The latest US employment report will be released at 12:30 GMT Friday and will test the notion that the economy is in solid shape. Business surveys point to some softness in jobs growth, but nothing dramatic yet. As for the dollar, it is enjoying the best of all worlds – widening interest rate differentials, a lack of alternatives, and safe-haven flows.

Optimism vs pessimism

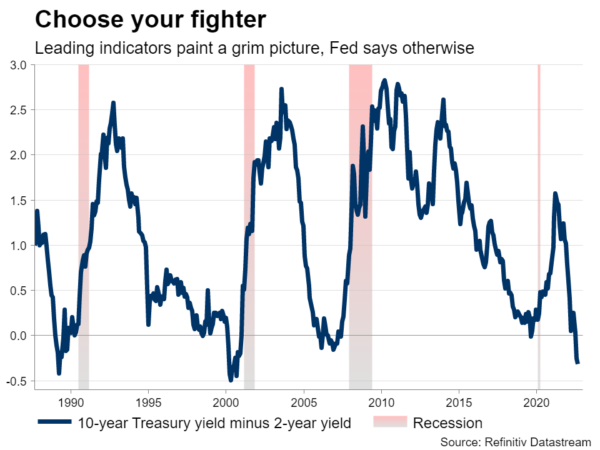

There is a raging debate going on about the strength of the US economy. Pessimists cite a range of leading indicators such as new business orders, consumer confidence, housing data, and the yield curve, all of which point to a sharp slowdown in economic activity just around the corner.

Optimists like Fed Chairman Powell point to a labor market that is essentially at full employment and argue the economy is still in good shape. It is difficult to have a recession when the unemployment rate is at its lowest level in five decades.

The problem with this logic is that employment is a lagging indicator. When investors look at jobs data, they are looking into the past. The labor market always looks to be at its strongest right before a recession hits. It is the last domino to fall.

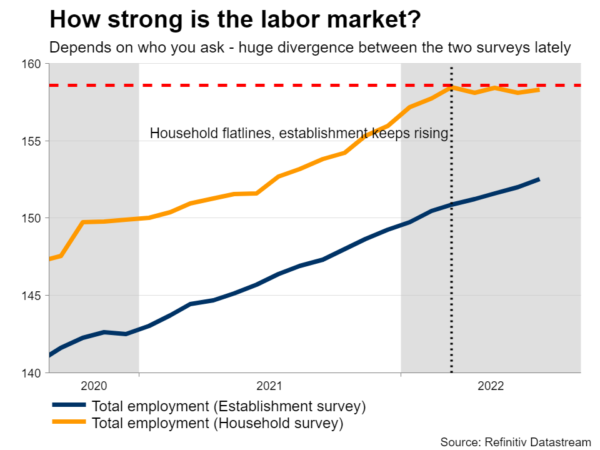

Another problem is that the job numbers aren’t so strong once you dig beneath the surface. The nonfarm payrolls print comes from the ‘establishment’ survey while the unemployment rate comes from the ‘household’ survey, and there has been a dramatic divergence between the two lately.

Nonfarm payrolls suggest the US economy added almost 2 million jobs since March, whereas the household survey suggests no jobs growth at all. One key difference is that people working two jobs are counted twice in nonfarm payrolls, but only once in the household survey.

Therefore, the ‘stellar’ employment gains in recent months might have simply been people taking on another job, because they were struggling to make ends meet.

Solid report?

Of course, traders care mostly about the nonfarm payrolls print. The US economy is projected to have added another 300k jobs in August outside of farms, which would keep the unemployment rate steady at 3.5%. Wage growth is expected to have cooled a little, both in monthly and yearly terms.

As for the risks, business surveys suggest a disappointment is more likely than a positive surprise in this report. The S&P Global PMI revealed the slowest increase in employment for almost a year, as companies facing uncertain demand and rising costs delayed the replacement of staff that left voluntarily.

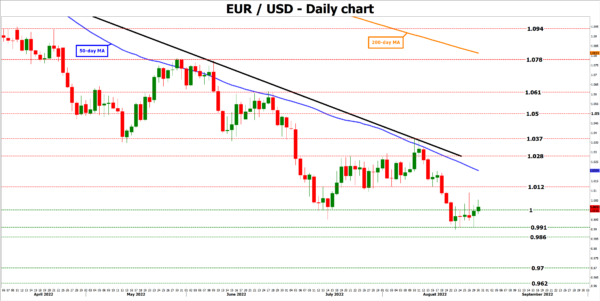

In case of disappointment, the US dollar could take a step back, pushing euro/dollar higher for another test of the 1.0120 region. That said, even if the pair rallies all the way up to 1.0370, it would still be stuck in a downtrend.

On the flipside, if the data surpasses expectations, that could hammer the pair back below parity, opening the door towards the 0.9910 zone.

Heading into the event, investors will get more labor market indicators to digest, starting with the revamped ADP employment report on Wednesday. Then on Thursday, the ISM manufacturing survey is due out.

Best of all worlds

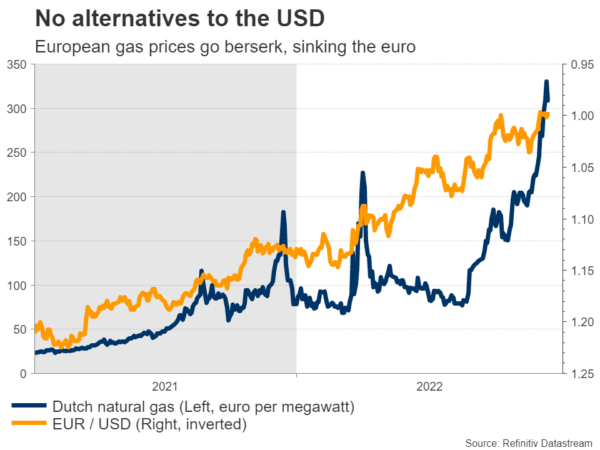

In the bigger picture, even if the dollar takes a hit this week, it is still difficult to argue for any trend reversal. With an energy shortage tormenting Europe, a deepening property crisis in China, and the Fed committed to keeping interest rates high as long as it takes to crush inflation, the dollar is enjoying the best of all worlds.

There is a lack of alternatives to replace it, safe-haven demand is booming, and widening interest rate differentials with other economies allow it to attract capital flows. It essentially offers a combination of safety and attractive returns that no other currency can replicate.

Until something changes in this narrative, king dollar is unlikely to lose its crown.