- We expect the Bank of England (BoE) to hike the Bank Rate by 25bp.

- We expect this to mark the peak in the Bank Rate of 4.50% as the BoE is set to signal a pause in the hiking cycle.

- EUR/GBP is set to remain rather unchanged but move slightly higher during the press conference on dovish remarks.

BoE call. We expect the Bank of England (BoE) to hike the Bank Rate (key policy rate) by 25bp on 11 May bringing it to 4.50%. This is in line with markets expectations.

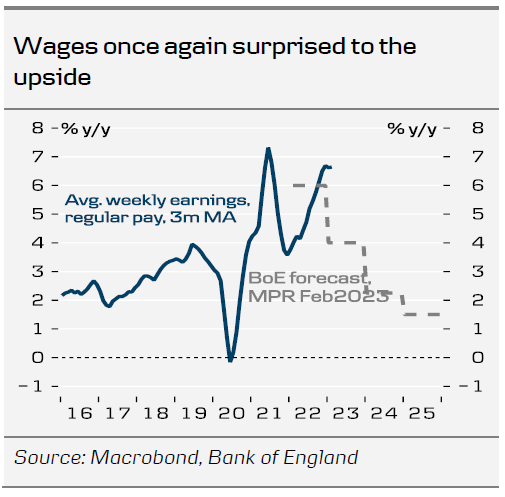

Since the last monetary policy decision in March, both wage growth and inflation releases have surprised to the upside. The latest labour market report showed a slightly higher unemployment rate at 3.8% (up from 3.7%), but unfilled vacancies remained markedly above pre-pandemic levels. However, wage growth excluding bonuses surprised largely to the upside at 6.6% (consensus: 6.2%) with wage growth levelling off in the private sector but continues to accelerate in the public sector. The MPC have expressed the importance of wage growth and hence this supports the view of another 25bp hike.

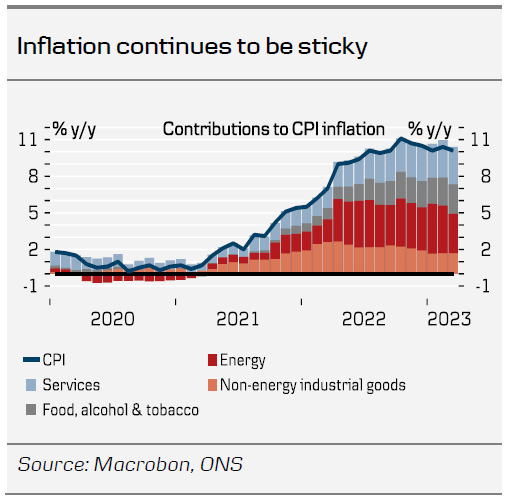

BoE’s forecast of 9.2% from the February report as well as the consensus view. The contribution from the services sector remained unchanged at 3.07%. Hence, the inflation remains stickier than expected but with the large drop in shipping prices, lower agricultural commodity prices and the slowing rate of producer prices all points to lower goods inflation from here we believe this will drag the inflation lower despite the stickier services inflation. The latest BoE’s monthly Decision Maker Panel survey showed that inflation expectations continued the trend lower seen over the recent months. Combined with core inflation, this remains a key release for the MPC in order to determine persistency of inflation pressures.

All in all, we expect this to be the final hike from the BoE but note that the BoE most likely will repeat the message that they will tighten further if there is evidence of further persistence in inflation. Hence, their approach remains increasingly data dependent. Markets pricing has increased the previous months to a peak rate of 4.8%, up from 4.5% at the end of March. At the same time, markets seems to see the probability for rate cuts this year as lower than previously. We expect no rate cuts until 2024.

Growth outlook. The UK economy seems to narrowly avoid a negative GDP growth in Q1 as well as the February print showed +0.1% on a 3M/3M basis at same time as the data from January was revised higher. PMI data also suggest a pick up in the activity with the composite index reached a 12 month high in April. The recession outcome that in October last year felt as a done deal for the UK economy is now on the course to be avoided.

FX. In our base case of a 25bp hike, we expect EUR/GBP to remain rather unchanged on the release but move slightly higher during the press conference. In its statement we expect the BoE to prime markets for a pause in the hiking cycle as the central banks want to fully evaluate the effect from previous Bank Rate increases. Overall, we regard the relative central bank outlook to be a positive for EUR/GBP but with other factors acting as a headwind, we increasingly see a case for continued range trading in the cross.