Summary

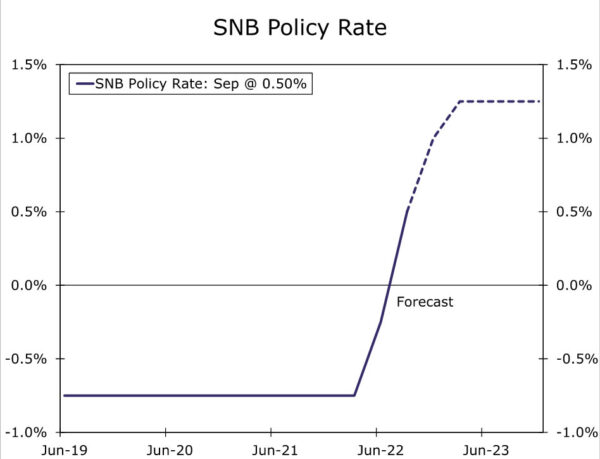

- The Swiss National Bank (SNB) delivered a 75 bps rate hike at its September monetary policy meeting, bringing its policy rate to +0.50%.

- Overall, the announcement’s forward guidance was not as hawkish compared to many other global central banks’ comments. Rather than signaling forceful rate hikes ahead, the SNB instead repeated that it cannot be ruled out that further increases in the SNB policy rate will be necessary to ensure price stability over the medium term. In addition, the central bank indicated it remains willing to intervene in the foreign exchange market as necessary.

- Looking ahead, we believe the SNB will continue tightening monetary policy but will deliver rate hikes of smaller magnitude, consistent with our outlook for slower growth and somewhat more contained inflation next year. More specifically, we expect the SNB to hike rates by 50 bps in December and 25 bps in March, with a terminal policy rate of 1.25%.

Swiss National Bank Exits Negative Rates

The Swiss National Bank (SNB) delivered a 75 bps rate hike at its September monetary policy meeting, bringing its policy rate to +0.50%. Switzerland was the last of the European countries to move its policy rate into positive territory.

Overall, the announcement’s forward guidance was not as hawkish compared to many other global central banks’ comments. Rather than signaling forceful rate hikes ahead like other institutions, the SNB instead repeated that it cannot rule out further increases in the SNB policy rate to ensure price stability over the medium term. In addition, the central bank continues to closely monitor the franc exchange rate given currency strength has been a factor in helping dampen inflation pressures. After reaching a seven-year high this week against the euro, the franc fell around 2% versus the euro after the announcement, as the 75 bps rate move fell short of the increase priced into interest rate markets. The SNB reiterated it remains willing to intervene in the foreign exchange market as necessary.

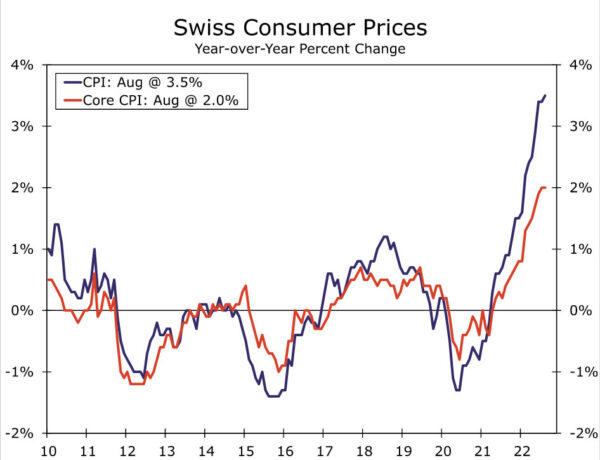

Along with its monetary policy decision, the SNB also released updated economic projections. It upwardly revised its overall CPI forecast, and now expects inflation to average 3% in 2022, 2.4% in 2023, and 1.7% in 2024, conditional on its current policy rate of 0.50%. As for growth, the SNB cut its forecast to 2% GDP growth this year, half a percentage point lower than its June forecast, citing slower overall global growth and the energy shortage in Europe.

Where to From Here?

Looking ahead, we believe the SNB will continue tightening monetary policy but will deliver rate hikes of smaller magnitude, consistent with our outlook for slower growth and somewhat more contained inflation next year. More specifically, we expect the SNB to hike rates by an additional 50 bps in December, bringing its policy rate to 1.00% by the end of 2022. Then in 2023, we expect a 25 bps rate hike in March, with a terminal policy rate of 1.25%. Moreover, we do not expect any unscheduled inter-meeting rate hikes, as President Jordan indicated the SNB would only resort to unplanned tightening if the economic outlook changed significantly.

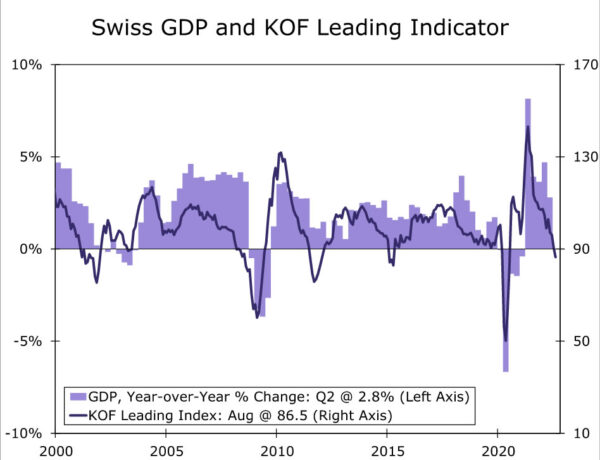

On the growth front, we see downside risks accumulating. While GDP growth in the second quarter was steady, warning signs are flashing for slower growth in the coming quarters as sentiment deteriorates and the Eurozone falls into recession. GDP grew 0.3% quarter-over-quarter in Q2, boosted by the services sector reopening and household consumption, which were resilient even amid higher prices (real private consumption was up 1.4% quarter-over-quarter). However, there was some noticeable softness in the manufacturing sector, which was also reflected in the manufacturing PMI falling for the fifth straight month in August.

Moreover, the KOF leading index, which historically has been a good indicator of GDP growth, declined for the fourth straight month in August, falling to 86.5. This downward trend suggests slower or negative growth ahead. Furthermore, our expectation for a Eurozone recession by the end of 2022 poses additional downside risks for Switzerland’s growth prospects, as the two regions have significant trade relations—36% of Swiss exports go to the Eurozone, while 45% of Swiss imports come from the Eurozone. The economic outlook is further complicated by the Russia-Ukraine war and resulting energy crisis, as Switzerland ultimately sources almost half of its natural gas from Russia. While Switzerland has relatively low demand for gas at only around 15% of total energy consumption, the country currently does not have large capacity to store natural gas or its own gas reserve, adding to uncertainty surrounding the growth outlook. Against this backdrop, we do not forecast an outright recession in Switzerland, but we expect economic growth to slow in 2023, which is consistent with a slower pace of rate hikes from the SNB.

Also consistent with our expectation for a slower pace of rate hikes is our outlook for more contained inflation in 2023. Inflation in Switzerland is at a 30-year high and is above the SNB’s 2% target, but remains much lower compared to other major European economies. In August, the CPI quickened to 3.5% year-over-year. Taking a closer look at the details, prices for housing, water, electricity, gas and other fuels were only up 4.7% from the previous year, significantly lower than in the Eurozone, where they are up 19.7%. With the updated SNB forecasts showing annual average inflation of 2.4% for 2023 and 1.7% for 2024, we believe the central bank will continue tightening monetary policy, although larger rate hikes are likely not needed given inflation is expected to be closer to target by the end of 2023. The central bank noted that without September’s 75 bps rate hike, its inflation forecast would be significantly higher.

While our base case is for smaller magnitude rate hikes in the coming quarters, we would not fully rule out a 75 bps rate hike in December. Since the SNB only has one monetary policy meeting per quarter, half as many as the ECB, the central bank could opt to deliver a larger rate hike to account for this. The central bank has also repeatedly emphasized its commitment to support the franc in order to soften the blow from higher import prices and inflationary pressures. While its willingness to intervene in foreign exchange markets is an important policy lever, large rate hikes that support the currency could also complement these actions.