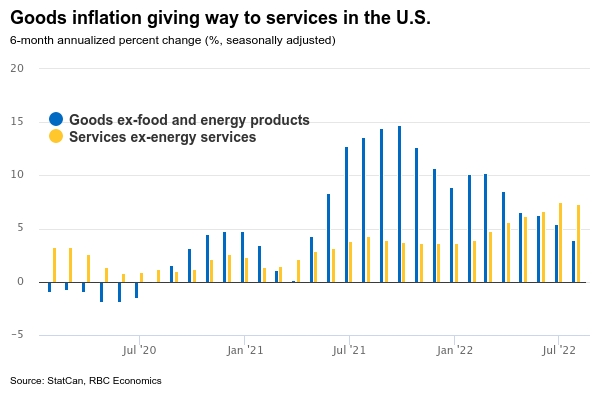

U.S. headline inflation likely trended lower in August, largely due to lower oil prices, which fell to nearly 19% from their June peak. But beyond energy prices, year-over-year core CPI growth likely rose—a signal that the Fed will need to continue its aggressive hiking path to tame inflation. That core price growth will be despite some further easing in goods-price inflation. Indeed, goods-sector inflation has begun to unwind even as services sector inflation escalates. Shelter costs are a huge component of this, with home rent costs reporting their highest growth in over three decades. But prices in the travel and hospitality sectors are growing too. Meantime, global supply chain constraints continue to ease, and commodity prices continue to fall. Used vehicle prices fell 4% month-over-month, but food prices continue to tick higher.

At its next meeting on Sept 21, the Fed will consider its “overarching focus” to bring inflation back down to 2%. While lower energy prices mean headline CPI is heading in the right direction, it’s still well above the Fed’s 2% medium-term goal. And since energy prices are just one component of headline growth, the Fed will keep a close eye on next week’s core inflation numbers.

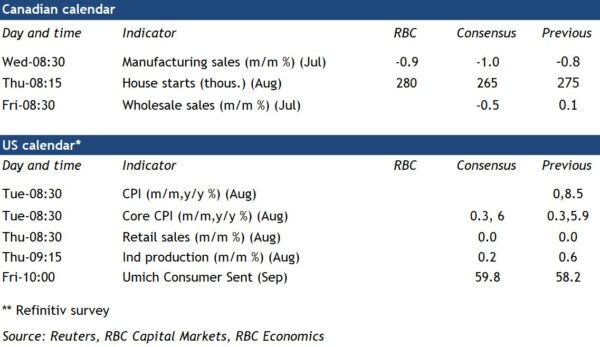

Week ahead data watch:

Housing starts likely stayed strong through August. Building permit issuance has averaged 288,000 units in each of the last three months even as resales cool off.

Manufacturing sales likely fell 0.9% in July, as per Statistics Canada’s flash estimates. Petroleum, coal products, and primary metal industries accounted for the largest share of the decline. But this is largely a price effect, since petroleum and coal prices fell significantly between July and August. With this in mind, sales volumes likely increased in these industries despite posted nominal declines.