The UK has been in political disarray recently, with the UK government announcing more reversals to its fiscal plans, the chancellor of the exchequer being replaced, and Conservative lawmakers preparing to submit letters of no confidence in the new prime minister. In the midst of this political drama, on Wednesday at 06:00 GMT, data is expected to reveal that UK inflation rebounded to double digits again. What does this mean for the BoE’s future course of action and how may the pound respond?

UK political scene into chaos

As if the UK economy has not been through enough storms during the last years, with the Brexit saga, the COVID pandemic, the supply shortages thereafter and the adverse effects of the war in Ukraine, the recent uncertainty surrounding politics is yet another storm hitting a ship already in trouble.

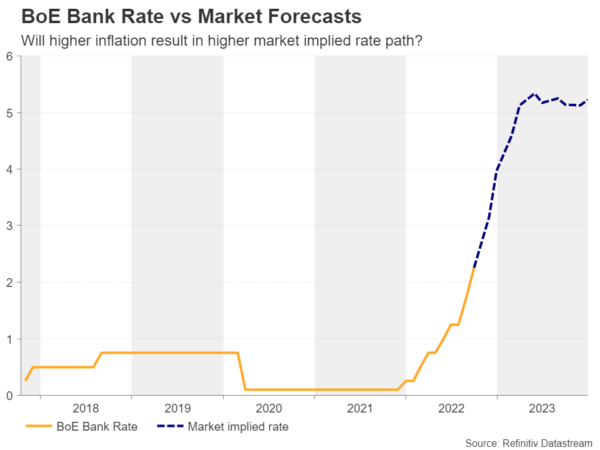

The announcement of the new government’s fiscal plans last month sent UK markets into tailspin, with UK bonds and the pound tumbling as investors got nervous that the measures will only serve to fuel further sky-high inflation and the already ballooned budget deficit. The rescue response came from the BoE, which enacted an emergency bond-buying scheme, raising speculation of bigger hikes in order to put out the stronger inflation flames and offset any potential loosening in financial conditions.

Up until Thursday, market participants were almost certain that the Bank would raise interest rates by a full percentage point at its November gathering. However, following reports that the government will likely proceed with more reversals to its announced policies, the probability for a 100-bps hike has slid to around 50% on Friday, before rebounding back to 85% on Monday.

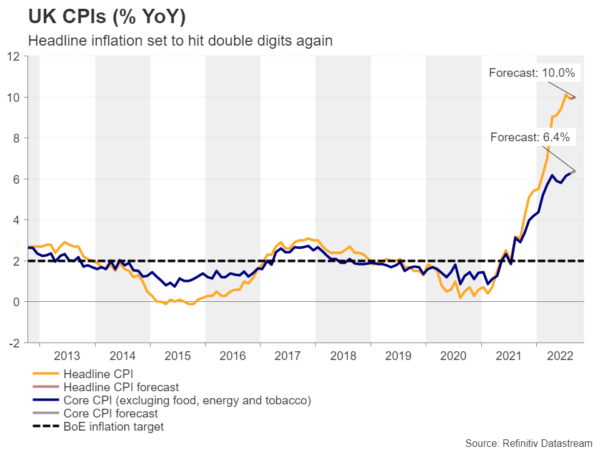

Inflation to hit double digits again

With investors shifting their BoE hike bets on a daily basis, Wednesday’s inflation data may attract special attention, although due to the likelihood of a leadership contest, politics will possibly stay on the top of investors’ agendas this week as well. The headline rate is forecast to have hit double digits again, rebounding to 10.0 % y/y from 9.9%, while the core is expected to have ticked up to 6.4% from 6.3%. This implies that the rise in headline inflation may not be only due to volatile and temporary items and may prompt market participants to increase bets of a full percentage point hike.

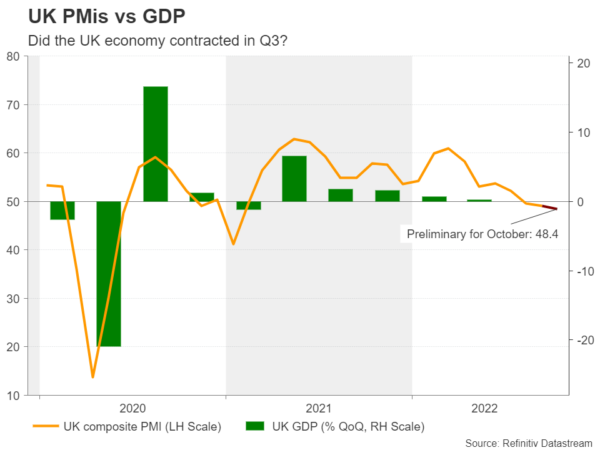

This could initially support the pound, but the advance may be limited and short-lived. Recent history has shown that pound traders are more concerned that bigger hikes by the BoE will only assist in dragging the UK economy into recession, rather than relieving their pockets from the pain of high consumer prices; and with the UK economy probably already shrinking during Q3, those fears are more than rational.

Despite the GDP estimate for Q2 being revised up to +0.2% q/q from -0.1%, the likelihood of a contraction during the third quarter is high. Data has shown that the economy contracted by 0.3% m/m in August, with the September number likely to be even lower due to the nation coming to a standstill for the Queen’s funeral. The slide in the composite PMI for September deeper into contractionary territory, and expectations of another slip in retail sales for the month, due to be released on Friday, add extra credence to that view.

Pound to struggle on

Pound/dollar continues to trade below the downtrend line drawn from the high of February 23, which still points to a negative outlook, despite the latest strong recovery and the higher low formed last week.

Even if the pair extends its recovery due to accelerating inflation, it could meet strong resistance near the 1.1500 zone or near the downtrend line, where another round of selling may result in the breach of the 1.0930 barrier, and perhaps set the stage for declines towards the record low of 1.0380, hit on September 26.

On the upside, the move signaling that the bulls have stolen all the bears’ weapons may be a break above the high of September 13 at 1.1750. But for any gains to be meaningful and lasting, UK data need to start suggesting that the economic wounds are healing, headlines may need to start pointing towards restoration of political stability, and the Fed may have to start considering a slower rate path moving forwards. The bulls could then get confident to climb to the 1.2000 territory, where another break may extend the advance towards the 1.2295 barrier.