Tuesday September 26: Five things the markets are talking about

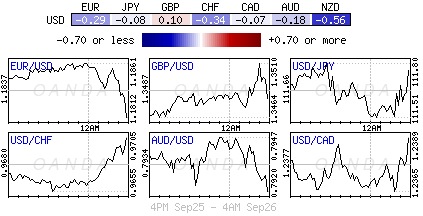

Ahead of the U.S open, markets are stabilizing as investors digest a host of catalysts from N. Korean war threats and central-bank policy to tailwinds for oil and the aftermath of the German election.

For Tuesday, investors are waiting for fresh signals about U.S monetary policy outlook. Yesterday saw two opposing views from Fed members on inflation.

New York’s Dudley expressed confidence that fading one-off effects and a weaker dollar would help inflation trend back to +2%, and deserves the gradual withdrawal of monetary stimulus.

In the opposing camp was Chicago Fed President Evans expressing concerns that the shortfall in price pressures may be more “structural rather than temporary.’

The debate continues on today, with Fed Governor Brainard (10:30 am EDT) and Chair Janet Yellen (12:45 EDT) set to give speeches while Cleveland Fed President Loretta Mester moderates a panel.

1. Global stocks trade with little direction

In Japan overnight, the Nikkei average edged lower as tech shares declined, tracking their U.S counterparts yesterday, while worries over N. Korea weakened risk appetite. The Nikkei ended -0.3% lower, while the broader Topix traded unchanged.

Down-under, Australia’s S&P/ASX 200 Index lost -0.2%, while South Korea’s Kospi index fell -0.3%.

In Hong Kong, the Hang Seng Index added +0.1% after slumping -1.4% Monday as Chinese property developers tumbled on fresh mainland home curbs.

In China, stocks inch up after three days of losses. The blue-chip CSI300 index rose +0.1%, while the Shanghai Composite Index added +0.1%.

Note: Do not expect Chinese authorities to tolerate any violent moves ahead of the key Communist Party Congress next month. Maintaining market stability is of “extreme importance,’ and is a political task.

In Europe, regional indices trade slightly higher, reversing earlier losses in a lackluster session despite tensions growing in the Far East. Energy stocks are being supported by a bump in oil prices over Kurdistan referendum (see below). Attention now moves to Fed Chair Yellen’s speech.

U.S stocks are set to open in the ‘red’ (-1%).

Indices: Stoxx50 +0.1% at 3,543, FTSE +0.2% at 7,290, DAX +0.2% at 12,624, CAC-40 +0.1% at 5,273, IBEX-35 flat at 10,213, FTSE MIB +0.4% at 22,474, SMI +0.1% at 9,150, S&P 500 Futures -1.0%

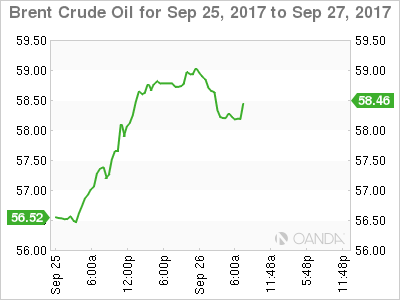

2. Oil at two-year high on Turkey threat, gold stable

Brent oil prices hover near their two-year high, supported by Turkey’s threat to cut crude exports from Iraq’s Kurdistan region as well as signs that market rebalancing is accelerating.

President Erdogan has threatened to cut off the pipeline that carries +600k barrels of crude per day from northern Iraq to the Turkish port of Ceyhan, intensifying pressure on the Kurdish autonomous region over its independence referendum.

The loss of this supply, combined with the -1.8m bpd of supply cuts by OPEC is raising concerns of tighter supply.

Brent crude futures have slipped -17c to +$58.85 a barrel (+34% higher from this years lows), while U.S crude WTI futures have eased -10c to +$52.12 a barrel, after hitting a five-month high of +$52.43 a barrel.

Note: The crude ‘bears’ remain sceptical about further price gains due to higher oil output from the U.S. The EIA said that production from wells in shale formations would rise for a 10th month in a row in October.

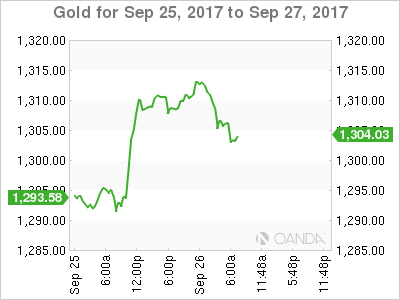

Gold is trading steady after hitting its one-week highs Monday, supported by safe-haven demand amidst lingering tensions over the Korean peninsula. Spot gold is unchanged at +$1,310.01 per ounce. It gained +1.3% in yesterdays session.

3. Euro yields steady after biggest drop in seven-weeks

Europe’s benchmark bond yield are trading steady ahead of the U.S open as the market waits for Fed speeches that may provide some clues to tighten U.S monetary conditions.

The yield on Germany’s 10-year Bund fell -6 bps to +0.41% yesterday after an unexpectedly weak election result for Chancellor Merkel’s CDU party and N. Korea accused the U.S of having declared war.

Note: Many believe that the U.S fixed income market is behind the Treasury curve and are underpricing ‘hawkish’ signals from Fed officials. The curve should be flatter if the Fed was in a tightening cycle.

According to CME’s FedWatch tool, money markets point to a +70% chance of a hike in December, but only a +20% chance of a further hike in March 2018. The yields on 10-year Treasuries have advanced less than +1 bps to +2.22%.

In the U.K, the 10-year Gilt yield has climbed +1 bps to +1.346%.

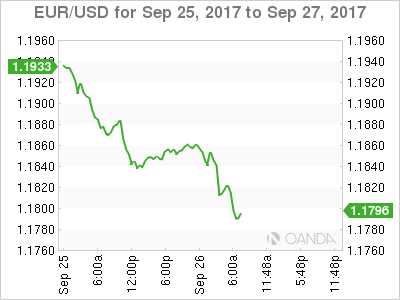

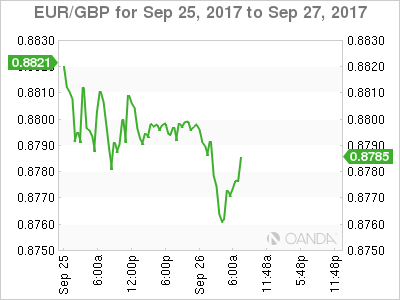

4. EUR under geopolitical pressure

Ahead of the U.S open, the EUR has fallen to a fresh one-month low of €1.1797 outright and to a 10-week low of €0.8758 against the pound, continuing yesterday’s losses after German elections reignited concerns about European political uncertainty.

A percentage of the market is concerned that Angela Merkel’s CDU party will have to form a potentially tricky three-way coalition with the liberal FDP and the Greens, as well as the degree of support for the far-right AfD.

Note: With the populist AFD party winning the third largest number of votes, fears that nationalism has returned to Europe are forcing some investors to stop seeing the EUR as a “political haven’.

EUR ‘bears’ are targeting €1.1625 as strong support, as they see little reason in terms of economic fundamentals for it to move much lower.

5. Bank of Japan (BoJ) monetary policy minutes

The July minutes showed that BoJ policymakers should stick with their current policy framework and had reason to be optimistic about consumer prices because measures of inflation expectations have stopped falling.

Note: The BoJ held rates steady, but pushed back the timing of its inflation target for the sixth-time since QE began.

A few members argued Japan’s jobless rate and output gap needed to improve to reach the BoJ’s +2% inflation target. The central bank expects to reach the target inflation sometime in the fiscal year ending in March 2020.

Note: As expected late yesterday, Japan’s PM Abe called for a snap election. According to Moody’s credit rating agency, the Japanese elections are unlikely to have implications for sovereign rating. “A refreshed mandate for reform would be considered a credit positive.’