- We expect Fed to hike 75bp next week – the market is more upbeat and see a possibility of a 100bp hike.

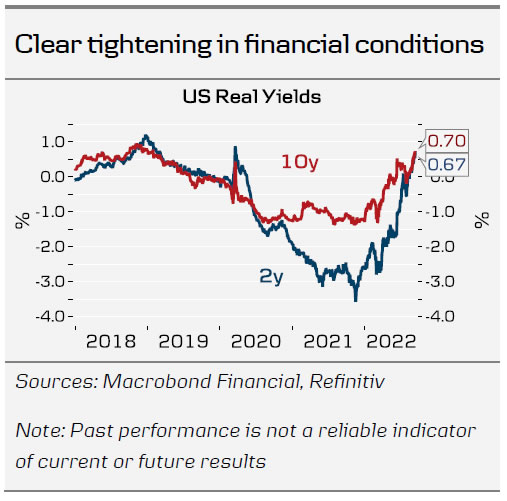

- Real yields are rising and financial conditions have tightened, which means Fed’s hawkish post-Jackson Hole communication works as intended.

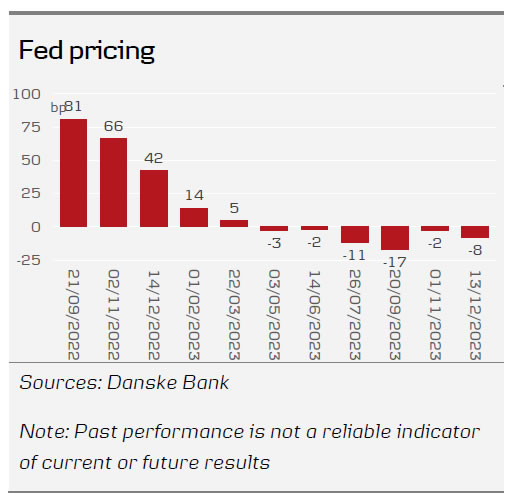

- The market now discounts a terminal rate close to 4.5% next spring. We look to review our forecast after next week’s FOMC meeting.

Two big questions lingers before next week’s FOMC meeting after core-CPI inflation was higher than expected in August. Could Fed hike 100bp next week and could the streak of large rate hikes (of 75bp or higher) continue after the September meeting?

We doubt Fed hikes 100bp next week. In our view, recent inflation data does not warrant an even higher rate hike, but we will watch out for any last minute media leaks to correct market expectations. We find the chance of a fourth hike of 75bp in November, a potentially a fifth 75bp hike in December and a terminal rate next year well above 4% more likely.

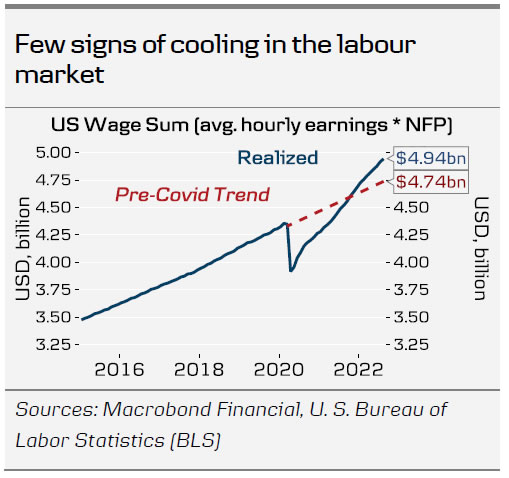

Going forward, Fed will increasingly focus on growth momentum in the economy and labour markets. As we argued in Research US – Fed continues to guide US economy towards a recession, 1 September, Fed needs to force a modest recession, or at least a lengthy period of below-trend growth in order to bring aggregate demand back into equilibrium with supply. However, the recovery in purchasing power indicates a rebound in GDP during Q3, strengthening the case that Fed is not about to ‘pivot’ in the near future.

Short-term market based inflation expectations have picked up the past week and while the NY Fed survey of inflation expectations 1Y ahead eased in August, it remains at a very high level close to 6%. Fed needs to close the gap to short-term inflation expectations to achieve a positive real interest rate and make monetary policy contractionary and that could very well mean a terminal rate of up to 5% next year.

At the same time, Fed has to balance the lagging effect from the tightening in financial conditions we have already seen. The hawkish communication since Jackson Hole has driven an uptick in longer real yields, which will weigh on growth towards 2023, and the turn in order-inventory cycle suggests that downside risks to growth are already increasing.

We currently forecast 125bp of hikes the rest of the year, the market discounts about 210bp of hikes by the end of Q1 next year. We plan to review our forecast after next week’s FOMC meeting, but on balance, we have likely underestimated how high interest rates would go.

We do not expect Fed to move market pricing on 1Y horizon at the meeting, i.e. maintain a terminal rate of close to 4.5% next spring, but the market will likely reassess the distribution of hikes at the following meetings. The market discounts about 80bp of hikes next week. That is 5bp too much in our view and the market will move the excess basis points to the November and December pricing instead and discount a high probability of a 75bp hike in November and 50bp hike in December.