Summary

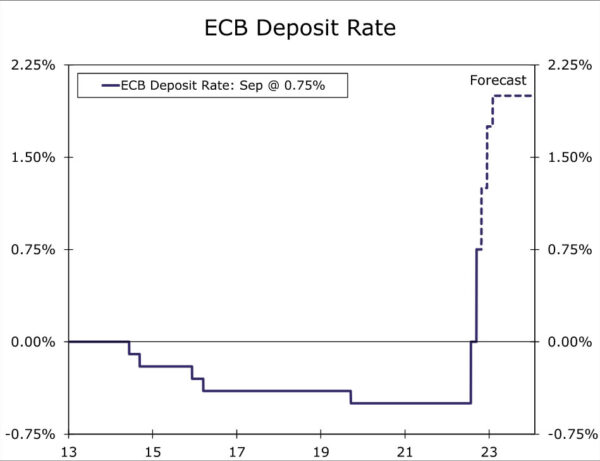

- Against a backdrop of persistent and elevated inflation, the European Central Bank (ECB) delivered a record rate hike at today’s monetary policy announcement, raising its Deposit Rate by 75 basis points to 0.75%.

- The ECB also said inflation remains far too high and that it expects to raise interest rates further over the next several meetings. Of particular note, the ECB revised up its 2023 CPI inflation projection to 5.5%.

- Thus, even with a softer outlook for economic growth, we now forecast the ECB will raise its Deposit Rate another 50 basis points in late October, and also 50 basis points in December, lifting the Deposit rate to 1.75% by the end of this year. We expect a final 25 basis point rate increase to 2.00% in early 2023. We subsequently expect the European Central Bank to hold interest rates steady through the rest of 2023.

- From a currency perspective, we still expect some further declines in the euro in the near-term, but see prospects for a euro rebound versus the U.S. dollar in 2023, with the latter likely weighed down by the anticipation and eventual implementation of Federal easing by late next year.

European Central Bank Goes Big

Against a backdrop of persistent and elevated inflation, the European Central Bank (ECB) delivered a record rate hike at today’s monetary policy announcement. The ECB raised its Deposit Rate by 75 basis points to 0.75%, matching the consensus forecast. Just as importantly, we viewed the central bank’s accompanying comments as mildly hawkish on balance, and expect the ECB to keep raising interest rates into early next year. Among the more hawkish elements of the ECB announcement, the central bank said:

- Inflation remains far too high and is likely to stay above target for an extended period.

- Over the next several meetings, it expects to raise interest rates further to dampen demand and guard against the risk of a persistent upward shift in inflation expectations.

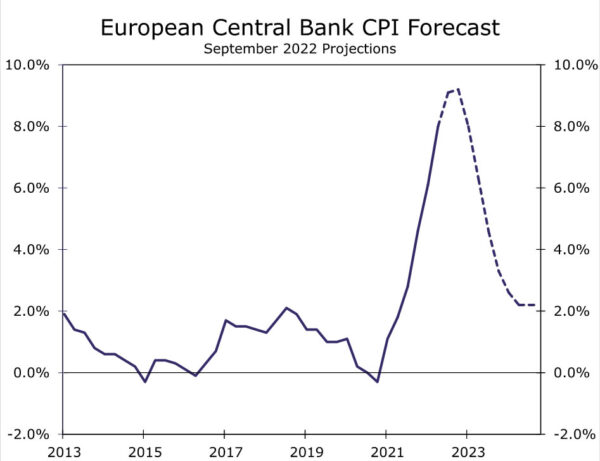

- It has significantly revised up its inflation projections and now expects CPI inflation to average 8.1% in 2022, 5.5% in 2023 and 2.3% in 2024.

- The Transmission Protection Instrument is available to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across all euro area countries, thus allowing the Governing Council to more effectively deliver on its price stability mandate.

The last comment is perhaps noteworthy, in that it suggests ECB policymakers will not cut their monetary policy tightening cycle short simply due to fears of fragmentation across Eurozone bond markets.

With respect to reinvestments, the ECB said it intends to keep reinvesting proceeds from bonds maturing under the Asset Purchase Program for an extended period, and to keep reinvesting proceeds from the Pandemic Emergency Purchase Program until at least the end of 2024. There did not appear to be any in depth discussion of quantitative tightening at today’s ECB meeting.

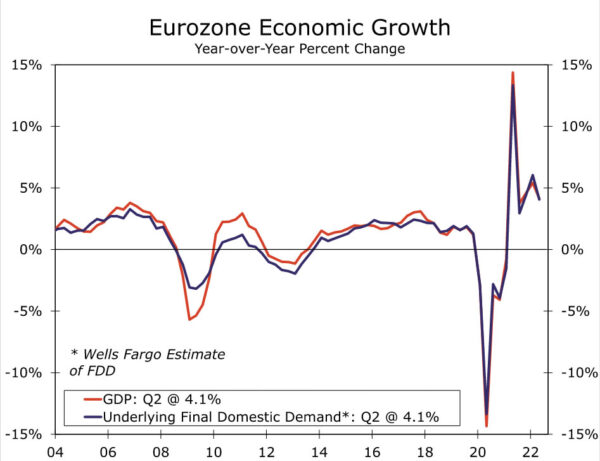

Finally, on the less hawkish, or more dovish side, the ECB acknowledged a slowdown in growth momentum, saying the Eurozone economy would likely stagnate in late 2022 and early 2023. More broadly, the ECB lowered its Eurozone GDP growth projections to 3.1% for 2022, just 0.9% for 2023, and 1.9% for 2024. The ECB said today’s interest rate increase “front loads” some of the transition to a more normal monetary policy stance and that, going forward, future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach.

ECB Policymakers Signal More to Come

A key takeaway from today’s monetary policy announcement is that even after the forceful start to its rate hike cycle, the ECB is signaling that it believes interest rates will remain on an upward path for some time yet. This is reflected explicitly in its expectation that it will raise interest rates for the next several meetings, its observation that inflation remains far too high, and the significant upward revision to its 2023 CPI inflation forecast in particular, to 5.5%.

Against this backdrop and following today’s record rate increase, we now forecast the European Central Bank will raise its Deposit Rate another 50 basis points in late October and also 50 basis points in December, lifting the Deposit rate to 1.75% by the end of this year. We expect a final 25 basis point rate increase to 2.00% in early 2023. That would lift the ECB’s policy rate to what is perceived as the upper end of a neutral range. In addition, as the depth of Eurozone economic recession becomes clearer, and also as underlying inflation perhaps begins to abate, we believe those factors will be influential in seeing the European Central Bank bringing its rate hike cycle to an end by early next year. However, with inflation likely to remain well above target, and the ECB’s policy rate close to rather than well above its neutral range, we subsequently expect the European Central Bank to hold interest rates steady through the rest of 2023. From a currency perspective, we still expect some further declines in the euro in the near-term, given the Fed remains firmly in tightening mode for now and with the Eurozone economic outlook less than stellar. We do expect some rebound in the euro in 2023 as a steady ECB monetary policy outlook sees the euro outperform against the U.S. dollar, with the latter likely weighed down by the anticipation and eventual implementation of Federal Reserve monetary easing by late 2023.

Winter is Coming

As the European Central Bank alluded to, economic growth is likely to slow sharply over the second half of this year, a factor we believe may be influential in eventually bringing the ECB’s monetary tightening cycle to an end. The detailed Eurozone Q2 GDP figures, also released this week, highlighted a favorable quarter for the region’s economy. Overall GDP growth rose 0.8% quarter-over-quarter and 4.1% year-over-year, more than initially estimated. In addition, the expenditure breakdown showed consumer spending increasing by 1.3% quarter-over-quarter, and fixed investment spending rising 0.9%. As a result, Eurozone final domestic demand rose a solid 1.0% in Q2.

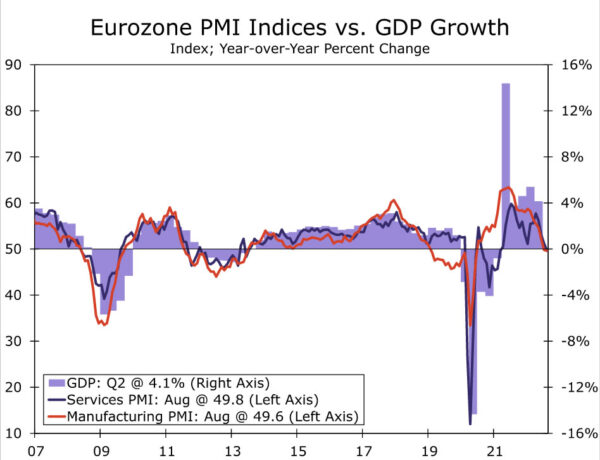

However, while the full income details are not yet available for Q2, those same GDP figures showed employee compensation rising 1.1% quarter-over-quarter, but being outpaced by a 1.8% rise in the private consumption deflator, meaning that real employee compensation actually fell 0.7% in Q2. More recently, survey data in particular suggests slower growth, and indeed Eurozone recession, remains likely in the months ahead. For August, the Eurozone manufacturing PMI of 49.6 and the services PMI of 49.8 were both below the breakeven 50 level, and consistent with a contracting Eurozone economy. That suggests our outlook for Eurozone recession beginning by late this year remains on course, which should also see the ECB bring its tightening cycle to an end by early 2023.