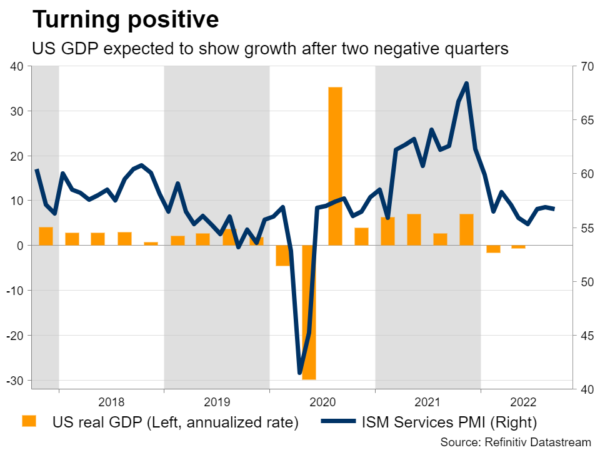

In the United States, there’s a flurry of crucial data releases coming up, starting with the S&P Global business surveys on Monday. But the main event will be on Thursday, when the preliminary estimate of GDP for the third quarter is published.

The Atlanta Fed GDPNow model points to growth of almost 3%. Coupled with sizzling inflation and a labor market that’s still firing on all cylinders, such a GDP print could cement expectations that the Fed will push rates all the way to 5% or beyond. The week will culminate with the core PCE price index on Friday.

In the UK, politics will remain front and center after the resignation of Prime Minister Truss. A new leader is expected to take over next week, with the frontrunners being Rishi Sunak and Boris Johnson. Sunak is probably the most sterling-positive choice given his more stable economic policies, but Johnson is more popular with the Conservative base. On the data front, the PMIs for October are out on Monday.

Finally in Australia, the inflation report for Q3 will hit the markets early on Wednesday.